Associate Commissioner, Office of Program Development and Research

Social Security Administration

before the House Committee on Ways and Means

Subcommittee on Social Security

June 19, 2013

Chairman Johnson, Ranking Member Becerra, and Members of the Subcommittee:

Thank you for the opportunity to discuss our responsibility to help disability beneficiaries return to work, or to go to work for the first time in the case of young adults with disabilities receiving Supplemental Security Income (SSI). Our beneficiaries have a wide-range of impairments and represent diverse age groups, levels of education, work experience, and capacities for potentially returning to work. Despite significant resource and staffing challenges, helping these beneficiaries with employment opportunities remains one of our highest priorities. We are making progress and building on our commitment that began over 50 years ago to help beneficiaries return to work. Today, I will discuss several topics related to our return to work efforts, including statutory work incentives, the Ticket to Work (Ticket) Program, and our demonstration projects.

Introduction

We serve a diverse population of Americans with disabilities through the Social Security Disability Insurance (SSDI) and the Supplemental Security Income (SSI) programs. In calendar year 2012, we paid about $135 billion in SSDI benefits to 10.9 million people, and about $33 billion in SSI benefits to 5.5 million people aged 18 to 64 based on disability.

According to our Chief Actuary, most of the growth in the SSDI rolls over the last 30 years can be attributed to a combination of demographic factors and increased employment of women. Specifically, the baby boom generation aged and reached its disability-prone years and more women entered the labor force. Changes in the law that raised the full retirement age further added to program growth as more people formerly classified as retired were classified as disabled.

While the SSDI program constitutes a part of our Nation’s social safety net, we cannot say that the benefits it offers substantially discourage work. For example, in December 2012 a disabled worker received, on average, a little over $1,100 in SSDI benefits per month. Thus, a disabled worker seeking more than a basic standard of living cannot rely on the SSDI program. Quite simply, he or she must return to work in order to achieve long-term financial stability and independence.

We must not downplay or dismiss the very real difficulties disability beneficiaries face. The Social Security Act (Act) defines disability stringently – a person must be unable to engage in any substantial gainful activity (SGA) due to a physical or mental impairment that has lasted or is expected to last at least one year or to result in death. SSDI beneficiaries are some of our Nation’s most severely disabled people. Realistically, we cannot expect most of them to return to work or leave benefits through substantial earnings. For most, self-supporting employment may not be a viable option. In fact, while approximately 40 percent of SSDI beneficiaries express interest in working, only about three percent of those awarded benefits in 1996 had their benefits terminated due to work activity within a 10 year follow-up period.1

Therefore, we need to be realistic and strategic about the number of beneficiaries who can become financially independent through work and earnings. We must also ensure that our work incentives and the Ticket program provide a path to jobs that lead to self- supporting futures.

Work Incentives

The Act includes a number of incentives to encourage disability beneficiaries to return to work. Generally, these incentives provide beneficiaries with continued benefits and medical coverage while working or pursuing an employment goal. For example, in the SSDI program, work incentives include the trial work period and the extended period of eligibility. The SSI program has different work incentives, such as special rules for counting earnings after disability is established and the Plan to Achieve Self-Support. Both programs have special rules about impairment-related work expenses, expedited reinstatement, and medical insurance. The Ticket to Work and Work Incentives Improvement Act of 1999 (Ticket Act) extended Medicare and Medicaid coverage for individuals even after they have become fully self-supporting and earned their way off SSDI or SSI. I have attached a more comprehensive description of our work incentives at the end of my testimony (Appendix A). Because work incentives are integral to both of our disability programs and are relevant to a significant number of disability claims, we have not captured work incentive costs as a separate budget item. Our work incentives should be viewed as a total package to fully appreciate the multiple levels of support available to help our beneficiaries achieve their goal of greater economic independence.

