| Skip to content Social Security Online |

History | |

| Home FAQs Contact Us Search |

History Home |

This is an archival or historical document and may not reflect current policies or procedures | |

Legislative History1935 Act |

||

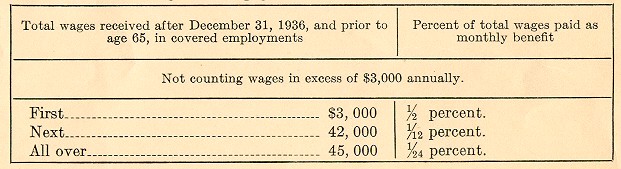

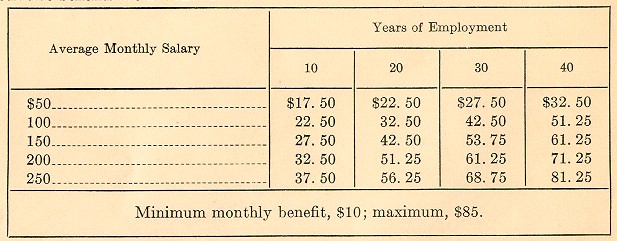

| FEDERAL OLD-AGE BENEFITS (TITLE II) COVERAGE (See. 210b): Old-age benefits are to be paid to all employees based upon wages received in employment in any service performed within the United States, Alaska, and Hawaii except: 1. Agricultural labor; 2. Domestic service in a private home; 3. Casual labor not in the course of employer's trade or business; 4. Officers or members of the crew of a vessel documented under the laws of the United States or of any foreign country; 5. Employees of the United States Government; 6. Employees of a State or political subdivision; 7. Employees of nonprofit institutions operated exclusively for religious, charitable, scientific, literary, or educational purposes, or for the prevention of cruelty to children or animals; 8. Employees of a carrier as defined in Railroad Retirement Act of 1935 (Public No. 399, 74th Cong. [H.R. 8651]). CONDITIONS TO QUALIFY FOR RECEIPT OF OLD-AGE BENEFITS (Sec. 210c): 1. At least 65 years of age; 2. Not less than $2,000 total wages received after December 31, 1936, and before age of 65; 3. Wages were paid to individual on some day in each of 5 years after December 31, 1936, and before age of 65. OLD-AGE BENEFIT PAYMENTS (Sec. 202): 1. Date monthly benefits first payable, January 1, 1942. 2. The amount of the monthly benefits payable is determined as follows:  3. Illustrative benefits are as follows:  4. Non-qualified individuals upon reaching age of 65 are paid a lump sum equal to 3.5 percent of the total wages paid after December 31, 1936, and before the attainment of age 65 (sec. 204). 5. Upon death of individual before age of 65, his estate receives payment equal to 3.5 percent of his total wages received after December 31, 1936; if he dies after age of 65, his estate receives the same amount less any benefits paid to him during his lifetime (sec. 208). 6. Payment of benefit withheld for each month in which a qualified individual who has attained age 65 received wages for regular employment (sec. 202d). 7. Payments not subject to assignment or other legal process (sec. 208). FEDERAL ADMINISTRATION: Old-Age Reserve Account in the United States Treasury. The Secretary of the Treasury submits annual estimate to Budget of appropriation to be made to account; and invests funds which draw interest at 3 percent (sec. 201). Social Security Board determines the qualifications of the individual and amount of benefits payable (sec. 202a); certifies to Treasury persons entitled to payments (sec. 207). |

| |

Privacy Policy | Website Policies & Other Important Information | Site Map |