|

Social Security Amendments of 1972: Summary

and Legislative History

by

Robert M. Ball

PRESIDENT NIXON'S SIGNATURE on H.R. 1, the Social Security Amendments

of 1972, brought to a close 3 years of consideration of and deliberations

on proposals to improve the social security program. What the President

called "landmark legislation" became Public law 92-603 on

October 30, 1972. Among its most significant and far-reaching provisions

are:

-Higher benefits for most people eligible for benefits as aged widows

and widowers

-For men reaching age 62 in the future, repeal of the provisions under

which a man the same age and with the same earnings as a woman generally

got a lower benefit than the woman worker and under which men needed

more social security credits to qualify for retirement benefits than

women did (the change will be accomplished over a 3-year period beginning

with 1973)

-Changes in the retirement test to assure that the more a beneficiary

works and earns, the more spendable income (social security benefits

plus earnings after taxes) he will have, and to raise from $1,680

to $2,100 the annual exempt amount of earnings with future automatic

adjustment to keep pace with increases in earnings levels

-A special minimum benefit for those who have worked in covered employment

for many years, but at low earnings

-Higher benefits for workers who do not get social security retirement

benefits before age 65 but continue to work past that age

-Improvements in disability insurance protection (including a reduction

in the waiting period for benefits and extension of childhood disability

benefits to persons disabled between ages 18 and 22) as well as improved

protection for a worker's dependents and survivors

-Extension of Medicare protection to disability insurance beneficiaries

who have been on the social security disability benefit rolls for

at least 2 years

-Extension of Medicare protection to persons under age 65 (those getting

monthly social security benefits, those not getting benefits who have

worked in covered employment long enough to be insured, and the wives

or husbands and children of such persons) if they need hemodialysis

treatment for chronic kidney disease or require a kidney transplant

-Changes in the Medicare program to improve its operating effectiveness.

The amendments also created a new Federal supplemental security income

program, effective January 1974, for the needy aged, blind, and disabled.

Administered by the Social Security Administration but financed out

of general revenues of the Federal Government, this program will replace

the present Federal-State programs of old-age assistance, aid to the

blind, and aid to the permanently and totally disabled. Federal payments

under this program will assure minimum income levels; States may supplement

the Federal payments to maintain existing payment levels where these

are higher.

Other major social security legislation was enacted in July 1972.

Those amendments (1) provided a 20-percent across-the-board increase

in social security benefits effective for September 1972; (2) included

provisions for keeping social security benefit amounts up to date

automatically in the future as the cost of living rises; and (3) increased

from $9,000 in 1972 to $10,800 in 1973 and to $12,000 in 1974 the

maximum amount of a worker's annual earnings that may be counted in

figuring his and his family's social security benefits (and on which

he pays social security contributions) and provided in addition for

keeping the amount up to date automatically in the future as average

wages rise, and a revised contribution rate schedule, which included

increases in the hospital insurance rates to restore the financial

soundness of that part of the program.

A detailed summary of all major provisions enacted in 1972 is given

later in this article.

Background and Legislative History

ACTION IN 1969

On September 25, 1969, the President sent to the Congress his recommendations

for social security legislation. They included:

(1) A 10-percent across-the-board increase in social security cash

benefits;

(2) automatic adjustment of social security benefits to future increases

in the cost of living;

(3) an increase in the annual exempt amount of earnings under the

retirement test from $1,680 to $1,800, with a corresponding increase

in the monthly measure of retirement, and a provision for $1-for-$2

withholding of benefits for all earnings in excess of $1,800 (instead

of withholding $1 for each $2 earned above $1,680 through $2,880 and

for each $1 of earnings above $2,880), and a provision for automatic

adjustment of the test to future earnings levels;

(4) an increase in the social security contribution and benefit base

from $7,800 to $9,000 for 1972 and 1973, with provision for subsequent

automatic increases to take account of future increases in earnings

levels;

(5) an increase from 82.5 percent to 100 percent of the spouse's benefit

for a widow or widower who begins receiving benefits at age 65 or

later, with the benefit amount graded down to 82.5 percent for a widow

or widower who takes benefits at age 62;

(6) non-contributory earnings credits (in addition to credit for contributory

coverage of basic pay) of $100 a month for military service from January

1957 through December 1967, similar to the credits previously provided

for service after 1967;

(7) extension of childhood disability benefits to people who become

disabled after age 18 and prior to age 22;

(8) determination of benefit amounts and insured status for men on

the same basis as that for women in the existing law--that is, over

a period equal to the number of years up to age 62 rather than up

to age 65; and

(9) changes in the contribution rate schedules for both cash benefits

and for hospital insurance.

On September 30, 1969, the minority leader of the House of Representatives,

Gerald R. Ford, introduced H.R. 14080, a bill containing the President's

recommendations for social security legislation. The bill was referred

to the Committee on Ways and Means of the House of Representatives

for consideration.

On October 15, the Ways and Means Committee began public hearings

on H.R. 14080 and H.R. 14173, which contained President Nixon's proposals

for reforming the Federal-State programs of public assistance. Secretary

of Health, Education, and Welfare Robert H. Finch appeared as the

Administration's first witness. In his testimony, Secretary Finch

announced that the Administration was forwarding to the Committee

that day for its consideration (along with the Medicare provisions

of H.R. 14080) a proposed bill the "Health Cost Effectiveness

Amendments of 1969," containing several provisions intended to

strengthen administrative controls over program payments, coordinating

health facility reimbursement with community planning efforts, and

experimenting with alternative methods of reimbursement that it was

hoped would be considered for inclusion in the social security bill,

The public hearings continued until November 13 and the Committee

went into executive sessions on November 19.

15-percent benefit increase enacted.-Early in December

it became clear that the Senate would attach several amendments to

the Social Security Act to a tax bill that seemed certain of enactment.

The Committee on Ways and Means unanimously ordered reported to the

House a bill, H.R. 15095, which had been introduced on December 4

by Committee Chairman Wilbur D. Mills and the ranking minority member

of the Committee, Representative John D. Byrnes. As reported, the

bill provided for a 15-percent increase in social security benefits,

effective for January 1970, removing the $105 limitation on wife's

and husband's insurance benefits which had been enacted by the previous

Congress, and increasing the allocation of contribution income to

the disability insurance trust fund. Because the old-age, survivors,

and disability insurance (OASDI) program had a substantial favorable

actuarial balance (1.16 percent of taxable payroll), the benefit increases

that were provided did not necessitate increases in either the contribution

rates or the contribution and benefit base. The House passed the bill

on December 15, 1969 by a vote of 398 to 0.

In the meantime H.R. 13270, the proposed Tax Reform Act of 1969, was

being debated and amended on the floor of the Senate. The amendments

that related to the social security program were to provide:

(1) A 15-percent across-the-board general increase in social security

benefits effective for January 1970;

(2) a minimum benefit of $100;

(3) an increase in the contribution and benefit base to $12,000 beginning

in 1973;

(4) elimination of the $105 limitation on wife's and husband's benefits;

(5) actuarially reduced benefits payable at age 60 for workers, wives,

husbands, widowers, and parents;

(6) a disregard of social security benefit increases for January and

February 1970 in determining eligibility for, and amount of, public

assistance; and

(7) a guarantee that all those receiving both aid to the aged, blind,

or disabled and social security benefits would receive a net increase

in income of at least $7.50 for months after March 1970.