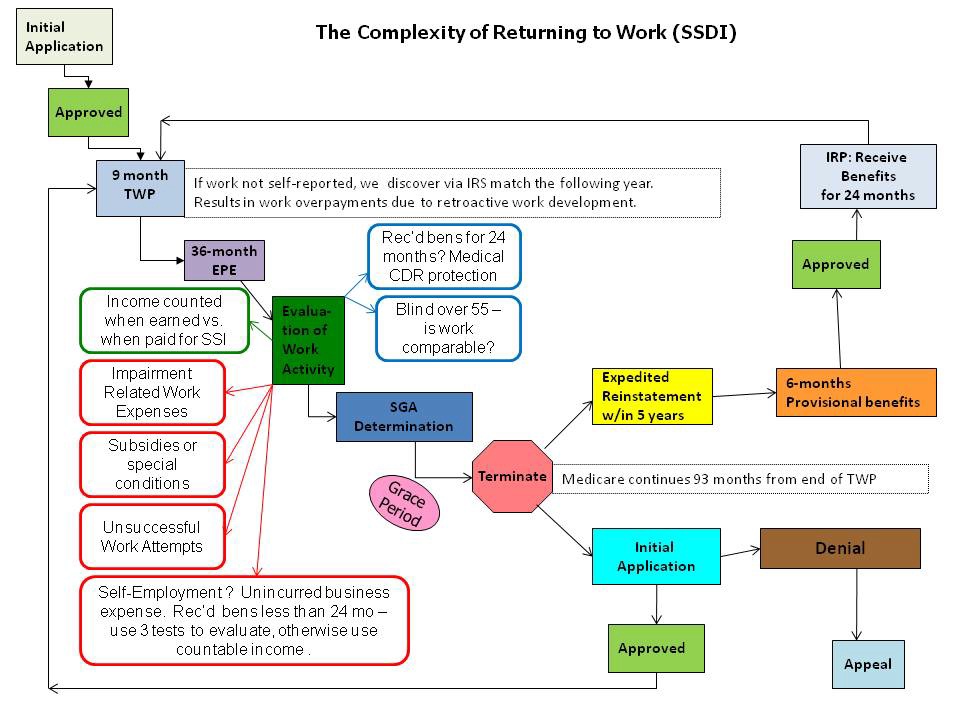

We have trained our field office personnel to explain work incentives, and we publish information on our website and in print to help people understand them. Nevertheless, as illustrated by this hard to understand chart, our work incentive provisions are complex and may be difficult for beneficiaries to understand and can be challenging for us to administer.

Because the work incentive rules are different for SSDI than they are for SSI, the situation is even more complex if a person is entitled to both types of benefits.

The Vocational Rehabilitation Cost Reimbursement Program

The issue of return to work has been a part of any discussion about the Social Security disability program since it was created by the Social Security Amendments of 1954. The law included a requirement that all disability claimants be referred to the State vocational rehabilitation (VR) agency “so that the maximum number of disabled individuals may be restored to productive activity.”2

Today, the VR cost reimbursement program is the primary employment support program used by our beneficiaries. VR cost reimbursement came into existence in the early 1980s after Congress determined that more accountability was required of State VR agencies receiving Trust Fund dollars to provide services to our beneficiaries. The program requires a State VR agency to file a reimbursement claim with us after the agency completes its work with a beneficiary and that beneficiary becomes employed. The claim documents the services provided and the cost of those services, both direct and indirect. Once we verify that the beneficiary earned an amount sufficient to allow reimbursement, the State VR agency receives funds from us as program income.3 The statutory reimbursement standard for State VR agencies is earnings at the SGA level for a continuous period of nine months. In FY 2012, we made 5,343 payments to VR agencies in the total amount of $78.8 million based on the work activity of 4,418 beneficiaries.4

The Ticket to Work Program

Despite the State VRs’ long history as partners in our employment support efforts, access to VR services remained an issue for disability beneficiaries. As Chairman Jim Bunning noted during a hearing in July 1997 before this Subcommittee:

…fewer than one-half of one percent of disabled recipients leave the rolls because of successful rehabilitation. Social Security and disability recipients are just not getting rehabilitative services they need…. Congress must give recipients with disabilities the opportunity to obtain the tools and training they need to return to productive and self-sufficient lives.5

In 1999, Congress passed the Ticket Act, which established the Ticket program. Congress intended the Ticket program to expand the universe of service providers and to provide beneficiaries with choices beyond the State VR agencies to obtain the services and supports they need to secure and maintain employment.

Ticket to Work Program Overview

Under our current Ticket program rules, any adult SSDI beneficiary or individual receiving SSI benefits based on blindness or disability is eligible to participate in the Ticket program. A beneficiary who is eligible to participate in the Ticket program may choose to assign his or her Ticket to an Employment Network (EN) or work with a State VR agency. We contract with ENs (which are qualified State, local, or private organizations) to provide or coordinate the delivery of employment support services to our disability beneficiaries. Some State VR agencies also act as ENs.6 Recently, we approved an AmeriCorps project to function as an EN.

Because ENs (including the Department of Labor’s American Job Centers and state and local workforce investment boards) are a critical element of the Ticket program, we rely on several oversight measures to help ensure they provide quality service. We have a specialized quality assurance unit that verifies the qualifications of prospective ENs and monitors the performance of current ones. Two years ago, we established new criteria for assessing EN qualifications and defined EN performance standards more clearly. These standards are a part of every EN agreement and measure whether the ENs substantially provide the services they agreed to provide to the beneficiaries. They also measure job placement rates for each EN and the extent to which the ENs help our disability beneficiaries achieve at least SGA-level earnings. These standards also require that ENs maintain at least quarterly contact with beneficiaries to assist with job retention.

Beneficiaries, ENs, and State VR agencies voluntarily participate in the Ticket program. An EN decides whether to accept a Ticket from the beneficiary. Once a beneficiary assigns a Ticket to an EN, the EN provides employment support services to assist the beneficiary in obtaining self-supporting employment. The beneficiary receives these services at no charge. Consistent with congressional intent, we pay an EN only when it is successful in assisting beneficiaries secure and maintain employment.

As of May 31, 2013, there were 44,452 Tickets assigned to 653 ENs. The measures we have taken to enhance the performance of ENs that participate in the program have resulted in fewer ENs, but the participating ENs are better qualified to help beneficiaries achieve their work goals. We have also directed ENs to put more emphasis on job retention and seek clients that want to become financially independent from disability cash benefits. The process of improving the performance of ENs is a gradual one.

Overall, we estimate that we spent approximately $46 million to run the Ticket program in fiscal year (FY) 2009, including the cost of agency staff responsible for overseeing the program, milestone and outcome payments to ENs, and support contracts.7 This estimate is the best and most current one available for program costs. In FY 2012, we made 46,001 payments to Employment Networks in the total amount of $28.4 million dollars based on the work activity of 8,408 beneficiaries.

