A SUMMARY OF THE 2016 ANNUAL REPORTS

Social Security and Medicare Boards of TrusteesA MESSAGE TO THE PUBLIC:

Each year the Trustees of the Social Security and Medicare trust funds report on the current and projected financial status of the two programs. This message summarizes the 2016 Annual Reports.

Both Social Security and Medicare face long-term financing shortfalls under currently scheduled benefits and financing. Lawmakers have a broad continuum of policy options that would close or reduce the long-term financing shortfall of both programs. The Trustees recommend that lawmakers take action sooner rather than later to address these shortfalls, so that a broader range of solutions can be considered and more time will be available to phase in changes while giving the public adequate time to prepare. Earlier action will also help elected officials minimize adverse impacts on vulnerable populations, including lower-income workers and people already dependent on program benefits.

Social Security and Medicare together accounted for 41 percent of Federal program expenditures in fiscal year 2015. The unified budget reflects current trust fund operations. Consequently, even when there are positive trust fund balances, any drawdown of those balances, as well as general fund transfers into Medicare's Supplementary Medical Insurance (SMI) fund and interest payments to the trust funds that are used to pay benefits, increase pressure on the unified budget. Both Social Security and Medicare will experience cost growth substantially in excess of GDP growth through the mid-2030s due to rapid population aging caused by the large baby-boom generation entering retirement and lower-birth-rate generations entering employment. For Medicare, it is also the case that growth in expenditures per beneficiary exceeds growth in per capita GDP over this time period. In later years, projected costs expressed as a share of GDP rise slowly for Medicare and are relatively flat for Social Security, reflecting very gradual population aging caused by increasing longevity and slower growth in per-beneficiary health care costs.

Social Security

The Social Security program provides workers and their families with retirement, disability, and survivors insurance benefits. Workers earn these benefits by paying into the system during their working years. Over the program's 80-year history, it has collected roughly $19.0 trillion and paid out $16.1 trillion, leaving asset reserves of more than $2.8 trillion at the end of 2015 in its two trust funds.

The Bipartisan Budget Act of 2015 was projected to postpone the depletion of Social Security Disability Insurance (DI) Trust Fund by six years, to 2022 from 2016, largely by temporarily reallocating a portion of the payroll tax rate from the Old Age and Survivors Insurance (OASI) Trust Fund to the DI Trust Fund. The effect of updated programmatic, demographic and economic data extends the DI Trust Fund reserve depletion date by an additional year, to the third quarter of 2023, in this year's report. While legislation is needed to address all of Social Security's financial imbalances, the need remains most pressing with respect to the program's disability insurance component.

The OASI and DI trust funds are by law separate entities. However, to summarize overall Social Security finances, the Trustees have traditionally emphasized the financial status of the hypothetical combined trust funds for OASI and DI. The combined funds satisfy the Trustees' test of short-range (ten-year) close actuarial balance. The Trustees project that the combined fund asset reserves at the beginning of each year will exceed that year's projected cost through 2028. However, the funds fail the test of long-range close actuarial balance.

The Trustees project that the combined trust funds will be depleted in 2034, the same year projected in last year's report. The projected 75-year actuarial deficit for the combined Old-Age and Survivors Insurance and Disability Insurance (OASDI) Trust Funds is 2.66 percent of taxable payroll, down from 2.68 percent projected in last year's report. This deficit amounts to 1.0 percent of GDP over the 75-year time period, or 20 percent of program non-interest income or 16 percent of program cost. A 0.06 percentage point increase in the OASDI actuarial deficit would have been expected if nothing had changed other than the one-year shift in the valuation period from 2015 through 2089 to 2016 through 2090. The effects of recently enacted legislation, updated demographic and economic data, and improved methodologies decrease the actuarial deficit by 0.08 percent of taxable payroll, causing the small net improvement in the actuarial balance.

Social Security's total income is projected to exceed its total cost through 2019, as it has since 1982. The 2015 surplus of total income relative to cost was $23 billion. However, when interest income is excluded, Social Security's cost is projected to exceed its non-interest income throughout the projection period, as it has since 2010. The Trustees project that this annual non-interest deficit will average about $69 billion between 2016 and 2019. It will then rise steeply as income growth slows to its sustainable trend rate as the economic recovery is complete while the number of beneficiaries continues to grow at a substantially faster rate than the number of covered workers.

After 2019, interest income and redemption of trust fund asset reserves from the General Fund of the Treasury will provide the resources needed to offset Social Security's annual deficits until 2034, when the reserves will be depleted. Thereafter, scheduled tax income is projected to be sufficient to pay about three-quarters of scheduled benefits through the end of the projection period in 2090. The ratio of reserves to one year's projected cost (the combined trust fund ratio) peaked in 2008, declined through 2015, and is expected to decline steadily until the trust funds are depleted in 2034.

Under current projections, the annual cost of Social Security benefits expressed as a share of workers' taxable earnings will grow from 14.1 percent in 2015 to roughly 16.6 percent in 2038, and will then decline slightly before slowly increasing after 2050. Costs display a slightly different pattern when expressed as a share of GDP. Program costs equaled 5.0 percent of GDP in 2015, and the Trustees project these costs will increase to 6.0 percent of GDP by 2035, decline to 5.9 percent of GDP by 2050, and thereafter rise slowly reaching 6.1 percent by 2090.

Medicare

The Medicare program has two separate trust funds, the Hospital Insurance Trust Fund (HI) and the Supplementary Medical Insurance Trust Fund (SMI). HI, otherwise known as Medicare Part A, helps pay for hospital, home health services following hospital stays, skilled nursing facility, and hospice care for the aged and disabled. SMI consists of Medicare Part B and Part D. Part B helps pay for physician, outpatient hospital, home health, and other services for the aged and disabled who have voluntarily enrolled. Part D provides subsidized access to drug insurance coverage on a voluntary basis for all beneficiaries and premium and cost-sharing subsidies for low-income enrollees.

The Trustees project that the Medicare Hospital Insurance (HI) Trust Fund will be depleted in 2028, two years earlier than projected in last year's report. At that time dedicated revenues will be sufficient to pay 87 percent of HI costs. The Trustees project that the share of HI cost that can be financed with HI dedicated revenues will decline slowly to 79 percent in 2043, and will then rise gradually to 86 percent in 2090. HI expenditure is projected to exceed non-interest income throughout the projection period, as it has in every year since 2008. The HI fund again fails the test of short-range financial adequacy, as its trust fund ratio is already below 100 percent of annual costs and is expected to decline in a continuous fashion until reserve depletion in 2028.

The HI Trust Fund's projected 75-year actuarial deficit is 0.73 percent of taxable payroll, which amounts to 0.3 percent of GDP through 2090, or 19 percent of non-interest income or 16 percent of program cost. This estimate is up from 0.68 percent of taxable payroll projected in last year's report. A 0.01 percentage point increase in the HI actuarial deficit would have been expected if nothing had changed other than the one-year extension of the valuation period to 2090. The remaining 0.04 percentage points worsening of the actuarial balance is primarily due to higher projected utilization rates and lower projected taxable payroll, especially in the near term.