The Tax Reform Act, with these amendments, was passed by the Senate

by a vote of 69 to 22. It was sent to a House-Senate conference committee

on December 11 to settle the differences between the two versions

of the bill. The conferees agreed upon:

(1) A 15-percent across-the-board general increase in social security

benefits effective for January 1970;

(2) elimination of the $105 limitation on wife's and husband's benefits;

(3) an increase in the allocation of contribution income to the disability

insurance trust fund;

(4) a disregard of social security benefit increases for January and

February 1970 in determining eligibility for, and amount of, public

assistance; and

(5) a guarantee that all people receiving aid to the aged, blind,

or disabled and also social security benefits for any month after

March 1970 and before July 1970 would receive a net increase in income

of at least $4 or, if less, the actual amount of the increase in their

social security benefits.

The report of the conference committee was agreed to by both the House

and the Senate on December 22. On December 30, the President signed

the Tax Reform Act of 1969 into law. It became Public Law 91-172.

ACTION IN 1970

In January the Ways and Means Committee resumed consideration of the

President's proposals. On May 11, a new bill, H.R. 17550, reflecting

the Committee's decisions, was introduced in the House by Chairman

Mills and Representative Byrnes.

The major social security proposals made by the President were included

in H.R. 17550 with several significant exceptions. In September 1969,

the President had recommended a 10-percent increase in cash benefits

effective for March 1970 and automatic adjustment of benefits in the

future. The Congress had subsequently enacted a 15-percent increase

in benefits effective for January 1970, and the Committee's bill provided

for an additional 5-percent increase in benefits to be effective for

January 1971. The bill did not include the President's proposal for

automatic adjustments of benefits (and of the contribution and benefit

base), though these proposals were later included in the bill before

it was passed by the House.

Under the Committee bill, the annual amount of earnings to be exempted

under the retirement test would have been increased from $1,680 to

$2,000, with $1 in benefits withheld for each $2 of earnings between

$2,000 and $3,200 and for each $1 of earnings above $3,200. The President

had recommended an annual exempt amount of $1,800, with $1 in benefits

to be withheld for each $2 of all annual earnings above $1,800 and

automatic adjustment of the exempt amount to keep pace with increases

in earnings levels.

The contribution rates approved by the Committee were in accord with

those recommended by the President but differed in detail from his.

The Committee also provided for significant changes in the financing

of the hospital insurance program, intended to restore it to a state

of acceptable actuarial balance.

H.R. 17550 included further changes in the cash benefits program,

in addition to those recommended by the President. Among these were

provisions for the payment of reduced benefits to dependent widowers,

at age 60, elimination of the support requirement as a condition for

benefits for divorced wives and widows, continuing child's benefits

beyond age 22 for certain full-time students, changes in the disability

insured status requirements for the blind, and a change in the workmen's

compensation offset for disability beneficiaries.

The provisions in the Committee bill dealing with the Medicare and

Medicaid programs reflected, for the most part, changes recommended

by the Department. In testimony before the Senate Finance Committee

in February, concerning that Committee's Staff Report on Medicare

and Medicaid, Under Secretary.John G. Veneman recommended a change

in the method of reimbursing institutional providers under Medicare

and the introduction of additional limitations on the recognition

of physicians' fee increases. These recommendations were embodied

in the Committee on Ways and Means version of H.R. 17550, under which

(1) the Secretary was directed to develop large-scale experiments

and demonstration projects to test various methods of making payments

to providers of services on a prospective, rather than retroactive,

cost basis and (2) recognition of increases in physician fee levels

were to be related to indexes reflecting changes in costs of practice

for physicians and in earnings levels.

As part of the Administration's proposals to stimulate the development

of health maintenance organizations, announced by Secretary Finch

in March 1970, an HMO option for Medicare beneficiaries was added

to the bill. Under the option, Medicare beneficiaries could choose

to receive their covered services only through an HMO. The organization

would be paid on a capitation basis instead of being reimbursed for

individual physician visits or hospital stays. The Committee's bill

also included a number of other changes designed to improve the operating

effectiveness of the Medicare program (as well as changes to improve

the operations of the Medicaid and maternal and child health programs).

On May 21, the House passed H.R. 17550 by a vote of 344 to 32, after

re-commitment to the Committee for amendments to provide for the automatic

adjustment of benefits, the contribution and benefit base, and the

retirement test exempt amount. These provisions had been included

in the Administration's proposals for improving the program but were

not included in the bill reported out by the Ways and Means Committee.

In adding the provision for automatic adjustment of the retirement

test, the House also extended the $1-for-$2 deduction provision so

that it would apply to all earnings above the $2,000 annual exempt

amount.

Following House passage, the bill was sent to the Senate for consideration

and was referred to the Senate Committee on Finance, which began public

hearings on June 17. During the summer of 1970, the Committee continued

to hold hearings on H.R. 17550 and it also held hearings on H.R. 16311,

the proposed Family Assistance Act of 1970, which had superseded H.R.

14173. In September the Committee began consideration of the two bills

in executive sessions.

These sessions lasted from September 29 to December 9, when the Committee

completed its deliberations and reported a revised version of H.R.

17550 to the Senate. Many of the provisions of the House-passed bill

were approved by the Committee on Finance, but a number of changes

were made and new provisions were added. In the cash benefits area,

the major modifications included:

(1) A 10-percent increase in social security benefits instead of the

5-percent increase in the House-passed bill;

(2) a $100 regular minimum benefit rather than the $67.20 minimum

resulting from the 5-percent increase in the House-passed bill ;

(3) a limitation on the increase in widow's and widower's benefits

so that benefits would not exceed the amount the deceased spouse would

be receiving if he were still alive (as could have occurred under

the House-passed provision) ;

(4) automatic increases in contribution rates and in the contribution

and benefit base, with the stipulation (not included in the House

bill) that automatic increases would only go into effect in the absence

of Congressional action changing social security benefit levels, contribution

rates, or the contribution and benefit base. Also, half of the cost

of each automatic benefit increase would be financed by an increase

in the contribution rates and the other half by an increase in the

contribution and benefit base. (Under the House bill rising wages

with automatic adjustment of the contribution and benefit base would

have provided adequate financing, without increases in the contribution

rates.);

(5) basing benefits for men on earnings up to age 62, rather than

on earnings up to age 65, only for those coming on the rolls in the

future, to be accomplished over a 3-year transition period (instead

of immediately, as in the House-passed provision and for those already

on the rolls as well as future beneficiaries);

(6) in place of the House-passed provision which eliminated the recency-of-work

requirement for disability insurance benefits to the blind, a much

more far-reaching provision, under which insurance benefits were provided

for a blind person with 6 quarters of coverage earned at any time,

regardless of his ability to work;

(7) extension of the House-passed provision improving childhood disability

benefits, by providing that a person who was entitled to childhood

disability benefits could become reentitled if he becomes disabled

within 7 years after his prior entitlement was terminated;

(8) reduction of the waiting period for disability benefits from 6

months to 4 months (not included in the House-passed bill); and

(9) a revised contribution rate schedule for cash benefits.