The Ticket program can be valuable even if it helps only a small number of beneficiaries return to work. Each disability award is expensive; on average, an award costs about $250,000 in SSDI benefits and Medicare costs over a beneficiary’s lifetime. To the extent that we get some of our beneficiaries back to work and off the disability rolls, we will save a portion of those program costs; it does not take many beneficiaries to return to work for those savings to add up.

Ticket to Work Program Success Stories

We continue to take steps to improve the Ticket program. For example, we are researching how former disability beneficiaries fare after they earn their way off the rolls. We plan to survey beneficiaries and analyze data to identify needs, characteristics, and experiences of these former beneficiaries to improve our return to work and job retention efforts.

The Ticket program has already helped some disability beneficiaries. Let me share a few stories.

- In 2007, T. lost her job when her employer downsized. She was also diagnosed with cancer, and its severity qualified her for SSDI benefits. Those benefits kept her from losing her house, but they could not guarantee financial stability. Once she completed her cancer treatment, she needed to resume working.

However, T. was concerned that she might not fit in with the modern workforce. She was also concerned that she would prematurely lose her benefits. Using her Ticket, she found an EN that helped her develop a plan to achieve her employment goals. The EN explained our work incentives to her, helped her improve her job-seeking techniques, and recommended that she develop her computer skills. Today, T. works as a loan specialist at a bank and as a trainer for a retailer. She no longer receives or needs benefits.

- After being diagnosed with lung cancer, F. had to take a medical leave of absence from her job. She qualified for SSDI benefits. These benefits helped cover some of her family’s household expenses. However, they would not be enough to keep her family farm. Therefore, she was worried that she would lose her job if she stayed on leave for too long. After a year of treatment, she used her Ticket to receive services that allowed her to transition back to work. F. was able to keep her job and her farm. She does not receive benefits.

- R. served in the military. After leaving the military, he worked as a civil servant. It was during this period when R. began to experience pain and difficulty walking. A surgical procedure to correct a ruptured disc left him paralyzed. The Department of Veterans Affairs (VA) helped get him SSDI benefits. Most importantly, VA introduced him to the Ticket program, and connected him to his EN. The Ticket program provided him the safety net supports and opportunity he needed to return to work.

Today, R. assists and advises other disabled veterans on how to access VA health care and employment support services. He does not receive benefits.

Other Return to Work Efforts

The Ticket Act created two other programs, the Work Incentives Planning and Assistance (WIPA) program and the Protection and Advocacy for Beneficiaries of Social Security (PABSS) program, to supplement the assistance available at our field offices. The two programs authorize grants to organizations with ties to the disability community at the local level.

The full-year continuing appropriations act that Congress passed for FY 2013 included $23 million and $7 million for the WIPA and PABSS programs, respectively. These programs are useful tools in our return to work efforts. We expect to make WIPA awards by August 1, 2013, and WIPA services will resume immediately thereafter.8 We have worked closely with the 57 PABSS grantees to resume services as quickly as possible. We estimate that all of the grants will be awarded by June 30, 2013.

Work Incentives Planning and Assistance

The WIPA program assists disability beneficiaries across the country. As I mentioned earlier, work incentives are complex and may be difficult to understand. Our WIPA grantees are community based organizations that help disability beneficiaries understand work incentives and the effect of earnings on disability and healthcare benefit eligibility. Currently, 95 of the 102 WIPA projects funded in 2012 are expected to resume services. We will have a WIPA project in almost every State, and we have successfully negotiated with WIPA projects within the same State or a contiguous State for coverage of catchment areas addressed by the seven previously funded WIPA projects that declined resumed funding in 2013.9

Specifically, the grantees offer information and referral (I&R) services and intensive services to our disability beneficiaries. I&R services consist of providing general information about work incentives and referrals to employment and support services. WIPA services help a beneficiary determine his or her work goals and the best way to achieve them.

Intensive services include the following:

- counseling individuals on available options for obtaining or maintaining employment based on their goals and abilities;

- providing individualized information to beneficiaries regarding the effect of changes in employment or personal circumstances on their benefits and health care coverage; and

- providing long-term assistance and support to beneficiaries as changes occur in their employment and benefits status.