The HI trust fund depletion date of 2028 is two years earlier than projected last year despite the modest changes in projected long-term finances because the revisions to projected income and cost are concentrated in early years of the projection, and also because last year's report projected only modest positive trust fund balances in 2028 and 2029.

For Supplementary Medical Insurance (SMI), the Trustees project that both Part B (which pays doctors' bills and other outpatient expenses) and Part D (which pays for prescription drug coverage) will remain adequately financed into the indefinite future because current law provides financing from general revenues and beneficiary premiums each year to meet the next year's expected costs. However, the aging population and rising health care costs cause SMI projected costs to grow steadily from 2.1 percent of GDP in 2015 to approximately 3.5 percent of GDP in 2037, and then more slowly to 3.8 percent of GDP by 2090. General revenues will finance roughly three-quarters of these costs, and premiums paid by beneficiaries almost all of the remaining quarter. SMI also receives a small amount of financing from special payments by States and from fees on manufacturers and importers of brand-name prescription drugs.

The Trustees project that total Medicare costs (including both HI and SMI expenditures) will grow from approximately 3.6 percent of GDP in 2015 to 5.6 percent of GDP by 2040 and will increase gradually thereafter to about 6.0 percent of GDP by 2090.

In recent years U.S. national health expenditure (NHE) growth has slowed considerably. There is uncertainty regarding the degree to which this slowdown reflects the impacts of the recent economic downturn and other non-persistent factors or structural changes in the health care sector that may continue to produce cost savings in the years ahead. The Trustees are hopeful that U.S. health care practices are in the process of becoming more efficient as new payment models become more prevalent and providers anticipate less rapid growth of reimbursement rates in both the public and private sectors than has occurred during the past several decades.

For a number of years, the methodology the Trustees have employed for projecting Medicare finances over the long term has assumed a substantial reduction in per capita health expenditure growth rates relative to historical experience. In addition, the Trustees have been revising down their projections for near-term Medicare expenditure growth in light of the recent favorable experience, in part due to effects of payment changes and delivery system reform that are changing how health care is practiced. However, the Trustees have not assumed additional, specific cost saving arising from structural changes in the delivery system that may result from new payment mechanisms in the Medicare Access and CHIP Reauthorization Act of 2015 and the cost-reduction incentives in the Affordable Care Act, or from payment reforms initiated by the private sector.

Notwithstanding the assumption of a substantial slowdown of per capita health expenditure growth, the projections indicate that Medicare still faces a substantial financial shortfall that will need to be addressed with further legislation. Such legislation should be enacted sooner rather than later to minimize the impact on beneficiaries, providers, and taxpayers.

Conclusion

Lawmakers have many policy options that would reduce or eliminate the long-term financing shortfalls in Social Security and Medicare. Lawmakers should address these financial challenges as soon as possible. Taking action sooner rather than later will permit consideration of a broader range of solutions and provide more time to phase in changes so that the public has adequate time to prepare.

By the Trustees:Secretary of the Treasury,

and Managing Trustee

of the Trust Funds.

Sylvia M. Burwell,

Secretary of Health

and Human Services,

and Trustee.

vacant,

Trustee.

Secretary of Labor,

and Trustee.

Carolyn W. Colvin,

Acting Commissioner of

Social Security,

and Trustee.

vacant,

Trustee.

A SUMMARY OF THE 2016 ANNUAL SOCIAL SECURITY

AND MEDICARE TRUST FUND REPORTS

In 2015, Social Security's reserves increased by $23 billion to $2.8 trillion by the end of the year. The Bipartisan Budget Act of 2015, signed into law on November 2, 2015, averted a near-term shortfall in Social Security's Disability Insurance (DI) Trust Fund. The temporary reallocation of tax rates from the Old-Age and Survivors Insurance (OASI) fund to the DI fund means that DI will be able to pay full benefits until 2023. OASI is able to pay full benefits until 2035, and the combined OASDI funds 1 until 2034, both unchanged from last year. Over the 75-year projection period, Social Security faces an actuarial deficit of 2.66 percent of taxable payroll, slightly less than the 2.68 percent projected in last year's report. The deficit equals 1.0 percent of GDP through 2090. Reserves in Medicare's two trust funds decreased by $3 billion to a total of $263 billion at the end of 2015. The Hospital Insurance (HI) Trust Fund is projected to be able to pay full benefits until 2028. The HI actuarial deficit is 0.73 percent of taxable payroll over the 75-year projection period, slightly larger than the 0.68 percent projected in last year's report, and equivalent to 0.3 percent of GDP through 2090.

Social Security's and Medicare's projected long-range costs exceed currently scheduled financing and will require legislative action to avoid subjecting beneficiaries and taxpayers to unanticipated program changes. The sooner that lawmakers take action, the wider will be the range of solutions to consider and the more time that will be available to phase in changes, giving the public adequate time to prepare. Earlier action allows more generations to share the economic cost of maintaining program solvency, and would provide more opportunity to ameliorate adverse impacts on vulnerable populations, including lower-income workers and people already significantly dependent on program benefits.

What Are the Trust Funds? Congress established trust funds managed by the Secretary of the Treasury to account for Social Security and Medicare income and disbursements. The Treasury credits Social Security and Medicare taxes, premiums, and other income to the funds. There are four separate trust funds. For Social Security, the Old-Age and Survivors Insurance (OASI) Trust Fund pays retirement and survivors benefits and the Disability Insurance (DI) Trust Fund pays disability benefits. For Medicare, the Hospital Insurance (HI) Trust Fund pays for inpatient hospital and related care. The Supplementary Medical Insurance (SMI) Trust Fund comprises two separate accounts: Part B, which pays for physician and outpatient services, and Part D, which covers the prescription drug benefit.

The only disbursements permitted from the funds are benefit payments and administrative costs. Federal law requires that all excess funds be invested in interest-bearing securities backed by the full faith and credit of the United States. The Department of the Treasury currently invests all program revenues in special non-marketable securities of the U.S. Government which earn interest equal to rates on marketable securities with durations defined in law. The balances in the trust funds, which represent the accumulated value, including interest, of all prior program annual surpluses and deficits, provide automatic authority to pay benefits.

What Were the Trust Fund Operations in 2015? In 2015, 49.2 million people received OASI benefits, 10.8 million received DI benefits, and 55.3 million were covered under Medicare. A summary of Social Security and Medicare trust fund operations is shown below (Table 1). The OASI Trust Fund increased asset reserves in 2015; reserves in the SMI Trust Funds increased slightly; reserves in the DI and HI Trust Funds declined.| OASI | DI | HI | SMI | |

|---|---|---|---|---|

| Reserves (end of 2014) | $2,729.2 | $60.2 | $197.3 | $69.1 |

| Income during 2015 | 801.6 | 118.6 | 275.4 | 369.9 |

| Cost during 2015 | 750.5 | 146.6 | 278.9 | 368.8 |

| Net change in Reserves | 51.0 | -28.0 | -3.5 | 0.3 |

| Reserves (end of 2015) | 2,780.3 | 32.3 | 193.8 | 69.5 |

Note: Totals do not necessarily equal the sum of rounded components.