The Committee deleted provisions under which (1) election to receive

actuarially reduced benefits in one category would not be applicable

to certain benefits in other categories; (2) the support requirements

for benefits for divorced women would be eliminated; and (3) the ceiling

on income from combined workmen's compensation and social security

disability benefits would be raised from 80 percent to 100 percent

of the worker's average earnings.

Medicare provisions that were added by the Committee included:

(1) Establishment of a peer review system through the use of organizations

representing a substantial number of practicing physicians in local

areas to be called Professional Standards Review Organizations (PSRO's)

(these organizations would assume responsibility for comprehensive

and ongoing review of services provided under Medicare and Medicaid);

(2) establishment of an Office of Inspector General for Health Administration

within the Department of Health, Education, and Welfare having the

responsibility to review and audit Medicare and other health programs

on a continuing and comprehensive basis and the authority to suspend

any regulation, practice, or procedure employed in the administration

of such programs if he determines that the suspension will promote

efficiency and economy of administration or that the regulation, practice,

or procedure involved is contrary to or does not carry out the objectives

and purposes of applicable provisions of law;

(3) provisions for conforming requirements for participation under

Medicare and Medicaid of extended care facilities and skilled nursing

homes;

(4) broadening of penalty provisions relating to the making of a false

statement of representation of a material fact in any application

for Medicare payments to include the soliciting, offering, or acceptance

of kickbacks or bribes by providers of health care services;

(5) establishment of a Provider Reimbursement Appeals Board to resolve

disputes between providers and fiscal intermediaries concerning the

amount of reasonable cost reimbursement;

(6) coverage of services involving the manipulation of the spine by

licensed chiropractors under Medicare if the chiropractor meets certain

minimum standards established by the Secretary;

(7) requirement that the Secretary of HEW make reports of a provider's

significant deficiencies (such as staffing, fire, safety, and sanitation)

a matter of public record readily available at social security offices

if, after a reasonable lapse of time (not to exceed 90 days), such

deficiencies are not corrected;

(8) requirement that the Secretary of HEW develop and employ proficiency

examinations to determine whether health care personnel, not otherwise

meeting specific formal criteria included in Medicare regulations,

have sufficient professional competence to be considered qualified

personnel for Medicare purposes; and

(9) a revised contribution schedule for hospital insurance.

In addition, the Finance Committee added a provision which would have

established a program of catastrophic health insurance under the Social

Security Act for all persons under age 65 who are insured under social

security, their spouses and dependent children, as well as all persons

under age 65 who are entitled to retirement, survivors, or disability

benefits. The health services covered under the provision would have

been those covered under the Medicare program, and coverage would

have been available after family health care expenses exceeded certain

defined limits. The program would have been administered through regular

Medicare administrative procedures and subject to all utilization,

cost, quality, and administrative controls applicable to that program.

Coverage under the program would have been effective beginning January

1972.

Committee modifications of the House-passed bill included:

(1) Expansion of the authority for the Secretary to engage in prospective

reimbursement experiments and to conduct experiments with methods

of payment or reimbursement designed to increase efficiency and economy,

to include experiments with various types of outpatient treatment

centers, including mental health centers;

(2) a liberalization in the definition of extended care and a provision

for deemed coverage of extended care or home health services if required

medical certification and plan of treatment are submitted promptly

; and

(3) elimination of provision for part B coverage of up to $100 per

calendar year of physical therapy services furnished by a licensed

physical therapist in his office or in the patient's home under a

physician's plan.

H.R. 17550 as modified by the Senate Finance Committee also included

certain changes in the welfare programs for families and for adults.

Changes in the welfare programs had been passed by the House in H.R.

16311, which contained the Administration's proposals. That bill was

not acted on separately by the Finance Committee but was, essentially,

incorporated in its consideration of H.R. 17550. With respect to the

aged, blind, and disabled, H.R. 16311 provided a substantially new

Federal-State program under a new title XVI, combining the three categories

into one adult assistance program. The minimum monthly income level

was to have been the higher of $110 or the State's standard on the

date of enactment. Uniform definitions of blindness and disability

were to be applied, and for the blind and disabled there would have

been a mandatory disregard of $85 of earned income plus one-half of

the remainder; there would have been an optional earnings exclusion

for the aged of $60 per month plus one-half of additional earnings.

The resource limitations for all would have been $1,500, plus home,

personal effects, and incomeproducing property essential to support.

This new program would have prevented the States from imposing any

duration of residency requirement, and they could not have citizenship

requirements affecting United States citizens or aliens lawfully admitted

for permanent residence and residing continuously for 5 years, nor

could there be relative responsibility provisions other than for spouses

or parents.

Under the House bill, the Federal Government was to share the administrative

costs on a dollar-for-dollar basis and pay 90 percent of the first

$65 of average payments to recipients and 25 percent of the remainder,

up to a maximum to be set by the Secretary. Any State could have agreed

to have the Federal Government administer all or part of the program

and thereby have the administrative costs paid by the Federal Government.

The Senate Finance Committee version of H.R. 17550 provided for retaining

the separate programs of aid to the aged, blind, and disabled, but

with national minimum income standards of $130 for an individual and

$200 for a couple (with States required to increase their standards

by $10 for an individual and $15 for a couple so that in States already

having standards above $120 and $190 for an individual and a couple,

respectively, recipients would realize an increase in income in connection

with the social security benefit increase), uniform definitions of

blindness and disability, similar to the social security definitions,

a prohibition of liens against the property of the blind as a condition

of eligibility for aid to the blind, and a provision to assure that

all additional expenditures required by the bill with respect to aid

for the aged, blind, and disabled would be met without increasing

State costs.

The bill was reported to the Senate on December 11. During the final

2 weeks of the 91st Congress the Senate debated the bill. Floor amendments

were added to increase the annual exempt amount of earnings under

the retirement test from $2,000 (in the Committee bill) to $2,400,

to provide benefits for dependent grandchildren, and to raise the

ceiling on income from combined social security disability benefits

and workmen's compensation benefits from 80 percent to 100 percent

of a worker's average earnings prior to becoming disabled (the provision

had been deleted by the Committee). The Senate voted to recommit the

bill to delete title IV (the catastrophic health insurance program)

and title III (the Trade Act of 1970), as well as other provisions

of the bill. The bill was passed by a vote of 81 to 0 on December

29.

The Senate requested a conference and appointed conferees. However,

there was no conference and the bill died with adjournment, January

2, 1971. Chairman Mills indicated he would make social security legislation

the Ways and Means Committee's first order of business in the 92d

Congress.

In 1970, an amendment to the act to continue the suspension of duties

on manganese ore (P.L. 91-306) extended the pass-along of $4 of the

1970 social security benefit increase for recipients of aid to the

aged, blind, and disabled. As enacted in the Tax Reform Act of 1969,

the pass-along was effective only for the period April-June 1970.

P.L. 91-306 extended the provision through October 1970. In the closing

days of the 91st Congress, another bill was passed which further extended

the $1 pass-along provision. As passed by the House, the pass-along

provision would have become permanent, but a Senate amendment made

the extension effective only through December 1971. This bill was

enacted in January 1971 as P.L. 91-669.