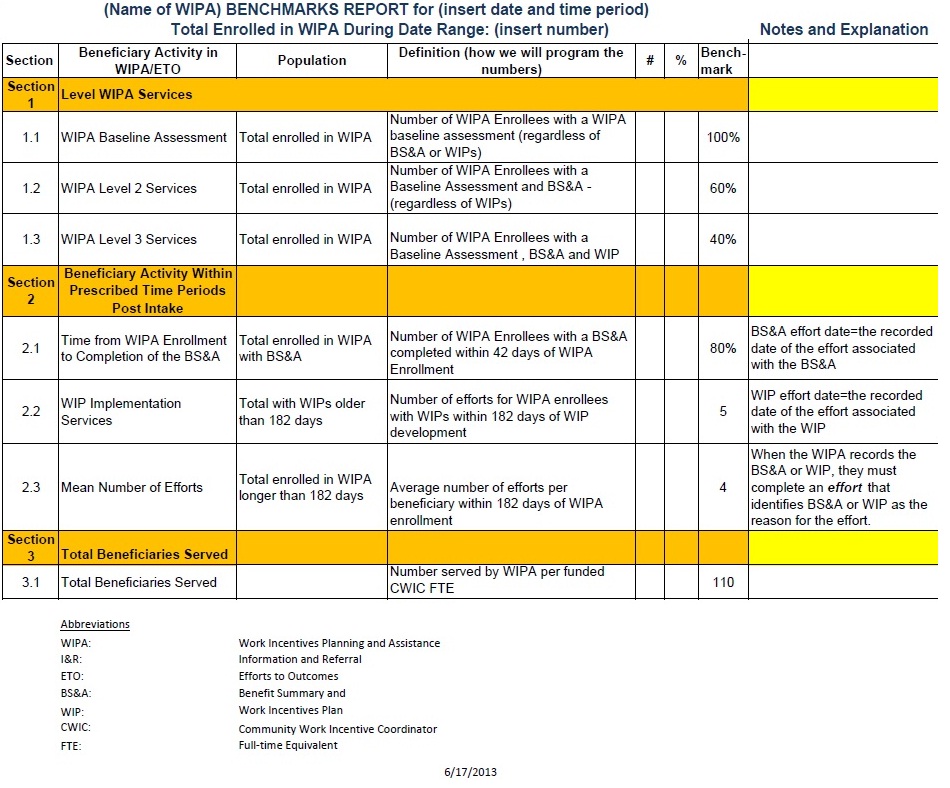

Given the complexity of our work incentives, providing this assistance is of vital importance and is probably the WIPA program’s most valuable service. We have also developed six WIPA benchmarks and one annual performance indicator.9 The annual performance indicator will measure the extent to which the WIPA services facilitated beneficiaries achieving full employment and self-sufficiency. The WIPA projects use the benchmarks as performance targets.

Technical Assistance

We set aside $3 million of the WIPA funds for our training and technical assistance contractor. Currently, Virginia Commonwealth University (VCU) helps us administer and manage the National Training Center that provides training, certification, and technical assistance to the WIPA projects. Specifically, VCU trains and certifies Community Work Incentives Coordinators so that each WIPA project is staffed with experts with the capacity to provide the most current and accurate information to our beneficiaries, enabling them to make informed choices about employment and financial self-sufficiency.

Protection and Advocacy for Beneficiaries of Social Security

The PABSS is a network of organizations (State-designated protection and advocacy agencies) in all 50 States, the District of Columbia, U.S. territories, and the tribal entities. This network represents the Nation’s largest provider of legal-based advocacy services for persons with disabilities. While WIPA projects provide our beneficiaries with information about our work incentives, the 57 agencies in the PABSS help beneficiaries obtain VR services, appropriate employment supports, and legal guidance and representation as needed when there are obstacles to employment and financial self-sufficiency.

The PABSS grantees provide I&R and in-depth services to beneficiaries. I&R are shortterm interventions that range from simply referring a beneficiary to a more appropriate service provider to making calls or writing letters on a beneficiary’s behalf. In-depth services involve more assistance than I&R and range from short-term problem solving and legal assistance and counseling to litigation help.

The primary goal of the PABSS grantees is to advocate for the removal of barriers to work. To maintain the flexibility of the PABSS, we do not dictate the number or types of cases a grantee must take. Instead, we outline the general nature of the services as part of the terms and conditions of the award. We monitor PABSS grantees by reviewing performance reports that offer numerical and narrative information about the project activities supported under PABSS funding. Our project officers review those reports to ensure that the cases described fit within the PABSS’ mission and grant conditions.

Disability Demonstration Projects

The Ticket Act authorized us to test how certain statutory changes to the disability program would affect beneficiary work activity.10 Pursuant to this demonstration authority, we initiated four demonstration projects: (1) the Benefit Offset National Demonstration (BOND); (2) the Mental Health Treatment Study (MHTS); (3) the Accelerated Benefits Demonstration (AB); and (4) the Youth Transition Demonstration (YTD). Each project has distinct objectives.

Benefit Offset National Demonstration

Because SSDI beneficiaries lose all of their cash benefits for any month in which they engage in SGA after completing the trial work period, they are often reluctant to attempt to work. The BOND project tests the effects of replacing this “cash cliff” with a benefit offset that reduces SSDI benefits $1 for every $2 a beneficiary earns above the SGA threshold. This benefit offset takes effect after the beneficiary completes the trial work period and subsequent three-month grace period, during which the beneficiary continues to receive his or her full benefits regardless of earnings amounts. We also offer certain BOND participants enhanced work incentives counseling. Based on data from this project, we will estimate the effect of the benefit offset and counseling on beneficiary work activity.

This demonstration consists of two phases. During the first phase, which lasted from August 2005 to December 2008, we conducted a four-State pilot project. 11 These States tested a $1 benefit offset for every $2 earned above SGA in combination with benefits counseling. Published research on outcomes for the four-State pilot found increases in the percentage of individuals earning above SGA, but also increases in benefit payments. However, because the sites and pilot participants were not nationally representative, researchers have noted that only a national test will yield results that provide definitive information on the earnings outcomes and potential costs associated with a $1-for-$2 offset.12

The four-State pilot has also helped inform our national demonstration project. In the four-State pilot, we used a manual process instead of building an automated system for delivering notices and adjusting benefit payments. We used our experience from the pilot to identify the extensive systems work that was necessary to create an automated process of delivering notices and benefit payments for the much larger sample of beneficiaries in the BOND.