OASI and DI and cost and reserve figures for 2015 do not include benefit payments regularly scheduled for January 3, 2016, which were actually paid on December 31, 2015. SMI income and reserves for 2015 do reflect premium payments and general revenue matching for SMI (Part B) regularly scheduled for January 3, 2016, but were received in 2015. Because January 3, 2016 was a Sunday, these income items moved to the next earliest date that was not a weekend or holiday.

Table 2 shows payments, by category, from each trust fund in 2015.

| Category (in billions) | OASI | DI | HI | SMI |

|---|---|---|---|---|

| Benefit payments | $742.9 | $143.4 | $273.4 | $365.3 |

| Railroad Retirement financial interchange | 4.3 | 0.4 | — | — |

| Administrative expenses | 3.4 | 2.8 | 5.5 | 3.5 |

| Total | 750.5 | 146.6 | 278.9 | 368.8 |

Note: Totals do not necessarily equal the sum of rounded components.

OASI and DI and cost figures for 2015 do not include benefit payments regularly scheduled for January 3, 2016, which were actually paid on December 31, 2015.

Trust fund income, by source, in 2015 is shown in Table 3.

| Source (in billions) | OASI | DI | HI | SMI |

|---|---|---|---|---|

| Payroll taxes | $679.5 | $115.4 | $241.1 | — |

| Taxes on OASDI benefits | 30.6 | 1.1 | 20.2 | — |

| Interest earnings | 91.2 | 2.1 | 8.2 | $2.3 |

| General Fund reimbursements | 0.3 | 0.0 | 1.0 | 1.6 |

| General revenues | — | — | — | $270.7 |

| Beneficiary premiums | — | — | 3.2 | 82.2 |

| Transfers from States | — | — | — | 8.9 |

| Other | 0.0 | — | 1.6 | 3.4 |

| Total | 801.6 | 118.6 | 275.4 | 369.1 |

Note: Totals do not necessarily equal the sum of rounded components.

A dash signifies 'not applicable;" 0.0 indicates that the value is less than $50 million.

SMI income for 2015 reflects premium payments and general revenue matching for SMI (Part B) regularly scheduled for January 3, 2016, but were received in 2015.

In 2015, Social Security's total income exceeded total cost by $23 billion. When interest received on trust fund assets is excluded from program income, there was a deficit of non-interest income relative to cost equal to $70 billion. The Trustees project that annual non-interest-income deficits will persist throughout the long-range period (2016-90).

In 2015, the HI fund used $8 billion of interest income (Table 3) and $4 billion of asset reserves (Table 1) to finance expenditures beyond those that could have been made solely on the basis of tax and other non-interest income. For SMI, transfers from the General Fund of the Treasury, which are set prospectively based on projected costs, represent the largest source of income.

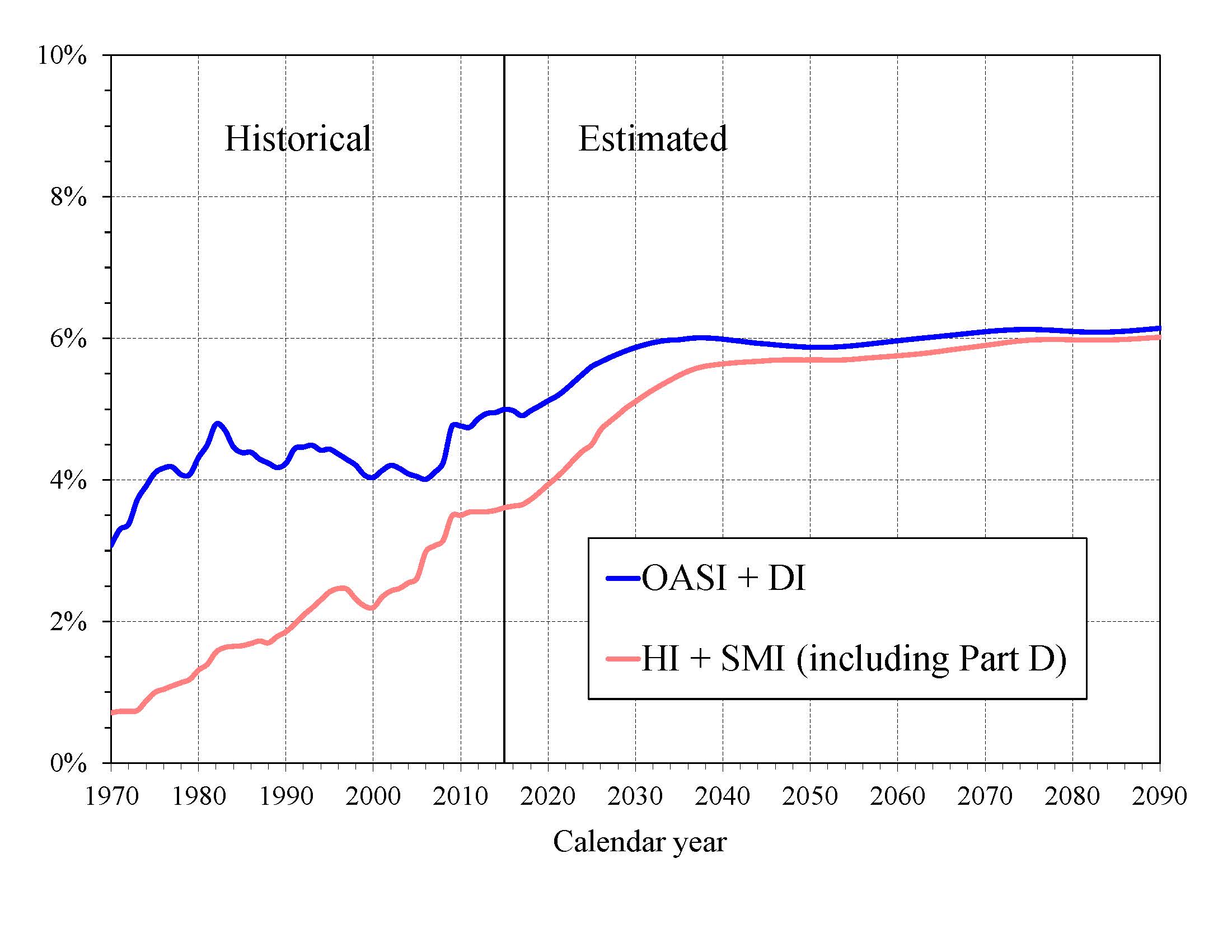

What is the Outlook for Future Social Security and Medicare Costs in Relation to GDP? One instructive way to view the projected costs of Social Security and Medicare is to compare the costs of scheduled benefits and administrative costs for the programs with the gross domestic product (GDP), the most frequently used measure of the total output of the U.S. economy (Chart A).

Under the intermediate assumptions employed in the reports, program costs as a percentage of GDP increase substantially through 2035 because: (1) the number of beneficiaries rises rapidly as the baby-boom generation retires; and (2) the lower birth rates that have persisted since the baby boom cause slower growth of the labor force and GDP.