ACTION IN 1971

When the 92d Congress convened, Chairman Mills and Representative

Byrnes jointly introduced H.R. 1, the social security provisions of

which were, for the most part, the same as those passed by the House

in H.R. 17550 in 1970. (In a few cases the provisions of H.R. 1 incorporated

changes made by the Senate in the House-passed version of H.R. 17550.)

H.R. 1 also included welfare reform provisions passed by the House

in a separate bill in 1970. The Ways and Means Committee held executive

sessions on H.R. 1 from February through May. No public hearings were

held since they had previously been held on essentially the same proposals.

10-percent benefit increase enacted.-In February and March

of 1971, the Congress was also considering H.R. 4690, a bill to increase

the public debt limit. During the debate the Senate added several

social security amendments to the bill. The House-Senate conference

committee, which met to resolve the differences, deleted two social

security provisions--those calling for a $100 minimum benefit and

for a $2,400 annual exempt amount under the retirement test--but accepted

the other social security changes which had been added by the Senate.

The President signed the bill into law on March 17. It became Public

Law 92-5.

The new law provided a 10-percent across-the-board increase in social

security benefits, including future maximum family benefits--the maximum

amount payable to a family based on one worker's earnings. Under earlier

benefit increases, maximum family benefits were increased only for

families whose benefits were limited to the maximum on the effective

date of the increase. In its report, the conference committee explained

that this new method of increasing maximum family benefits was intended

to "change the basic nature of the family maximum by making it

a percentage of the primary insurance amount rather than a percentage

of the worker's average monthly wage."

Under the change, families coming on the rolls after all increase

in benefits has been enacted will get the same benefits as those already

on the rolls.

The special monthly payments made to certain individuals aged 72 and

over who are not insured for regular social security cash benefits

were increased by only 5 percent. Both the 10-percent across-the-board

increase and the 5-percent increase in special age 72 payments were

effective retroactively to January 1971.

The social security contribution and benefit base was increased from

$7,800 to $9,000, beginning in 1972. In addition, the contribution

rate for the social security cash benefits program for 1976 and after

was increased from 5.0 percent each for employees and employers to

5.15 percent. There was no change in the contribution rate for the

self-employed.

1971 Advisory Council on Social Security. In March, the Advisory

Council on Social Security--a group composed, by law, of representatives

of organizations of employers and employees in equal numbers, and

representatives of the self-employed and the public, and including

many distinguished leaders in insurance, labor, business, and other

fields--issued its reports. The Council had been appointed by Secretary

Finch in 1969 and had conducted a comprehensive study of all aspects

of the social security program. Its recommendations for changes in

the social security cash benefits program included most of the major

changes relating to cash benefits that were contained in H.R. I and

major changes in financing policy, which will be described.

Further action on H.R. 1-In May, the Committee on Ways and

Means completed its consideration of H.R. 1 and sent the bill, as

amended by the Committee, to the House for its consideration.

As approved by the Committee, H.R. 1 called for a 5-percent, across-the-board

benefit increase, effective for June 1972, and an increase in the

contribution and benefit base to $10,200, beginning in 1972. It also

contained the major cash benefits and Medicare provisions that were

in H.R. 17550 in 1970--some as they were passed by the House, others

that were passed by the House but modified by the Senate, and still

others that were added to the House-passed version by the Senate.

The bill included compromise provisions for automatically adjusting

benefits to increases in prices and for automatically adjusting the

contribution and benefit base and the retirement test exempt amount

to increases in earnings levels; increased benefits for widows and

widowers, with benefits limited to the amount the worker would be

getting if he were alive; an age-62 computation point for men effective

over a 3-year transitional period; liberalization of the retirement

test; and the several health cost effectiveness amendments to the

Medicare program.

Several major provisions affecting cash benefits that were not in

the 1970 House-passed bill (H.R. 179550) were added by the Committee.

These included a special minimum benefit for people who work for 15

or more years under social security; additional dropout years for

long-term workers; increased benefits for workers who delay retirement

beyond age 65; computation of benefits for certain married couples

based on their combined earnings, and a reduction in the waiting period

for disability benefits from 6 months to 5 months.

The Committee's bill also included a number of new provisions in the

Medicare area. The most significant of these was the extension of

Medicare protection to the disabled. Other provisions, not in the

House-passed bill in 1970, included: a restriction on increases in

the amount of the supplementary medical insurance premium so that

each increase would be limited to the percentage by which benefits

had been increased across-the-board since the premium was last increased;

automatic enrollment (subject to individual opting out) for supplementary

insurance for people entitled to hospital insurance; an increase in

the supplementary medical insurance deductible from $50 to $60 per

year; an increase in the lifetime reserve under hospital insurance

from 60 to 120 days: and coinsurance equal to one-eighth of the inpatient

hospital deductible for each day of inpatient hospital coverage during

a benefit period beginning with the 31st day and through the 60th

day.

In order to pay the additional cost of the changes made by the Committee

in the cash benefits and hospital insurance programs and to restore

the actuarial soundness of the hospital insurance program, a new schedule

of contribution rates was provided and the contribution and benefit

base was raised.

H.R. 1 also contained provisions for far-reaching reforms in the Nation's

public assistance programs. Three new Federal welfare programs incorporating

the President's plans for welfare reform were included. In line with

Administration recommendations, one was to be a Federal adult assistance

program to replace the existing Federal-State programs of aid to the

aged, blind, and permanently and totally disabled. Two new Federal

programs were to replace the program of aid to families with dependent

children to provide assistance for the working poor.

The provisions for a Federal adult assistance program differed significantly

from the adult assistance provisions of H.R. 16311 (passed by the

House in 1970) and H.R. 1 as it was introduced. Under the Committee's

bill, a new title XX of the Social Security Act would establish a

totally Federal program to replace the Federal-State programs of old-age

assistance, aid to the blind, and aid to the permanently and totally

disabled, beginning July 1, 1972; provisions were included, however,

for States to supplement the Federal payments with the objective of

continuing higher payment levels where they existed. The Federal program

and the State supplement, if the State so elected, would be administered

by the Social Security Administration.

The Committee bill provided for full monthly payments (assuming no

other income) of $130 for an individual for fiscal year 1973, $140

for fiscal year 1974, and $150 thereafter; for a couple, $195 for

fiscal year 1973, and $200 thereafter. Aged, blind, and disabled persons

would be eligible if their income (except for certain exclusions)

did not exceed the full benefit amount, and their resources did not

exceed $1,500. A home, household goods, personal effects, and property

essential to self-support generally would not be counted as resources.

The principal exclusion of income from consideration in determining

eligibility and payment amounts applied to earnings: the first $85

of earnings per month and one-half above $85 for the blind and disabled

(plus work expenses for the blind), and the first $60 of earnings

per month and one-third above $60 for the aged.

Definitions of disability and blindness under the adult assistance

provisions were generally the same as under the social security (title

II) provisions. Disabled and blind recipients would be referred to

State agencies for consideration for vocational rehabilitation services;

refusal, without good cause, to accept offered vocational rehabilitation

services would mean ineligibility for assistance payments.