During the second phase, we are conducting a more expansive demonstration in sites across the Nation. We started full field operations of BOND in April 2011 and have met our enrollment goals. We currently have over 1,000 beneficiaries working at a level where their benefit payment is offset. We are conducting additional outreach to ensure that participants are aware of the BOND program and the modified rules. Because enrollment ended in September 2012, we do not have meaningful data yet on employment outcomes.

Regarding administrative costs, we spent $10.6 million dollars on the BOND design contract and $9.4 million on the four-State pilot. Our implementation and evaluation contract is for $124.8 million, and we expect the project will be completed within the $124.8 million. We are completing systems work with Lockheed Martin and will have spent $8 million on the systems changes to administer BOND payments. The total nonbenefit cost of BOND and the four-State pilot activities will be approximately $152.8 million.

Mental Health Treatment Study

We awarded a contract in September 2005 for the MHTS. This study tested the hypothesis that access to medical care and employment supports would enable SSDI beneficiaries with schizophrenia or affective disorders to return to work. We developed this demonstration for the following reasons: (1) SSDI beneficiaries with psychiatric impairments represent roughly one-quarter of the SSDI roles; (2) there are employment supports that can help people with mental illness return to work; and (3) despite surveys consistently indicating that they want to work, individuals with severe mental illness have one of the lowest employment rates of any subpopulation.

Conducted between November 2006 and July 2010, the MHTS included 2,238 beneficiaries in 23 study sites throughout the United States. Beneficiaries volunteering to participate in the study received a random assignment to either a treatment group or a control group and participated for 24 months. The study collected data on the primary outcome measures of employment (including earnings), health status, and quality of life. The contractor completed the final report in August 2011, and it is available on our website: http://socialsecurity.gov/disabilityresearch/mentalhealth.htm.

Overall, study findings show that beneficiaries in the treatment group ended the study, relative to the control group, with the following:

- significantly better employment rates

- higher earnings and income;

- more hours worked;

- a greater number of months worked;

- better mental health; and

- a higher quality of life.

Study findings also show that the treatment package played a significant role in reducing inpatient hospital use (for both admissions and number of days) and reducing psychiatric crisis visits. This reduction in hospital days per year translated into reduced annual medical costs of approximately $1,800 per person.13 The study had no impact on increasing SGA or reducing SSDI benefit payments among beneficiaries.

We continue to do research on the study population and to conduct outreach activities to share findings, promote best practices, and encourage additional research in this area.

Accelerated Benefits Demonstration

Under current rules, most SSDI beneficiaries have a 24-month waiting period after the date of entitlement before they are eligible for Medicare. In this project, we tested the effect of providing immediate access to healthcare to newly entitled SSDI beneficiaries. Specifically, we tested whether providing medical benefits sooner would result in better health and return to work outcomes for beneficiaries. The project started in October 2007. We enrolled about 2,000 beneficiaries in one of three study groups: (1) a control group; (2) a group that receives a medical benefits package (AB group); and (3) a group that receives the medical benefits package and comprehensive support services (AB plus group). We completed this project in January 2011. The final report is available to the public on our website: http://www.ssa.gov/disabilityresearch/accelerated.htm. We continue to use the data collected during the project to further examine outcomes in the areas of health and mortality, earnings and employment, and health care spending and utilization.

Our recent findings include:

- Participants made extensive use of program services.

- AB health care benefits increased health care use and reduced reported unmet medical needs.

- We found positive effects on mental health and physical health for those who had access to the AB health insurance.

- AB Plus services encouraged people to look for work, increased use of employment services, and increased Ticket to Work participation.

- The AB intervention led to a 50 percent increase in employment levels and a significant increase in annual earnings two years after enrollment in the project. These impacts shrink by the third year, with all groups reaching a similar level of employment and earnings.

- AB health care benefits reduced difficulties paying for basic necessities.

We will continue to use the data collected during the project to track outcomes to assess whether there are long-term employment gains and reduced need for health care that result in future savings for the Federal government.

Youth Transition Demonstration

The YTD seeks to identify effective and efficient methods for assisting youths to transition from school to work and become self-sufficient. This project identifies services, implements service interventions, and tests modified SSI income and resource exclusions that lead to better education and employment outcomes for youth with disabilities. The YTD serves youths between the ages of 14 and 25 who receive SSI or SSDI (including child's insurance benefits based on disability) or who are at heightened risk of becoming eligible for those benefits.