Social Security's annual cost is projected to increase from 5.0 percent of GDP in 2016 to about 6.0 percent of GDP by 2035, then decline to 5.9 percent by 2050, and then rise to 6.1 percent of GDP by 2090. Under the intermediate assumptions, Medicare cost rises from 3.6 percent of GDP in 2016 to 5.5 percent of GDP by 2035 due mainly to the growth in the number of beneficiaries, and then increases further to 6.0 percent by 2090. The growth in health care cost per beneficiary becomes the larger factor later in the valuation period, particularly in Part D.

|

In 2016, the combined cost of the Social Security and Medicare programs is estimated to equal 8.6 percent of GDP. The Trustees project an increase to 11.5 percent of GDP by 2035 and to 12.1 percent by 2090, with most of these increases attributable to Medicare. Medicare's relative cost is expected to rise gradually from 73 percent of the cost of Social Security in 2016 to 98 percent by 2090.

The projected costs for OASDI and HI depicted in Chart A and elsewhere in this document reflect the full cost of scheduled current-law benefits without regard to whether the trust funds will have sufficient resources to meet these obligations. Current law precludes payment of any benefits beyond the amount that can be financed by the trust funds, that is, from annual income and trust fund reserves. In years after trust fund depletion, the amount of benefits that would be payable is lower than shown because OASDI and HI, by law, cannot borrow money or pay benefits that exceed the asset reserves in their trust funds. The projected costs assume realization of the full estimated savings of the Affordable Care Act and the physician payment rate updates specified in the Medicare Access and CHIP Reauthorization Act (MACRA) of 2015. As described in the Medicare Trustees Report, the projections for HI and SMI Part B depend significantly on the sustained effectiveness of various current-law cost-saving measures, in particular, the lower increases in Medicare payment rates to most categories of health care providers.

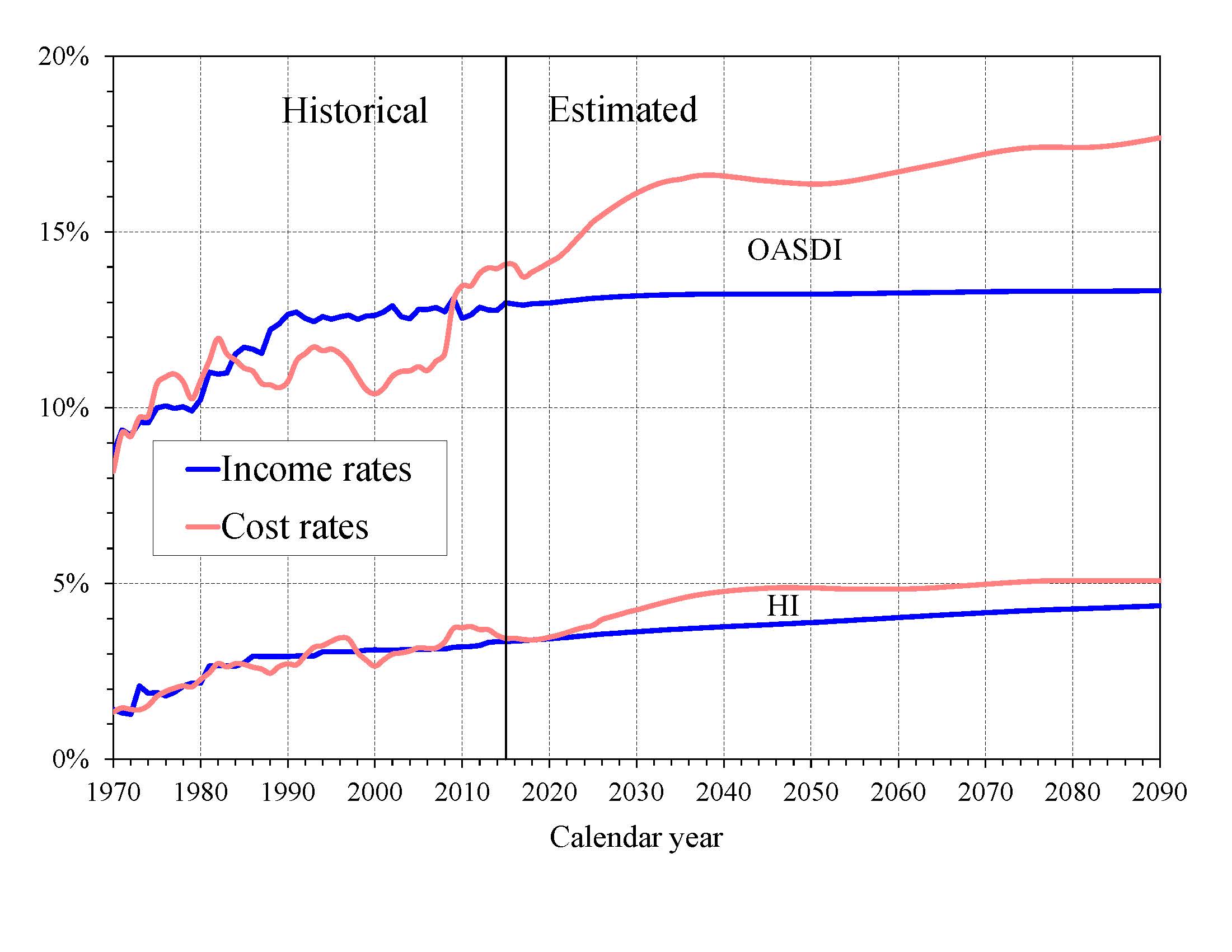

What is the Outlook for Future Social Security and Medicare HI Costs and Income in Relation to Taxable Earnings? Because the primary source of income for OASDI and HI is the payroll tax, it is informative to express the programs' incomes and costs as percentages of taxable payroll — that is, of the base of worker earnings taxed to support each program (Chart B).

It is important to understand that the two programs have different taxable payrolls. HI taxable payroll is about 25 percent larger than that of OASDI because the HI payroll tax is imposed on all earnings while OASDI taxes apply only to earnings up to a maximum ($118,500 in 2016), which ordinarily is adjusted each year. Thus, the percentages in Chart B are comparable within each program, but not across programs.

Both the OASDI and HI annual cost rates rise over the long run from their 2015 levels (14.08 and 3.44 percent). Projected Social Security cost grows to 16.61 percent of taxable payroll by 2038, declines to 16.36 percent by 2050, and then rises gradually to 17.68 percent of taxable payroll in 2090. The projected Medicare HI cost rate rises to 4.88 percent of taxable payroll in 2050, and thereafter increases to 5.08 percent in 2090.

|

The OASDI and HI income rates in Chart B include payroll taxes and taxes on OASDI benefits, but not interest payments. The projected OASDI income rate is stable at about 13 percent throughout the long-range period.

The HI income rate rises gradually from 3.35 percent in 2015 to 4.37 percent in 2090 due to the Affordable Care Act's increase in payroll tax rates for high earners that began in 2013. Individual tax return filers with earnings above $200,000, and joint return filers with earnings above $250,000, pay an additional 0.9 percent tax on earnings above these earnings thresholds. An increasing fraction of all earnings will be subject to the higher tax rate over time because the thresholds are not indexed. By 2090, an estimated 79 percent of workers would pay the higher rate.