States choosing to provide their own supplements to the Federal payments

could have the Federal Government administer the supplements, with

the Federal Government paying full administrative costs. States also

were provided with a guarantee that if they supplemented the Federal

payments, to the extent that the Federal payments and a State's supplementary

payments to recipients did not exceed the payment levels in effect

under public assistance programs in the State in January 1971, their

costs for the payments would not exceed their total expenditures for

all public assistance payments in calendar 1971; the Federal Government

would assume the additional cost.

Following the Ways and Means Committee's action on H.R. 1, President

Nixon endorsed the bill, calling it "the single most significant

piece of social legislation to be considered by the Congress in decades."

In his statement, the President said:

"The House Ways and Means Committee has taken a momentous

step in approving H.R. 1. This bill, with its important symbolic designation

as the first order of business of the 92d Congress, represents an

important landmark in the history of both social security and public

welfare reform. As reported by the Committee, under the responsible

leadership of Chairman Wilbur Mills and Congressman John Byrnes, this

bill represents the finest kind of cooperation between this administration

and the Congress."

The President also said, however, that there were areas in the bill

that could be improved In particular, he continued to urge inclusion

of his proposal to eliminate the supplementary medical insurance premium

and to finance the supplementary medical insurance program (as hospital

insurance is financed) through employer-employee contributions made

during the working years, rather than from reduced retirement incomes.

On June 22, H.R. 1 was passed by a House vote of 288 to 132 and sent

to the Senate for consideration. The Senate Committee on Finance held

public hearings in July and August, but no further action was taken

until 1972.

Late in 1971, the Congress passed and the President signed into law

H.R. 10604, which contained a minor social security amendment. It

permitted the payment of the social security lump-sum death payment

in cases where the body of an insured worker is not available for

burial and the worker had no spouse who was living with him at the

time of his death. (The law already provided that the spouse of a

worker who was living with him before his death could get the lump-sum

death payment whether or not the body was available for burial.)

Under the change, where no body is available for burial, the provisions

previously applicable where a body was available will apply; that

is, the lump-sum death benefit is paid to any equitably entitled person,

or persons, to the extent and in proportion to the expenses each person

incurred in connection with the death of the insured worker. The expenses

can include a memorial service, a memorial marker, a site for the

marker, or other expenses customarily incurred in connection with

a death. The amendment was effective for deaths occurring after 1970.

The bill extended until the end of 1972 the $4 pass-along provision

that was first enacted in 1969 to guarantee recipients of aid to the

aged, blind, and disabled, who also receive social security benefits,

an increase in income as a result of the social security benefit increase

effective for January 1970. Had the amendment not been passed, the

pass-along provision would have expired at the end of 1971.

ACTION IN 1972

Further public hearings on H.R. 1 were held by the Senate Finance

Committee in January and February of 1972, and the bill was then considered

by the Committee in executive sessions through June. While these sessions

were going on, interest in providing another substantial benefit increase

was growing. On February 23, 1972, Chairman Mills introduced a bill,

H.R. 133207 calling for a 20-percent increase in social security benefits,

an increase in the contribution and benefit base to $10,200 in 1972

and to $12,000 in 1973, and automatic increases in benefits and the

contribution and benefit base.

The contribution rate schedule in H.R. 13320 was based on financing

recommendations that had been made by the 1971 Advisory Council on

Social Security in its reports that year and that had subsequently

been endorsed by the boards of trustees of the social security trust

funds and by the Nixon administration. Under the practice usually

followed in the past, when a schedule of social security contribution

rates was enacted, it was generally designed to provide income slightly

in excess of expenditures for the first few years after enactment

and sufficient income to build up large trust funds in later years.

Interest earned by investing these accumulated funds would provide

a significant amount of income that would help to support the program

in future years. The Advisory Council's recommendation reflected in

H.R. 13320 was that the law should include contribution rates sufficient

to finance all benefit costs (assuming that benefits are increased

as the cost of living increases) fund administrative expenses of the

program, but that would keep the trust funds at a contingency-reserve

level--a level approximately equal to one year's expenditures.

In this regard the Council's recommendation was in basic accord with

the practice followed in financing social security for many years.

Over the years, when Congress has provided for changes in the social

security program, it has generally postponed the effective date of

the high contribution rates under which the large trust funds would

accumulate and provided new current rates at levels necessary to meet

program costs and allow for relatively small annual increases in the

trust funds. The Council's recommendation, then, reflected the way

the program had, in fact, been financed over the past 20 years.

The Council also recommended, and H.R. 130320 reflected, a change

in the assumptions used in making the cost estimates on which contribution

rates are based. In the past, cost estimates were based on the assumption

that wages and benefits would remain level. When wages did in fact

rise, the actual income to the program was greater than the income

shown in the estimates. As a result, the program was over-financed;

the contribution rates in the law were higher than were necessary

to meet the cost of the benefits payable under the program. The Council

recommended that the cost estimates used to determine contribution

rates should be based on the assumption that wages and benefits will

continue to rise in the future as they have in the past. Thus, the

financing recommendations of the Advisory Council made it possible

to finance the existing social security benefits with lower contribution

rates for the next 40 years than were then in the law.

On June 30, 1972, during its consideration of H.R. 15390, a bill which

provided for an extension of the public debt limitation, the Senate

added an amendment, introduced on June 28 by Senator Frank Church,

which was substantially the same as the Mills bill. (The 20-percent

benefit increase was to be effective for September 1972, instead of

June, as under the Mills bill, and the contribution and benefit base

was to be increased to $10,800 in 1973, and to $12,000 in 1974, with

automatic adjustments thereafter.) Both the Church amendment and the

Mills bill provided for financing the cost of automatic benefit increases

from increases in the contribution and benefit base, rather than financing

half the cost from increases in the contribution rates and the other

half from increases in the base as the Senate Committee on Finance

had recommended earlier.

The amendment also provided for a new contribution rate schedule based

on the financing recommendations of the Advisory Council, as had the

Mills bill. In addition, it corrected, through revised hospital insurance

contribution rates, the underfinancing of the hospital insurance program

and put that program on a financially sound basis.

H.R. 15390, with these social security amendments was passed by both

the Senate and the House on June 30, and on July 1 President Nixon

signed the bill into law. It became Public Law 92-336.

In September, the Senate Finance Committee again turned its attention

to H.R. 1 and on September 26 completed its deliberations and reported

the bill to the Senate. A number of changes in the House-passed bill

were made by the Committee. Major changes in the social security cash

benefits program included:

(1) Provision for a special minimum benefit of as much as $200 a month

for a person who had been in covered employment for 30 years, instead

of $150 a month;

(2) making the delayed retirement increment effective retrospectively;

(3) providing a $2,400 annual exempt amount under the retirement test;

and

(4) reducing the waiting period for disability benefits from 6 months

to 4 months (instead of 5 months as in the House provision).

The Committee added a number of new provisions, including one which

would have provided for the payment of benefits for certain aged dependent

sisters and disabled dependent brothers and sisters. It deleted the

provisions relating to actuarially reduced benefits in cases where

the beneficiary is eligible for benefits in more than one category,

computation of benefits on the basis of combined earnings of a married

couple, and dropping of additional years of low earnings from the

computation of benefits. In view of the fact that a 20-percent benefit

increase had just been enacted, the bill reported by the Committee

did not contain a general benefit increase.