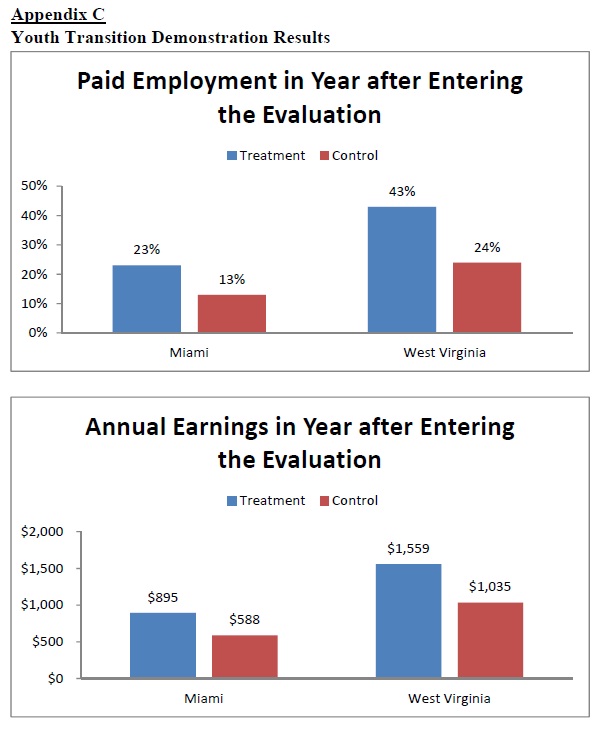

To date, we have found impacts on earnings in three of the six sites. YTD services increased the paid employment rate for disabled youth (relative to control groups) from approximately 24 percent to 43 percent in West Virginia and from approximately 13 percent to 23 percent in Miami, Florida.14 Based on these research findings, SSA has asked the WIPAs to focus additional outreach in the coming year to families with disabled youth. We believe WIPA services to this population may yield tangible outcomes in the labor market.

Several interim reports are available to the public on our website: http://www.ssa.gov/disabilityresearch/youth.htm. We plan to complete a comprehensive final report on this project by 2014.

Promoting Readiness of Minors in SSI

Although this is not an SSA demonstration, I want to take this opportunity to mention another effort to improve future opportunities for young SSI beneficiaries with disabilities. Promoting Readiness of Minors in SSI (PROMISE) is an interagency pilot project with the Departments of Education, Labor, and Health and Human Services to improve outcomes for youth receiving SSI payments through better, more-strategic provision of services to children with disabilities and their families. The Department of Education will award competitive grants to States that will develop and implement model demonstration projects that will test and evaluate interventions provided through State interagency partnerships to improve the educational and economic well-being of children receiving SSI and their families. The model demonstration projects will focus on improving a range of outcomes, such as graduating from high school ready for college and a career, completing postsecondary education and job training, and obtaining competitive employment in an integrated setting. In conjunction with improving outcomes, PROMISE aims to reduce reliance on SSI and, in the long run, other public services through greater self-sufficiency.

PROMISE will encourage innovation by better coordinating existing programs and services that are likely to reduce the probability of future dependency on SSI. The program also intends to help families of child SSI recipients through improved services and supports such as education and training. Our YTD findings have helped shape PROMISE. The importance of early employment, as demonstrated by YTD, will be central to the PROMISE service package. We will further support this effort by developing and conducting a rigorous evaluation to guide implementation and to gather evidence on the effectiveness of the interventions.

New Demonstration Authority

The President’s Budget for Fiscal year 2014 includes a legislative proposal that would authorize us to test ways to help people with disabilities remain in the workforce. In addition to providing new authority to test early interventions, it would re-establish and broaden the SSDI demonstration authority that we previously had. Thus, we would be able to further test effective ways to boost employment and support current SSDI and SSI beneficiaries who are seeking to return to work, including through work incentive simplifications.

We urge you to support this proposal. Demonstration projects are the best vehicles for identifying promising program changes and measuring their effects on disability beneficiaries and potential beneficiaries. However, our authority to initiate SSDI demonstration projects expired in December 2005.

Return to Work and Overpayments

A work continuing disability review (work review) evaluates a beneficiary’s work activity to determine if the work represents SGA and if eligibility for benefits should continue. When conducting a work review, we consider a number of factors to determine whether an SSDI beneficiary who is working can continue to receive monthly benefits. For example, an SSDI beneficiary who has not completed a trial work period will continue to receive monthly benefits even if his or her earnings are above the SGA level. In FY 2012, we completed about 287,650 work reviews. These work reviews resulted in more than 123,740 cessations of benefits or subsequent reinstatements or suspensions of benefits during the extended period of eligibility.15

The potential for an overpayment may discourage some beneficiaries from working, and we have taken several steps to handle our work reviews more quickly and efficiently. For example, we allocated additional staff resources to analyze work reports and to conduct work reviews, and we are targeting the oldest cases – those over 365 days old. We are also shifting work to offices with more capacity to conduct work reviews.

Furthermore, we have established internal goals for processing work reviews. When we receive a report of work directly from a beneficiary, our goal is to screen that report within 30 days to determine if the work activity is likely to affect benefit payments or entitlement. If the work activity will affect benefits or entitlement, we assign the case for review, with a goal of completing the case review and handling within 270 days. Although we instruct beneficiaries to report any work activity, most do not. We learn about this work activity through our annual match with earnings information from the IRS. In those cases, our goal is to process 95 percent of the work alerts we receive within one year of receipt.

We also developed a statistical model that predicts the likelihood of beneficiaries being at risk of receiving large earnings-related overpayments.

- In October 2010, we began a pilot using this model in our New York Region. We prioritize the alerts we receive on SSDI beneficiaries with unreported earnings according to the likelihood of risk of a “critical” overpayment ($20,000 or more). Prioritization is based on historical earnings, prior alerts, previous benefit increases due to earnings, overpayments, amount of monthly benefits, time on the rolls, and impairment codes. In June 2011, we expanded the pilot to include over 50 percent of the work review cases, with the inclusion of the Kansas City Region and the Office of Central Operations. We completed our pilot evaluation in May 2013 and implemented the predictive model nationally in June 2013.