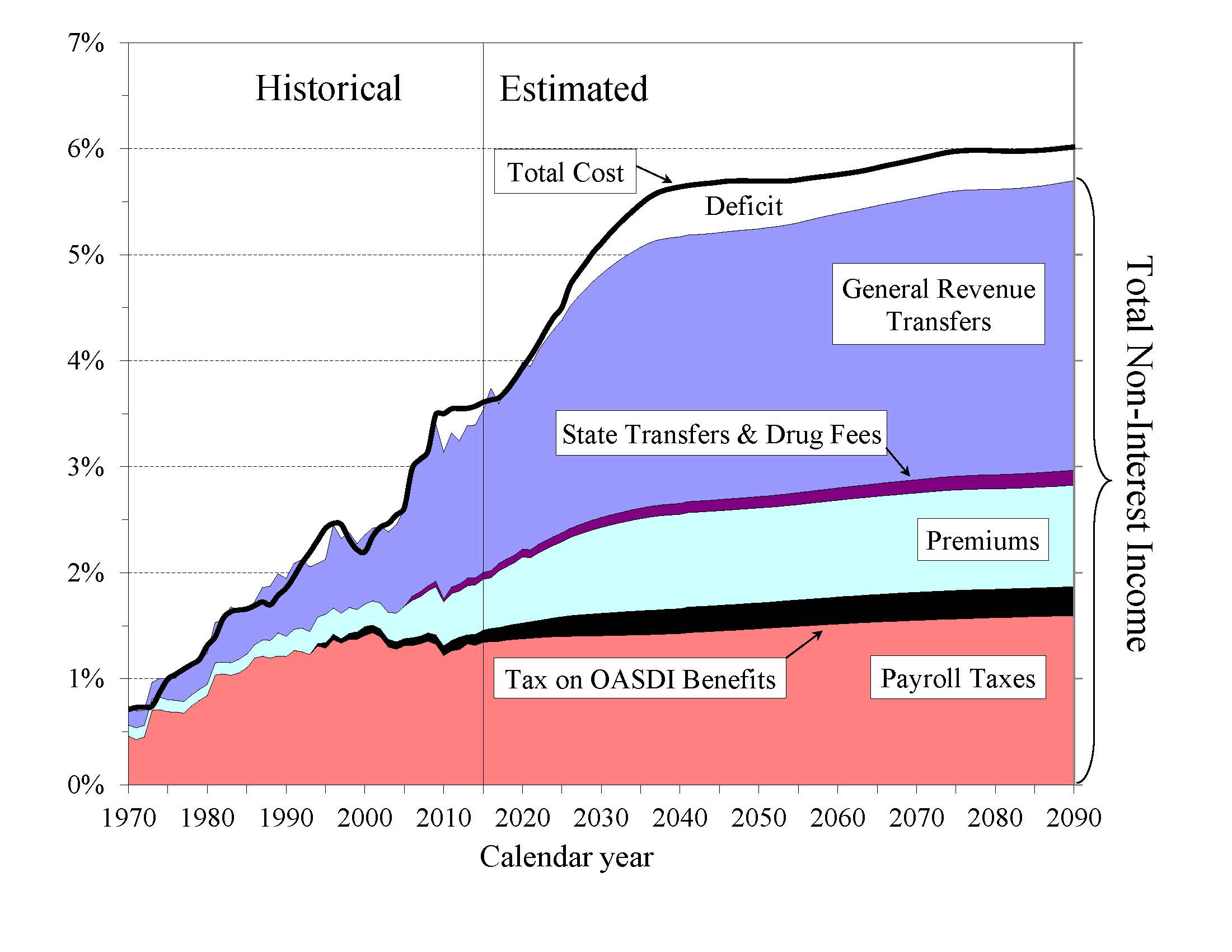

How Will Cost Growth in the Different Parts of Medicare Change the Sources of Program Financing? As Medicare cost grows over time, general revenues and beneficiary premiums will play an increasing role in financing the program. Chart C shows scheduled cost and non-interest revenue sources under current law for HI and SMI combined as a percentage of GDP. The total cost line is the same as displayed in Chart A and shows Medicare cost rising to 6.0 percent of GDP by 2090.

|

Projected revenue from payroll taxes and taxes on OASDI benefits credited to the HI Trust Fund increases from 1.5 percent of GDP in 2016 to 1.9 percent in 2090 under current law, while projected general revenue transfers to the SMI Trust Fund increase from 1.7 percent of GDP in 2016 to 2.7 percent in 2090, and beneficiary premiums increase from 0.5 to 1.0 percent of GDP during the same period. Thus, the share of total non-interest Medicare income from taxes declines (from 39 percent to 33 percent) while the general revenue share rises (from 46 percent to 48 percent), as does the share of premiums (from 13 percent to 17 percent). The distribution of financing changes in large part because costs for Part B and especially Part D—the Medicare components that are financed largely from general revenues—increase at a faster rate than Part A cost under the Trustees' projections. The projected annual HI financial deficit beyond 2035 through 2090 averages about 0.4 percent of GDP and there is no provision under current law to finance that shortfall through general revenue transfers or any other revenue source.

The Medicare Modernization Act (2003) requires that the Board of Trustees determine each year whether the annual difference between program cost and dedicated revenues (the bottom four layers of Chart C) under current law exceeds 45 percent of total Medicare cost in any of the first seven fiscal years of the 75-year projection period, in which case the annual Trustees Report must include, as it did from 2006 through 2013, a determination of “excess general revenue Medicare funding.” Because the difference between program cost and dedicated revenues is not expected to exceed the 45 percent threshold during fiscal years 2016-22, there is no such determination in this year's report.

What are the Budgetary Implications of Rising Social Security and Medicare Costs? Discussion of the long-range financial outlook for Medicare and Social Security often focuses on the depletion dates for the HI and OASDI trust funds—the times when the projected trust fund balances under current law will be insufficient to pay the full amounts of scheduled benefits. Normal operations of the trust fund also have an impact on the unified Federal budget.

Under the OASDI and HI programs, when taxes and other sources of revenue are collected in excess of immediate program costs, funds are converted to Treasury bonds and held in reserve for future periods. Accumulation of assets in the trust fund improves the unified Federal budget position. When trust fund assets are drawn down to pay scheduled benefits, bonds are redeemed and interest payments are made, creating a current-year cost to the unified Federal budget.

Unlike HI and OASDI, SMI does not have a trust fund structure with surpluses accumulated from prior years. General revenues pay for roughly 75 percent of all SMI costs and pose an immediate cost for the unified Federal budget.