With respect to Medicare, the Committee made substantial changes and

additions to the House passed bill. Again included were the amendments,

added earlier by the Senate to H.R. 17550, that related to Professional

Standards Review Organizations, an Inspector General for Health Administration,

disclosure of information concerning provider deficiencies, and coverage

of services of chiropractors. Substantive changes in the House-passed

version:

(1) Expanded the Secretary's experimental authority to include experiments

with payment for various forms of care (not currently covered under

Medicare) as alternatives to covered care, particularly the services

of physicians' assistants and additional types of institutional and

home care;

(2) eliminated provisions which would have (a) raised the part B annual

deductible from $50 to $60 and (b) covered services of independently

practicing physical therapists;

(3) eliminated the addition of coinsurance for the 31st through the

60th day of an inpatient hospital stay and an increased lifetime reserve

and substituted a provision reducing the lifetime reserve coinsurance

from one-half to one-fourth of the inpatient hospital deductible;

and

(4) changed the method of reimbursement of health maintenance organizations

to provide for sharing between the Government and an established HMO

of any savings achieved under the costs of non-HMO beneficiaries,

and recognized a second category of "newly established"

HMO's which would have prospective reimbursement payments retroactively

adjusted to reflect actual cost (the House bill authorized payment

on a capitation basis not to exceed 95 percent of the cost of Medicare

benefits had beneficiaries not been enrolled with an HMO).

Additions made by the Finance Committee included:

(1) Coverage of certain maintenance prescription drugs used in treatment

of most common chronic diseases of the elderly, with $1 co-payment

per prescription;

(2) extension of Medicare protection, on an optional basis, at cost

($33 monthly for part A and $11.60 monthly for part B) to spouses,

aged 60-64, of Medicare beneficiaries; to others aged 60-64 who are

entitled to retirement, dependents, or survivors benefits under the

social security or railroad retirement programs; and to disability

beneficiaries aged 60-64 not otherwise eligible for Medicare because

they have not been entitled to cash disability benefits for 24 months

(the House bill extended Medicare to uninsured persons 65 and over

on a voluntary, premium-financed basis);

(3) termination of the Medical Assistance Advisory Council and consolidation

of its functions with that of the Health Insurance Benefits Advisory

Council, as advisory body to the Secretary on matters of general Medicare

and Medicaid policy;

(4) provisions which would conform Medicare and Medicaid requirements

and procedures with respect to skilled nursing facilities (formerly

called ECF's under Medicare) and level of care requirements for reimbursement

of care received in such facilities (including a broadening of Medicare's

extended care definition to include certain rehabilitation care);

(5) requirement that the Secretary disclose certain information concerning

performance of State agencies, fiscal intermediaries, and carriers;

(6) program for validating, for Medicare purposes, accreditations

by the Joint Commission on Accreditations of Hospitals; and

(7) waiver of Medicare's 14-day transfer requirement for extended

care benefits in certain situations involving non-availability of

beds or unavoidable delay in start of a skilled care regimen.

The Senate Committee also made a number of substantial changes in

the welfare reform provisions of the bill. After previously (in June

of 1972) having made a tentative decision to abandon federalization

of adult assistance in favor of continuing State and local administration

of the existing programs of aid to the aged, blind, and disabled,

modified to set a Federal guaranteed minimum income level, the Senate

Finance Committee decided to include in its bill a Federal program

structured like that provided for by the House. Details of the Federal

program differed in certain significant respects from those in the

House bill. The Finance Committee provided for a new title XVI Federal

program of supplemental security income assuring aged, blind, and

disabled people of income of at least $130 a month for an individual

and $195 a month for a couple. The limit on assets of an eligible

individual or couple was set at $2,500, compared with $1,500 under

the House bill. It also called for an exclusion of $50 of any income,

which in the majority of cases would mean that $50 of social security

benefits would not count as income. The earned income exclusions were

set at $85 per month plus one-half of the rest for all three categories,

that is, aged, blind, and disabled. Those disabled under age 18 would

not have been eligible as they would have been under the House bill.

Disabled persons who were drug addicts or alcoholics were excluded

from eligibility for supplemental security income, but the bill established

a new program (title XV) to provide treatment and, if necessary, maintenance

payments for addicts and alcoholics who qualified under the new title

XV provisions.

The supplemental security income provisions were not made applicable

to Puerto Rico, Guam, and the Virgin Islands; the present Federal-State

programs were to remain in effect in those areas.

Debate on the bill began in the Senate on September 26 and continued

until October 6. A number of amendments were offered from the floor

and several were adopted. These included reduced benefits at age 60

for workers, wives, husbands, and parents, and at age 55 for widows;

an increase to $3,000 in the annual exempt amount of earnings under

the retirement test, with a corresponding change in the monthly measure;

Medicare coverage for most persons under age 65 suffering from chronic

kidney disease; elimination of the part B coinsurance payment for

home health services under Medicare; and coverage under Medicare for

coal miners entitled to black lung benefits.

On October 6, the bill passed the Senate by a vote of 68 to 5. The

Senate requested a conference with the House, and a committee was

appointed. The conferees met on October 10, and by October 14 they

had completed their work and submitted a report. Most of the welfare

provisions of the bill, except those relating to the new Federal adult

assistance program, as well as most of the changes in the bill, that

were added on the floor of the Senate, were dropped.

In the Medicare area, the conferees dropped the provisions relating

to the coverage of drugs, the creation of an Office of Inspector General,

coverage of miners on entitlement to black lung benefits, and coverage

for the uninsured aged 60-64. They agreed not to change the part A

coinsurance provisions or to increase the lifetime reserve days. The

conference committee compromises were agreed to by the House on October

17 by a vote of 305 to 1, and on the same day by the Senate by a vote

of 61 to 0. On October 30, 1972, H.R. 1 was signed into law by the

President and became Public Law 92-603.

Major Provisions of 1972 Social Security

Legislation

PUBLIC LAW 92-336

On July 1, 1972, President Nixon signed Public

Law 92-336, a bill to extend the public debt limit. The legislation

also contained amendment to the Social Security Act, raising the

amount of monthly cash benefits and revising several financing provisions.

Increase in Benefits

A 20-percent increase across the board was

provided for monthly cash benefits, including the special monthly

payments to certain individuals aged 72 and over who are not insured

for regular monthly benefits. The amendments also provided for automatic

increases in benefits as prices rise in the future. The first automatic

increase will be possible in 1975. The procedure in the law for

such increases is as follows:

In 1974 and every calendar year thereafter

(except in a calendar year in which a general benefit increase is

enacted or becomes effective), it will be determined if a "cost-of

-living" increase in cash benefits shall be established. For

the first determination, the arithmetical mean of the Consumer Price

Index (CPI) prepared by the Department of Labor for April, May,

and June of 1974 will be divided by the arithmetical mean of the

CPI for July, August, and September 1972. If such quotient (rounded

to the nearest one-half of 1 percent) is greater than or equal to

3 percent, then a "cost-of-living" increase in benefits

will be established in 1974 and the level of benefits will be increased

by the same percentage, effective January 1, 1975. If the contribution

and benefit base is raised at the same time (see below), the benefit

formula will provide an additional 20 percent on average monthly

earnings above the previous monthly contribution and benefit base.