- In October 2012, we began to pilot a process to identify and delay pending benefit recomputations for beneficiaries who also have pending work reviews. We use our predictive model to identify the beneficiaries at risk of receiving large earnings-related overpayments and delay the increase in benefits for six months for the highest predicted 10 percent of cases nationwide. This delay provides additional time to complete work reviews, and prevents an increase in the benefits that we may later determine are not payable as a result of completing the work review. The initial results of the pilot are promising, and we plan to continue the pilot in October 2013 with approximately the same size sample.

Finally, we are developing new policies and procedures that will streamline work review case processing, resulting in faster decisions and reduced overpayments. Examples include the following:

- revising our work activity reports and streamlining our follow-up procedures;

- minimizing documentation for work activity that is obviously not SGA; and

- updating our work review instructions to improve coordination between our field offices and processing centers.

Let me repeat that our work incentives are very complex. This complexity can contribute to overpayments in two ways – disability beneficiaries may not understand when they have to report earnings to us, and our employees need considerable time to handle work reviews properly. Both of these can contribute to the likelihood of overpayments. We believe simplifying work incentives would reduce overpayments resulting from work, thereby making reporting and administration easier and encouraging more disability beneficiaries to attempt to work.

Conclusion

We are proud of the role our disability programs play in the Nation’s social safety net. It is not realistic to expect that every disability beneficiary can become financially independent by working. However, we must find ways to improve work outcomes for those who can. We look forward to continuing our work with this subcommittee to support as many individuals as possible to pursue their employment goals and reduce their reliance on disability insurance benefits. Thank you again for your support and interest in this matter.

___________________________________________

1 Gina A. Livermore, “Earnings and Work Expectations of Social Security Disability

Beneficiaries.” Washington, DC: Mathematica Policy Research, Inc., 2008.

2 H.R. Rep. No. 1698, 83rd Congress, 2nd Sess., at 76. The Ticket Act struck this requirement.

3 SSA cost reimbursement is in addition to the allotment of Federal funds State VR agencies already

receive from the Department of Education under Title I of the Rehabilitation Act of 1973

(as amended).

4 Seventeen percent of those reimbursement claims were supplemental claims for service to the

same beneficiary.

5 Barriers Preventing Social Security Disability Recipients from Returning to Work, 105th Cong.

5 (1997) (opening statement of Representative Jim Bunning).

6 Our rules allow State VR agencies and ENs to work collaboratively in an arrangement known as

Partnership Plus. This team approach allows beneficiaries to consecutively access services from

both State VR agencies and ENs. We believe this initiative increases the likelihood that

beneficiaries will keep working, become self-supporting, and leave the rolls.

7 Craig Thornton, “Can the Ticket to Work Program Be Self-Financing?” Washington, DC:

Mathematica Policy Research, Inc., 2012. Specifically, operational costs were approximately

$32 million, and the costs for payments to ENs were approximately $14 million, for a total annual

cost of $46 million.

8 To restart the WIPA program, we will award FY 2013 WIPA cooperative agreements to those

entities submitting compliant applications that have previously applied for, received (through a

competitive process), and performed WIPA cooperative agreements over the past several years.

Upon reaching agreement with the entity on a budget, we will fund the cooperative agreements

for a full 12 months from August 1, 2013 through July 31, 2014. We expect to spend $20 million

for the grants and $3 million for training and technical assistance. This period will be the first

year of an up-to two-year extension of the previous cooperative agreements. The second year

will be contingent on an entity’s satisfactory performance during the year.

9 I have attached a copy of the benchmark document at the end of my testimony (Appendix B).

10 Our authority to initiate new demonstration projects expired on December 18, 2005.

11 The four States were Connecticut, Utah, Wisconsin, and Vermont.

12 See “The Impact of Changing Financial Work Incentives on the Earnings of Social Security

Disability Insurance (SSDI) Beneficiaries”, Journal of Policy Analysis and Management, Vol. 30,

No. 4, 2011 by Robert R. Weathers II and Jeffrey Hemmeter.

13 Average is for all MHTS participants in the treatment group.

14 Two charts at the end of my testimony illustrate some of the YTD results (Appendix C).

15 The Social Security Administration, Fourth Annual Accountable Official’s Report – Reducing

Improper Payments. March 2013.

______________________________________________________

Appendix A

Work Incentives

The Social Security Act (Act) defines disability as the inability to perform substantial gainful activity (SGA) due to a medically determinable impairment that has lasted or is expected to last at least one year or to result in death. SGA refers to the performance of significant physical or mental activities in work for pay or profit or in work of a type generally performed for pay or profit. SGA is a test for determining both initial and continuing eligibility for Social Security Disability Insurance (SSDI). In initial claims situations, if a claimant’s work is at SGA, then the claimant generally does not meet the definition of disability and does not receive benefits. Countable earnings averaging over $1,040 a month (in 2013) demonstrate the ability to perform SGA in most cases. For claimants who are blind, countable earnings averaging over $1,740 a month (in 2013) usually demonstrate SGA for SSDI.