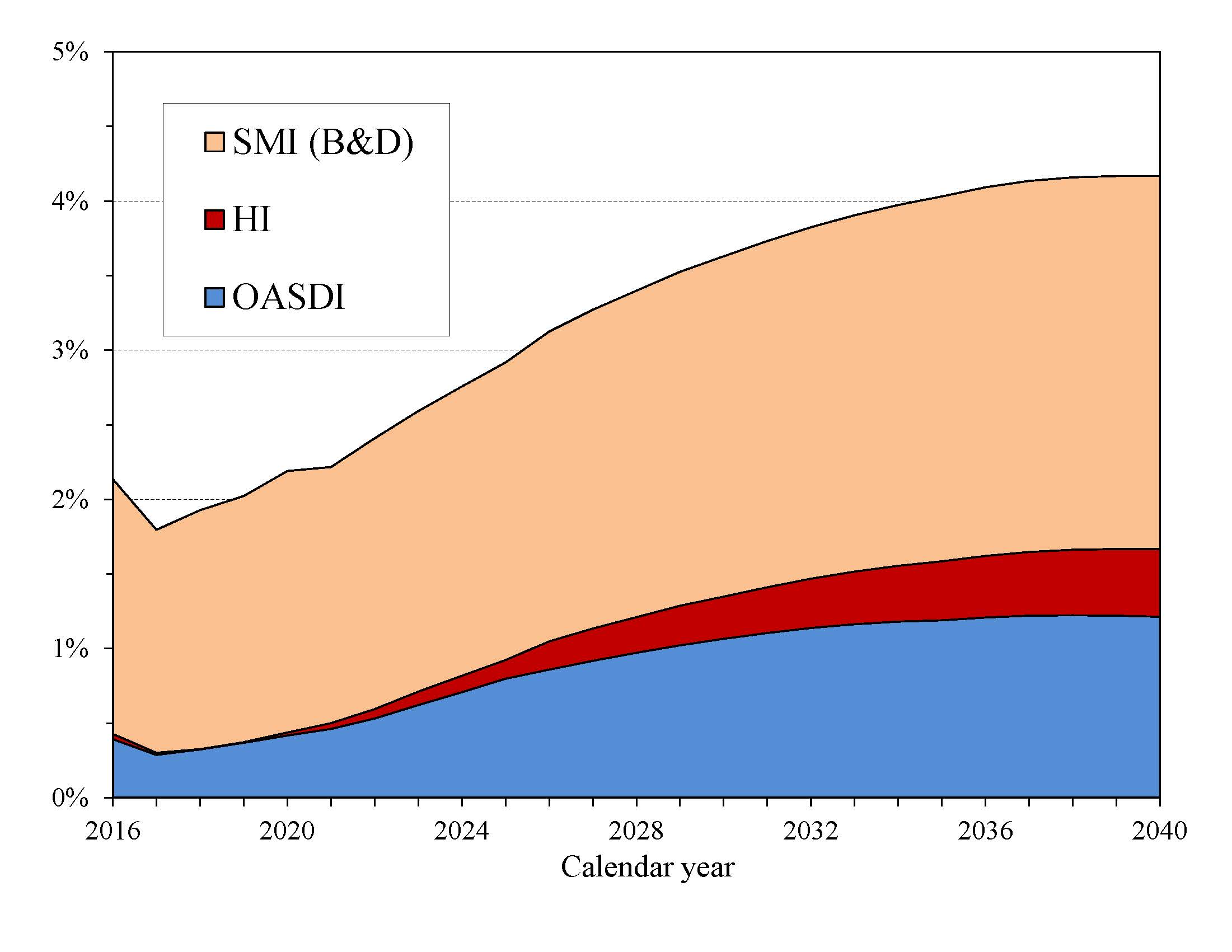

Chart D shows the required SMI general revenue funding, plus the excess of scheduled costs over dedicated tax and premium income for the OASDI and HI trust funds expressed as percentages of GDP through 2040. For OASDI and HI, the difference between scheduled cost and dedicated revenues is equal to interest earnings and asset redemptions prior to trust fund depletion, and unfunded obligations after depletion. The chart assumes full benefits will be paid after trust fund depletion, even though under current law expenditures can only be made to the extent covered by current income. Such budgetary assumptions are typical of unified budget baselines, but do not reflect current law in the Social Security Act, nor do they reflect policy approaches that Congress has used in the past.

|

In 2016, the projected difference between Social Security's expenditures and dedicated tax income is $73 billion. For HI, the projected difference between expenditures and non-interest income is $9 billion.2 The projected general revenue demands of SMI are $319 billion. Thus, the total General Fund requirements for Social Security and Medicare in 2016 are $401 billion, or 2.1 percent of GDP. Redemption of trust fund bonds, interest paid on those bonds, and transfers from the General Fund provide no new net income to the Treasury. When the unified budget is not in surplus, these payments are made through some combination of increased taxation, reductions in other government spending, or additional borrowing from the public.

Each of these trust funds' operations will contribute increasing amounts to Federal unified budget deficits in future years as trust fund bonds are redeemed. Until 2028, interest earnings and asset redemptions, financed from general revenues, will cover the shortfall of HI tax and premium revenues relative to expenditures. In addition, general revenues must cover similar payments as a result of growing OASDI bond redemption and interest payments through 2034 as the trust fund is drawn down.

If full benefits are to be maintained for both Social Security and Medicare, by 2040 the combined OASDI and HI financing gap plus SMI's projected general revenue demands will equal 4.2 percent of GDP—double the 2016 share.