In subsequent years, the same procedure will

be followed except that the arithmetical mean of the CPI for April,

May, and June in the year of the computation will be divided by

the latest of (a) the arithmetical mean of the CPI for April, May,

and June of the year in which the last effective "cost-of -living"

increase was established or (b) the mean of the 3 months of the

quarter in which the effective month of the last general benefit

increase occurred (July-September 1972, if that is the latest such

quarter). When a "cost-of-living" increase is established,

the new benefits become effective on January 1 of the following

year.

The bill also included a revised tax rate

schedule that included increases in the hospital insurance rates

to restore the financial soundness of that part of the program.

Financing

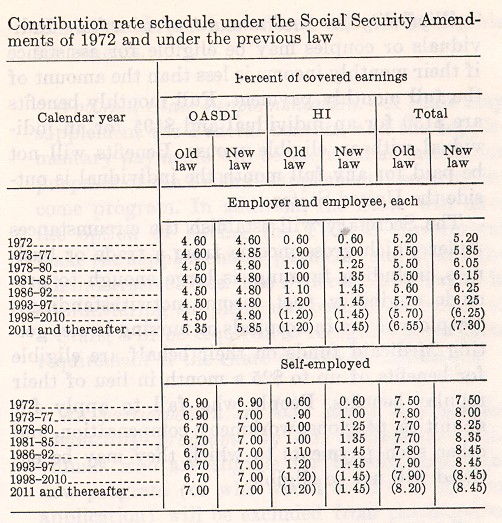

A revised contribution rate schedule was

enacted (and later superseded by the schedule in the October amendments),

with rates as shown in the table . . . under the heading "old

law." The earnings base for contribution and benefit purposes

was also revised--from $9,000 in 1972 to $10,800 in 1973 and to

$12,000 in 1974. The base is to be raised automatically

in the future as wages rise, under the following procedure:

Whenever an automatic adjustment in monthly

cash benefits is made, a determination will also be made as to whether

an adjustment in the maximum amount of annual earnings that will

be taxed and credited toward benefits is required. The determination

is made by multiplying the contribution and benefit base in effect

in the year of determination by the ratio of the average taxable

wages (under the social security program) of all employees, as reported

in the first calendar quarter of the year of determination, to the

average taxable wages of all employees as reported for the latest

of (a) the first calendar quarter of 1973 or (b) the first calendar

quarter of the year in which the last automatic determination resulted

in a base increase or of the year in which a legislative increase

in the base was enacted. The product, rounded to the nearest multiple

of $300, will be the amount of the contribution and benefit base,

effective with respect to remuneration paid after the year of determination.

In no case, however, will the base be reduced to an amount lower

than the base in the year of determination.

PUBLIC LAW 92-603

Cash Benefits

Increase in widow's and widower's benefits.

A widow (or widower) who first becomes entitled to benefits at or

after age 65 receives a benefit equal to 100 percent of her deceased

husband's primary insurance amount if he did not receive reduced

benefits before his death. If he did receive reduced benefits, the

widow's benefit can be no more than the amount her husband would

be receiving if he were still alive. (A widow

who becomes entitled to benefits at or after age 62 receives

no less than 82.5 percent of her husband's primary insurance amount.)

Benefits for widows (or widowers) who become entitled between ages

62 and 65 are reduced to take account of the longer period over

which they are paid, just as widow's benefits are reduced, under

the previous law, between ages 60 and 62.

Age-62 computation point for men.-For

men who reach age 62 in the future, benefits will be based on average

monthly earnings figured up to age 62, as is now the case for women.

The change is to be accomplished in three steps: A man who reaches

age 62 in 1973 will have his average earnings figured over a period

1 year shorter than under the old law; a man who reaches age 62

in 1974 will have his earnings figured over a period 2 years shorter

than under previous law. For men reaching age 62 in 1975 or later,

the computation period will end at age 62 (3 years less than previously).

Similar changes are made in the insured-status requirements.

Liberalization and automatic adjustment

of the earnings test.-The annual exempt amount of earnings

is increased from $1,680 to $2,100. The amount of wages

an individual may earn in a month and still receive full benefits

for the month is raised from $140 to $175. Benefits are reduced

by $1 for each $2 of all earnings above $2,100. At no point

is $1 in benefits withheld for each $1 of earnings, as had been

the case for earnings above $2,880. The annual exempt amount in

the retirement test and the monthly test will be adjusted automatically

in the future to reflect rises in the general earnings levels, according

to the following procedure in the law:

A determination as to whether an adjustment

of the earnings test is required will be made in the year a "cost-of-living"

increase is established. The determination is made by multiplying

the exempt monthly amount that is effective with respect to months

in the year of determination by the ratio of the average taxable

wages of all employees, as reported in the first calendar quarter

of the year of determination, to the average taxable wages of all

employees as reported for the latest of (a) the first calendar quarter

of 1973 or (b) the first calendar quarter of the year in which the

last automatic determination resulted in an increase in the base

or of the year in which a legislative increase in the base was enacted.

The product, rounded to the nearest multiple

of $10, will be the new exempt monthly amount effective for the

taxable year beginning after the year of determination (unless Congress

has enacted an increase in the exempt amount in the year of determination).

In no case, however, will the new exempt amount be reduced to an

amount lower than the exempt amount in the year of determination.

In the year in which a person attains age

72, his earnings in and after the month of attainment of age 72

will not be included in determining his total earnings for the year.

(Before the amendment, they were included.) These provisions are

effective for taxable years ending after 1972.

Delayed retirement credit.-The average

benefit of a worker who does not take a reduced benefit is increased

by 1 percent for each year (1/12 of 1 percent for each month) after

1970 for which the worker between ages 65 and 72 did not receive

benefits because of earnings from work. No increased benefit will

be paid under this provision to the worker's dependents or survivors.

Special minimum primary insurance amount.

A special minimum benefit equal to $8.50 multiplied by a worker's

years of coverage in excess of 10 years, up to a maximum of 30 years,

is provided. The highest minimum benefit under this provision is

$170 a month for an individual ($255 for a couple) with 30 or more

years of coverage. A special minimum is thus payable to those who

worked for many years at low earnings under the social security

program. The special minimum will be paid as an alternative to the

regular benefit when a higher benefit results. If an increase is

provided under the automatic benefit increase provision in the law,

this special minimum will not, however, be raised.

Reduced benefits for widowers

at age 60. Non-disabled widowers, like widows, may elect to

receive reduced benefits at age 60.

Changes in disability provisions.-Several

changes have been made that relate to the disability program:

1. The waiting period throughout which a

person must be disabled before disability benefits can begin is

reduced from 6 months to 5 months. The first benefit is payable

for the sixth month of disability.

2. A blind person will be insured for disability

insurance benefits if he is fully insured-that is, if he has as

many quarters of coverage as the number of calendar years elapsing

after the year he reached age 21 (or 1950, if later) and

up to the year in which he became disabled. He no longer has to

meet the requirement of recent covered work (generally 20 quarters

of coverage in the period of 40 calendar quarters preceding disablement).