The Act includes employment support provisions, commonly referred to as work incentives that encourage our disability beneficiaries to test their ability to work. Some of the work incentives that we may apply to SSDI beneficiaries are:

Trial Work Period (TWP) (Section 222(c) of the Act)—Allows beneficiaries to test their ability to work for at least nine months. During the TWP, beneficiaries receive their full benefits regardless of how high their earnings might be so long as they have not fraudulently concealed work activity and they continue to have a disabling impairment. The TWP continues until the beneficiary accumulates 9 months (not necessarily consecutive) in which he or she performed what we call “services” within a rolling 60-consecutive-month period. In 2013, we consider work to be “services” if the beneficiary earns more than $750 a month or works more than 80 self-employed hours in a month.

Extended Period of Eligibility (EPE) (Section 223(a)(1) of the Act)— At the end of the TWP, a 36-consecutive-month EPE begins unless we find that the beneficiary has medically improved and no longer meets the definition of disability. During the EPE, we pay benefits for:

- the first month that earnings exceed SGA and the next two months (we refer to this as the “grace period”); and

- any month the beneficiary’s earnings do not exceed SGA.

After the EPE ends, benefits terminate if a beneficiary's earnings exceed the SGA level in any month.

Impairment Related Work Expenses (Section 223(d)(4) of the Act)—We deduct the outof- pocket costs for disability-related items and services that a beneficiary needs in order to work when we determine if work is SGA.

Extended Medicare (Section 226(b) of the Act)—If a beneficiary’s benefits are terminated because of work, Medicare coverage will continue for at least 93 months after the end of the trial work period (at least eight and one-half years from first return to work).

Expedited Reinstatement (EXR) (Section 223(i) of the Act)—We may be able to start benefits again without a new application if a person stops working within five years of the previous termination date. To be eligible for EXR, the beneficiary must: (1) have had his or her benefits terminated due to work; (2) become unable to continue working at SGA within five years of that termination; and (3) have the same or a related medical impairment.

Unsuccessful Work Attempts (20 CFR 404.1574(c) and 20 CFR 416.974(c))—We disregard earnings from work attempts of six months or less that were stopped or reduced to below SGA due to the beneficiary’s impairment or the removal of special conditions.

“Section 301” Payment Continuation (Sections 225(b) and 1631(a)(6) of the Act (created by section 301 of Public Law 96-265))—This provision allows for continuation of SSDI or SSI disability benefits to individuals whose disability medically ceases while they are participating in a vocational rehabilitation or similar program. To be eligible the individual must have begun participating before the month his or her disability ceased. We must also determine that completion of the program will increase the likelihood that the individual will not return to the disability benefit rolls.

Work incentives are also available to Supplemental Security Income (SSI) disability beneficiaries. For SSI disability, SGA is a test to determine only initial eligibility rather than continuing eligibility. We do not use SGA as a factor to determine initial eligibility to SSI for blind individuals. When an SSI disability beneficiary returns to work, we do not apply SGA to determine if eligibility continues. We count income and earnings (after allowable deductions) to determine the monthly payment amount. Some of the work incentives that reduce countable earnings for SSI disability are:

Blind Work Expenses (Section 1612(b)(4)(A)(ii) of the Act)—For people receiving SSI based on blindness, we exclude any earnings used to meet expenses needed to earn that income. The expenses do not need to be related to blindness.

Impairment Related Work Expenses (Section 1612(b)(4)(B)(ii) of the Act)—We exclude out-of-pocket costs for certain impairment-related items and services needed to work when we count earned income for SSI.

Plan to Achieve Self-Support (PASS) (Sections 1612(b)(4)(A)(iii), 1612(b)(4)(B)(iv), and 1613(a)(4) of the Act)—Disability beneficiaries can develop an individualized employment plan that has the goal of reducing or eliminating their dependence on benefits. Under the PASS provisions, an individual can set aside money for specific employment goals that we will not count as income and resources for the SSI means test while the PASS is in effect. The PASS must contain an occupational goal that we expect to increase the individual's prospect for self-support. It must also specify beginning and ending dates, and target dates for reaching milestones that reflect progress towards achievement of the occupational goal.

Student Earned Income Exclusion (Section 1612(b)(1) of the Act)—We exclude some of the earnings of SSI beneficiaries who work and are under age 22, and regularly attending school or training. In 2013, we can exclude $1,730 of earnings monthly up to a maximum of $6,960 annually.

Special SSI Payments for Persons Who Work (Section 1619(a) of the Act)—Recipients can receive SSI cash payments even when earned income is at the SGA level as long as they continue to meet all other eligibility rules.

Medicaid While Working (Section 1619(b) of the Act)—Medicaid coverage can continue even if earnings are too high to allow an SSI payment. Medicaid coverage will continue until an individual's earnings reach an annual “threshold” level. Each State establishes a threshold level every year. We can also determine individualized thresholds for individuals with extremely high medical costs they would be unable to pay without Medicaid.

Expedited Reinstatement (EXR) (Section 1631(p) of the Act)—We may be able to start benefits again without a new application if a person stops working within five years of the previous termination date. To be eligible for EXR, the person must: (1) have had his or her benefits terminated due to work; (2) become unable to continue working at SGA, within five years of that termination; and (3) have the same or a related medical impairment.

Our Red Book (http://www.socialsecurity.gov/redbook/) provides comprehensive explanations for all of our work incentives.

______________________________________________________

Appendix B

______________________________________________________