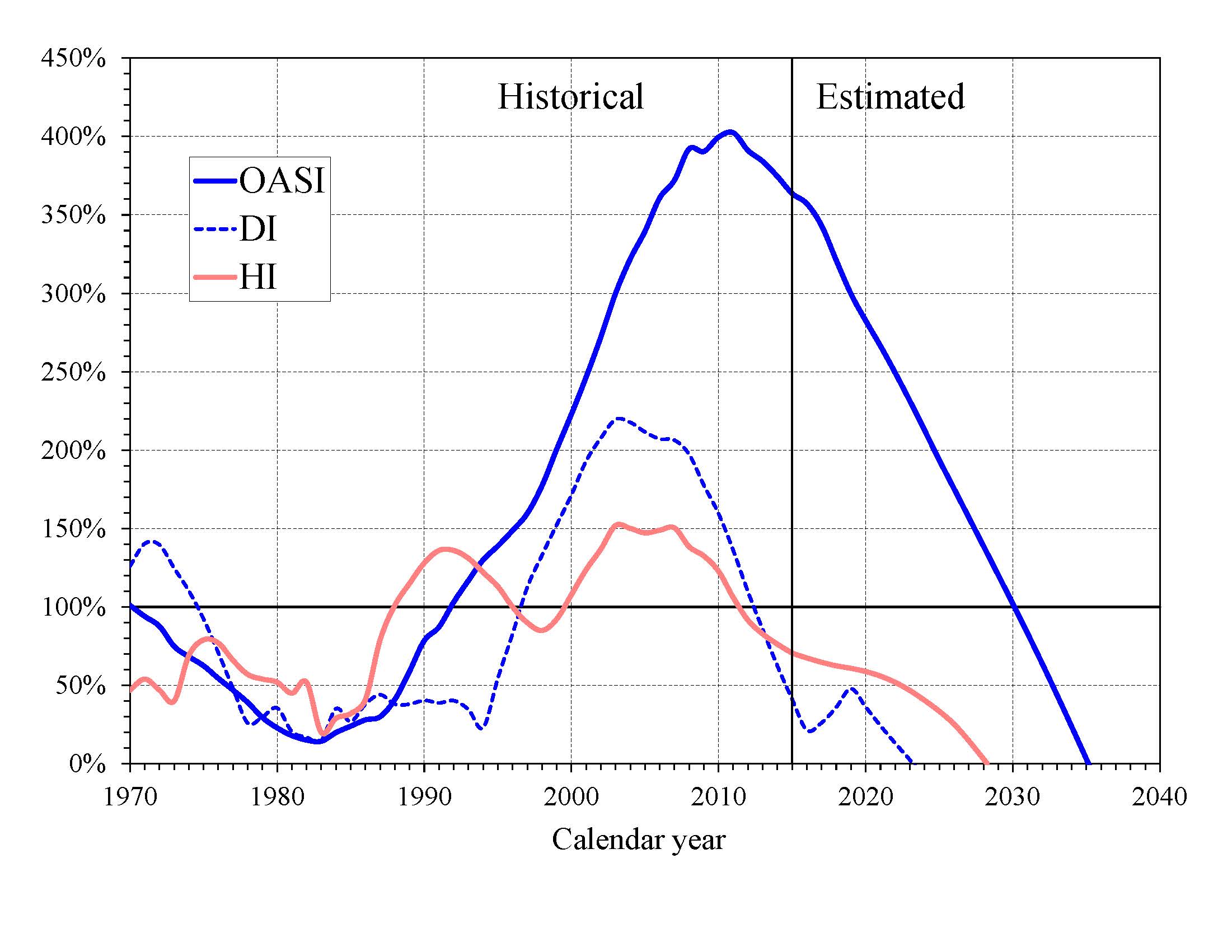

What Is the Outlook for Short-Term Trust Fund Adequacy? The reports measure the short-range adequacy of the OASI, DI, and HI Trust Funds by comparing fund asset reserves at the start of a year to projected costs for the ensuing year (the “trust fund ratio”). A trust fund ratio of 100 percent or more—that is, asset reserves at least equal to projected cost for the year—is a good indicator of a fund's short-range adequacy. That level of projected reserves for any year suggests that even if cost exceeds income, the trust fund reserves, combined with annual tax revenues, would be sufficient to pay full benefits for several years. Chart E shows the trust fund ratios through 2040 under the intermediate assumptions.

By this measure, the OASI Trust Fund is financially adequate throughout and beyond the short-range period (2016-25), but the DI Trust Fund fails the short-range test because its trust fund ratio was 21 percent at the beginning of 2016 and is not projected to reach 100 percent within 5 years. The Trustees project that the DI Trust Fund ratio will increase to 48 percent at the start of 2019, due largely to the temporary payroll tax reallocation enacted in the Bipartisan Budget Act of 2015, and subsequently decline until depletion of all reserves in 2023.

The HI Trust Fund does not meet the short-range test of financial adequacy; its trust fund ratio was 67 percent at the beginning of 2016 based on the year's anticipated expenditures, and the projected ratio does not rise to 100 percent within five years. Projected HI Trust Fund asset reserves become fully depleted in 2028.

|

The Trustees apply a less stringent annual "contingency reserve" test to SMI Part B asset reserves because (i) the financing for that account is set each year to meet expected costs, and (ii) the overwhelming portion of the financing for that account consists of general revenue contributions and beneficiary premiums, which were 73 percent and 25 percent of total Part B income in calendar year 2015. Part D premiums paid by enrollees and the amounts apportioned from the General Fund of the Treasury are determined each year. Moreover, flexible appropriation authority established by lawmakers for Part D allows additional General Fund financing if costs are higher than anticipated, limiting the need for a contingency reserve in that account.

What Are Key Dates in OASI, DI, and HI Financing? The 2016 reports project that the OASI, DI, and HI Trust Funds will all be depleted within 20 years. The following table shows key dates for the respective trust funds as well as for the combined OASDI trust funds. 3

| OASI | DI | OASDI | HI | |

|---|---|---|---|---|

| First year cost exceeds income excluding interesta | 2010 | 2019 | 2010 | 2015 |

| First year cost exceeds total incomea | 2022 | 2019 | 2020 | 2021 |

| Year trust funds are depleted | 2035 | 2023 | 2034 | 2028 |

a Dates indicate the first year that a condition is projected to occur and to persist annually thereafter through 2090.

DI Trust Fund reserves will increase until 2019 and then fall steadily until they are fully depleted in 2023. Payment of full DI benefits beyond 2023, when tax income would cover only 89 percent of scheduled benefits, will require legislation to address the financial imbalance.

The OASI Trust Fund, when considered separately, has a projected reserve depletion date of 2035, the same as in last year's report. At that time, income would be sufficient to pay 77 percent of scheduled OASI benefits.

The combined OASDI trust funds have a projected depletion date of 2034, the same as in last year's report. After the depletion of reserves, continuing tax income would be sufficient to pay 79 percent of scheduled benefits in 2034 and 74 percent in 2090.

The OASDI reserves are projected to grow in 2016 because total income ($944.6 billion) will exceed total cost ($928.9 billion). This year's report indicates that annual OASDI income, including payments of interest to the trust funds from the General Fund, will continue to exceed annual cost every year until 2020, increasing the nominal value of combined OASDI trust fund asset reserves. Social Security's cost is projected to exceed its non-interest income by $73 billion in 2016, and annual non-interest income deficits will persist through 2090. The trust fund ratio (the ratio of projected reserves to annual cost) will continue to decline gradually (Chart E), as it has since 2008, despite this nominal balance increase. Beginning in 2020, net redemptions of trust fund asset reserves with General Fund payments will be required until projected depletion of these reserves in 2034.

The projected HI Trust Fund depletion date is 2028, two years earlier than in last year's report. Under current law, scheduled HI tax and premium income would be sufficient to pay 87 percent of estimated HI cost after trust fund depletion in 2028, declining to 79 percent by 2040, and then gradually increasing to 86 percent by 2090.

This report projects that HI Trust Fund reserve assets will increase slightly in 2016 because total income ($288.4 billion) will exceed total cost ($287.1 billion). Projected annual HI cost exceeds non-interest HI income throughout the long-range projection period. After 2020, assets will decline continuously until depletion of all reserves in 2028.

What is the Long-Range Actuarial Balance of the OASI, DI, and HI Trust Funds? Another way to view the outlook for payroll tax-financed trust funds (OASI, DI, and HI) is to consider their actuarial balances for the 75-year valuation period. The actuarial balance measure includes the trust fund asset reserves at the beginning of the period, an ending fund balance equal to the 76th year's costs, and projected costs and income during the valuation period, all expressed as a percentage of taxable payroll for the 75-year projection period. Actuarial balance is not an informative concept for the SMI program because Federal law sets premium increases and general revenue transfers at the levels necessary to bring SMI into annual balance.

The actuarial deficit represents the average amount of change in income or cost that is needed throughout the valuation period in order to achieve actuarial balance. The actuarial balance equals zero if cost for the period can be met for the period as a whole and trust fund asset reserves at the end of the period are equal to the following year's cost. The OASI, DI, and HI Trust Funds all have long-range actuarial deficits under the intermediate assumptions, as shown in the following table.

| OASI | DI | OASDI | HI | |

|---|---|---|---|---|

| Actuarial deficit | 2.39 | 0.26 | 2.66 | 0.73 |

NOTE: Totals do not necessarily equal the sums of rounded components.