3. Childhood disability benefits are extended

to the disabled adult son or daughter of an insured deceased parent

or a parent eligible for old-age or disability insurance benefits

if the son or daughter became totally disabled after age 18 but

before age 22. Previously, benefits were limited to those disabled

before age 18. In addition, a person can now become re-entitled

to childhood disability benefits if he again becomes disabled within

7 years after his earlier entitlement to such benefits was terminated.

4. The amendments modify the provisions under

which social security disability benefits are reduced where workmen's

compensation is also payable. Previously, social security disability

benefits had been reduced if the combined payments from both programs

exceeded 80 percent of the worker's average current earnings before

disablement; average current earnings for this purpose were computed

on two different bases and the larger amount was used. The new provision

adds a third alternative base under which a worker's average current

earnings can be based on a single year of his highest earnings in

a period consisting of the year of disablement and the 5 preceding

years.

5. The application requirement for disability

insurance benefits (and dependents' benefits based on the worker's

entitlement to disability benefits) will be met if the application

is filed within 3 months after the disabled worker's death or within

3 months after enactment of the provision. (Previously, an application

had to be filed while the disabled worker was alive, either by the

disabled worker or, if he was unable to file, by another person

on his behalf.) This new provision applies with respect to deaths

occurring after 1969.

6. The amendments authorize an increase in

the amount of social security trust fund money that can be used

to pay the costs of rehabilitation services for social security

disability beneficiaries. The amount is increased from 1 percent

of the previous year s disability benefits under the old law, to

1.25 percent for fiscal year 1973 and to 1.5 percent for fiscal

year 1974 and thereafter.

Changes in eligibility requirements.

-The amendments include the following revisions relating

to eligibility:

1. The law no longer requires that to qualify

for benefits as a divorced wife, divorced widow, or surviving divorced

mother, a woman must show that a court order in effect provided

for substantial contributions to the woman's support by the former

husband, that she received substantial contributions from her former

husband, pursuant to a written agreement, or that she received half

her support from her former husband.

2. For a child who is attending school full

time when he reaches age 22, benefit payments will continue through

the end of the semester or quarter in which he reaches that age

if he has not received or completed the requirements for a bachelor's

degree from a college or university. If the educational institution

in which he is enrolled is not operated on a semester or quarter

system, benefits continue until the month following the completion

of the course in which he is enrolled or 2 calendar months have

elapsed after the month in which he reaches age 22, whichever occurs

first.

3. For children adopted by old-age and disability

insurance beneficiaries, the differences in eligibility requirements

for entitlement to child's benefits are repealed and new uniform

requirements for both cases are provided. Now, a child who is adopted

by a worker getting retirement or disability benefits, regardless

of when the adoption occurs, may get benefits if (1) the adoption

was decreed by a court of competent jurisdiction within the United

States; (2) the child was living with and receiving at least half

his support from the worker for at least 1 year before the worker

became entitled to retirement or disability benefits; and (3) the

child was under age 18 when he began to live with the worker. A

child born in the 1-year period during which he would otherwise

be required to have been living with and receiving at least half

his support from the retired or disabled beneficiary is deemed

to meet the living-with and support requirements if he

was living with the beneficiary in the United States and receiving

at least half his support from the beneficiary for substantially

all of the period occurring after his birth.)

This provision is effective with respect

to benefits payable for January 1968 and thereafter if an application

for benefits is filed within 6 months after the month of enactment;

otherwise, it is effective with respect to benefits payable for

the month of enactment and after.

4. Child's insurance benefits are provided

for a grandchild of a worker or of his spouse if (1) the child was

living with and receiving at least half his support from the worker

for the year immediately before the worker became disabled or entitled

to old-age or disability benefits or died; (2) the child began living

with the worker before he attained age 18; and (3) at the time the

worker became disabled or entitled or died (a) the child's natural

or adopting parents or stepparents were disabled or were not alive

or (b) the child was adopted by the worker or by the workers surviving

spouse after the Worker's death and the child's natural or adopting

parent or stepparent was not living in the worker's household and

making regular contributions toward the child's support at the time

the worker died. (A child born in the 1-year period during which

he would otherwise be required to have been living with and receiving

at least half his support from the grandparent is deemed to meet

the requirement if he was living with the grandparent in the United

States and receiving at least half his support from the grandparent

for substantially all of the period occurring after his birth.)

5. Effective on enactment, the amendments

repeal the provisions that required the termination of child's insurance

benefits if the child was adopted by someone other than (1) his

natural parent, (2) his natural parent's spouse jointly with the

natural parent, (3) the worker-a stepparent, for example--on whose

earnings the child was getting benefits, or (4) a stepparent, grandparent,

aunt, uncle, brother, or sister after the death of the worker on

whose earnings the child is getting benefits. A child whose entitlement

to benefits was terminated because of the earlier provision and

who would otherwise still be entitled may, on filing an application,

become re-entitled to benefits effective with the month of enactment

of the amendments.

6. The 3-month duration-of-relationship requirement

in the old law is repealed for cases of accidental death or death

in the line of duty as a member of a uniformed service on active

duty. Retained, however, is the prohibition against the payment

of benefits in cases where the relationship does not last 9 months

because of such deaths, if the Secretary of Health, Education, and

Welfare determines that at the time of the marriage of the deceased

individual he could not have reasonably been expected to live for

9 months. Also waived is the duration-of-relationship requirement

for entitlement to benefits as a worker's widow, widower, or stepchild

when the worker and his spouse were previously married, divorced,

and then remarried, the relationship existed at the time of the

worker's death, and the duration-of-relationship requirement would

have been met if the worker had died on the date he was divorced

from his spouse.

Wage credits for Members of the Uniformed Services.- Non-contributory

wage credits are provided, in addition to contributory credits for

basic pay, for military service during the period January 1957 (when

military service was first covered) through December 1967. (Previously,

such credits had been provided for military service beginning January

1968.) Wage credits will uniformly be $300 for each quarter in which

the serviceman receives military pay--rather than $100, $200, or

$300, depending on the amount of covered military pay in the quarter,

under the old provision. The new provision is effective for monthly

benefits after December 1972.

Members of religious orders taking a

vow of poverty. -Effective on enactment, the amendments extend

coverage to members of a religious order who have taken a vow of

poverty (with respect to services performed in the exercise of duties

required by the order) as employees of the order, if the order makes

an irrevocable election of coverage for its entire active membership

and for its lay employees. Wages for social security purposes will

be the fair market value of any board, lodging, clothing, and other

perquisites furnished to the member (but not less than $100 a month).

Each order can elect up to 5 years of retroactive coverage for persons

who were active members on the day coverage took effect.

Social security numbers. -Effective

on enactment, the amendments make it a misdemeanor (1) to willfully,

knowingly, and with intent to deceive the Secretary of Health, Education,

and Welfare as to someone's identity, furnish false information

to the Secretary in connection with the establishment and maintenance

of social security records and (2) to use a social security number

obtained on the basis of false information, to falsely represent

a number to be a social security number, or to use someone else's

social security number, for the purpose of increasing a payment

under social security or any other federally funded program, or

for the purpose of obtaining such payment.

The provision directs the Secretary to issue

social security numbers to (1) aliens at the time of their adinission

for permanent residence and aliens at the time they are admitted

temporarily with permission to work or at the time their status

is changed to permit them to work; (2) any individual who applies

for or receives benefits under any Federal or federally subsidized