The Trustees project that the annual deficits for Social Security as a whole, expressed as the difference between the cost rate and income rate for a particular year, will remain about the same or lower than the 2015 value (1.10 percent of taxable payroll) during 2016-19. The annual deficits then increase steadily to 3.38 percent in 2038. Annual deficits then decline gradually to 3.13 percent in 2050 before resuming an upward trajectory and reaching 4.35 percent of taxable payroll in 2090 (Chart B). The relatively large variation in annual deficits indicates that a single tax rate increase for all years starting in 2016 sufficient to achieve actuarial balance would result in sizable annual surpluses early in the period followed by increasing deficits in later years. Sustainable solvency would require payroll tax rate increases or benefit reductions (or a combination thereof) by the end of the period that are substantially larger than those needed on average for this report's long-range period (2016-90).

In 2015, the HI cost rate exceeded the income rate by 0.09 percent of taxable payroll. The Trustees project smaller annual deficits from 2016 through 2021. Deficits subsequently grow rapidly with the aging of the baby boom population through about 2045, when the annual deficit reaches a peak of 1.04 percent of taxable payroll. Annual deficits then decline gradually to 0.71 percent of taxable payroll by 2090.

The financial outlooks for both OASDI and HI depend on a number of demographic and economic assumptions. Nevertheless, the actuarial deficit in each of these programs is large enough that averting trust fund depletion under current-law financing is extremely unlikely. An analysis that allows plausible random variations around the intermediate assumptions employed in the report indicates that OASDI trust fund depletion is highly probable by mid-century.

How Has the Financial Outlook for Social Security and Medicare Changed Since Last Year? Under the intermediate assumptions, the combined OASDI trust funds have a projected 75-year actuarial deficit equal to 2.66 percent of taxable payroll, 0.02 percentage point smaller than last year's estimate. The projected depletion date for the combined asset reserves remains 2034. If the assumptions, methods, starting values, and the law had remained unchanged from last year, the actuarial deficit would have increased by about 0.06 percent of payroll due to advancing the valuation date by one year and including the year 2090. Improvements in the methods used to project net immigration account for most of the small net decline in the actuarial deficit.

Medicare's HI Trust Fund has a long-range actuarial deficit equal to 0.73 percent of taxable payroll under the intermediate assumptions, 0.05 percentage point larger than reported last year. This change was primarily due to lower taxable payroll and higher projected utilization of inpatient hospital services than previously estimated. The anticipated date of depletion of the HI Trust Fund is now 2028, two years earlier than stated in last year's report, which projected small trust fund balances in 2028 and 2029. The earlier depletion date is mostly due to lower assumed productivity adjustments through 2019 and lower projected HI tax income in the short range due to anticipated slower real-wage growth.

How Are Social Security and Medicare Financed? For OASDI and HI, the major source of financing is payroll taxes on earnings paid by employees and their employers. Self-employed workers pay the equivalent of the combined employer and employee tax rates. During 2015, an estimated 168.9 million people had earnings covered by Social Security and paid payroll taxes; for Medicare the corresponding figure was 172.7 million. Current law establishes payroll tax rates for OASDI, which apply to earnings up to an annual maximum ($118,500 in 2016) that ordinarily increases with the growth in the nationwide average wage. When the cost-of-living adjustment (COLA) for December of any year is zero, as occurred in 2015, the maximum taxable earnings amount does not increase for the following year. In contrast to OASDI, covered workers pay HI taxes on total earnings. The scheduled payroll tax rates (in percent) for 2016 are:

| OASI | DI | OASDI | HI | Total | |

|---|---|---|---|---|---|

| Employees | 5.015 | 1.185 | 6.20 | 1.45 | 7.65 |

| Employers | 5.015 | 1.185 | 6.20 | 1.45 | 7.65 |

| Combined total | 10.030 | 2.370 | 12.40 | 2.90 | 15.30 |

Self-employed persons pay the combined rates. The Bipartisan Budget Act of 2015 reallocated OASDI payroll tax rates on a temporary basis. For earnings in calendar years 2016-18, 0.57 percentage point of the 12.40 percent OASDI payroll tax rate is shifted from OASI to DI. The Affordable Care Act applies an additional HI tax equal to 0.9 percent of earnings over $200,000 for individual tax return filers, and on earnings over $250,000 for joint return filers.

Taxation of Social Security benefits is another source of income for the Social Security and Medicare trust funds. Beneficiaries with incomes above $25,000 for individuals (or $32,000 for married couples filing jointly) pay income taxes on up to 50 percent of their benefits, with the revenues going to the OASDI trust funds. This income from taxation of benefits made up about 3 percent of Social Security's income in 2015. Those with incomes above $34,000 (or $44,000 for married couples filing jointly) pay income taxes on up to 85 percent of benefits, with the additional revenues going to the Medicare trust fund. This income from taxation of benefits made up about 7 percent of HI Trust Fund income in 2015.

The trust funds also receive income from interest on their accumulated reserves, which are invested in U.S. Government securities. In 2015, interest income made up 10 percent of total income to the OASDI trust funds, 3 percent for HI, and less than 1 percent for SMI.

Payments from the General Fund currently finance about 75 percent of SMI Part B and Part D costs, with most of the remaining costs covered by monthly premiums charged to enrollees or in the case of low-income beneficiaries, paid on their behalf by Medicaid for Part B and Medicare for Part D. Part B and Part D premium amounts are determined by methods defined in law and increase as the estimated costs of those programs rise.

In 2016, the Part B standard monthly premium is $121.80, $16.90 higher than the 2015 amount.4 There are also income-related premium surcharges for Part B beneficiaries whose modified adjusted gross income exceeds a specified threshold. In 2016 through 2019, the threshold is $85,000 for individual tax return filers and $170,000 for joint return filers. Income-related premiums range from $170.50 to $389.80 per month in 2016.

In 2016, the Part D "base monthly premium" is $34.10. Actual premium amounts charged to Part D beneficiaries depend on the specific plan they have selected and average around $33 for standard coverage. Part D enrollees with incomes exceeding the thresholds established for Part B must pay income-related monthly adjustment amounts in addition to their normal plan premium. For 2016, the adjustments range from $12.70 to $72.90 per month. Part D also receives payments from States that partially compensate for the Federal assumption of Medicaid responsibilities for prescription drug costs for individuals eligible for both Medicare and Medicaid. In 2016, State payments cover about 9 percent of Part D costs.

Who Are the Trustees? There are six Trustees, four of whom serve by virtue of their positions in the Federal Government: the Secretary of the Treasury, the Secretary of Labor, the Secretary of Health and Human Services, and the Commissioner of Social Security. The other two Trustees are public representatives appointed by the President, subject to confirmation by the Senate. The two Public Trustee positions are currently vacant.

Document revised 7/12/16. The range of income-related premiums per month in 2016 (page 14) was corrected to be $170.50 to $389.80 (originally stated as $166.30 to $380.20).

2 This difference is projected on a cash rather than the incurred expenditures basis applied elsewhere in the long-range projections, except where explicitly noted otherwise.

3 HI results in this section of the Summary are on a cash rather than the incurred expenditures basis.

4 Because there was a zero COLA for Social Security in 2016, about 70 percent of SMI Part B enrollees experienced no premium increase. The Bipartisan Budget Act of 2015 called for replacing that lost premium income with a transfer from the General Fund of the Treasury to the Part B account.

A MESSAGE FROM THE PUBLIC TRUSTEES

Because the two Public Trustee positions are currently vacant, there is no Message from the Public Trustees for inclusion in the Summary of the 2016 Annual Reports.