|

|

THE PROGRAM FOR ECONOMIC SECURITY

President's Committee on Economic Security

THE PROGRAM FOR ECONOMIC SECURITY

The President's Committee on Economic Security

1734 New York Avenue, Washington, D.C.

TABLE OF CONTENTS

President Roosevelt's Message to Congress on the Economic Security Program

Summary of the Recommendations of the President's

Committee on Economic Security

Need for Security

Employment Assurance

Unemployment Compensation

Old-Age Security

Security for Children

Health Services and Accident Compensation

The Economic Security Act-- by Edwin E. Witte

The President's Committee

on Economic Security

FRANCES PERKINS,

Secretary of Labor, Chairman.

HENRY MORGENTHAU, Jr.,

Secretary of the Treasury.

HOMER S. CUMMINGS,

Attorney General.

HENRY A. WALLACE,

Secretary of Agriculture.

HARRY L. HOPKINS,

Federal Emergency Relief Administrator.

EDWIN E. WITTE,

Executive Director.

|

PRESIDENT ROOSEVELT'S MESSAGE TO CONGRESS ON THE ECONOMIC SECURITY PROGRAM

In addressing you on June eighth, 1934, 1 summarized the main objectives of our American program. Among these was, and is, the security of the men, women, and children of the Nation against certain hazards and vicissitudes of life. This purpose is an essential part of our task. In my annual message to you I promised to submit a definite program of action. This I do in tile form of a report to me by a Committee on Economic Security, appointed by me for the purpose of surveying the field and of recommending the basis of legislation.

I am gratified with the work of this Committee and of those who have helped it: The Technical Board on Economic Security drawn from various departments of the Government, the Advisory Council on Economic Security, consisting of informed and public spirited private citizens and a number of other advisory groups, including a committee on actuarial consultants, a medical advisory board, a dental advisory committee, a hospital advisory committee, a public health advisory committee, a child welfare committee and an advisory committee on employment relief. All of those who participated in this notable task of planning this major legislative proposal are ready and willing, at any time, to consult with and assist in any way the appropriate Congressional committees and members, with respect to detailed aspects.

It is my best judgment that this legislation should be brought forward with a of delay. Federal action is necessary to, and conditioned upon, the action of States. Forty-four legislatures are meeting or will meet soon. In order that the necessary State action may be taken promptly it is important that the Federal Government proceed speedily.

The detailed report of the Committee sets forth a series of proposals that will appeal to the sound sense of the American people. It has not attempted the impossible, nor has it failed to exercise sound caution and consideration of all of the factors concerned: the national credit, the rights and responsibilities of States, the capacity of industry to assume financial responsibilities and the fundamental necessity of proceeding in a manner that will merit the enthusiastic support of citizens of all sorts.

It is overwhelmingly important to avoid any danger of permanently discrediting the sound and necessary policy of Federal legislation for economic security by attempting to apply it on too ambitious a scale before actual experience has provided guidance for the permanently safe direction of such efforts. The place of such a fundamental in Our future civilization is too precious to be jeopardized now by extravagant action. It is a sound idea--a sound ideal. Most of the other advanced countries of the world have already adopted it and their experience affords the knowledge that social insurance can be made a sound and workable project.

Three principles should be observed in legislation oil this subject. First, the system adopted, except for the money necessary to initiate it, should be self-sustaining in the sense that funds for the payment of insurance benefits should not come from the proceeds of general taxation. Second, excepting in old-age insurance, actual management should be left to the States subject to standards established by the Federal Government. Third, sound financial management of the funds and the reserves, and protection of the credit structure of the Nation should be assured by retaining Federal control over all funds through trustees in the Treasury of the United States.

At this time, I recommend the following types of legislation looking to economic security:

- Unemployment compensation.

- Old-age benefits, including compulsory and Voluntary annuities.

- Federal aid to dependent children through grants to States for the support of existing mothers' pension systems and for services for the protection and care of homeless, neglected, dependent, and crippled children.

- Additional Federal aid to State and local public health agencies and the strengthening of the Federal Public Health Service. I am not at this time recommending the adoption of so called "health insurance," although groups representing the medical profession are cooperating with the Federal Government in the further study of the subject and definite progress is being made.

With respect to unemployment compensation, I have concluded that the most practical proposal is the levy of a uniform Federal payroll tax, ninety per cent of which should be allowed as an offset to employers contributing under a compulsory State unemployment compensation act. The purpose of this is to afford a requirement of a reasonably uniform character for all States cooperating with the Federal Government and to promote and encourage the passage of unemployment compensation laws in the States. The ten per cent not thus offset should be used to cover the costs of Federal and State administration of this broad system. Thus, States will largely administer unemployment compensation, assisted and guided by the Federal Government. An unemployment compensation system should be constructed in such a way as to afford every practicable aid and incentive toward the larger purpose of employment stabilization. This can be helped by the intelligent planning of both public and private employment. It also can be helped by correlating the system with public employment so that a person who has exhausted his benefits may be eligible for some form of public work as is recommended in this report. Moreover, in order to encourage the stabilization of private employment, Federal legislation should not foreclose the States from establishing means for indicating industries to afford an even greater stabilization of employment.

In the important field of security for our old people, it seems necessary to adopt three principles: First, non-contributory old-age pensions for those who are now too old to build up their own insurance. It is, of course, clear that for perhaps thirty years to come funds will have to be provided by the States and the Federal Government to meet these pensions. Second, compulsory contributory annuities which in time will establish a self-supporting system for those now young and for future generations. Third, voluntary contributory annuities by which individual initiative can increase the annual amounts received in old age. It is proposed that the Federal Government assume one-half of the cost of the old-age pension plan, which ought ultimately to be supplanted by self-supporting annuity plans.

The amount necessary at this time for the initiation of unemployment compensation, old-age security, children's aid, and the promotion of public health, as outlined in the report of the Committee on Economic Security, is approximately one hundred million dollars.

The establishment of sound means toward a greater future economic security of the American people is dictated by a prudent consideration of the hazards involved in our national life. No one can guarantee this country against the dangers of future depressions but we can reduce these dangers. We can eliminate many of the factors that cause economic depressions, and we can provide the means of mitigating their results. This plan for economic security is at once a measure of prevention and a method of alleviation.

We pay now for the dreadful consequence of economic insecurity and dearly. This plan presents a more equitable and infinitely less expensive means of meeting these costs. We cannot afford to neglect the plain duty before us. I strongly recommend action to attain the objectives sought in this report.

FRANKLIN D. ROOSEVELT

The White House, January 17, 1935.

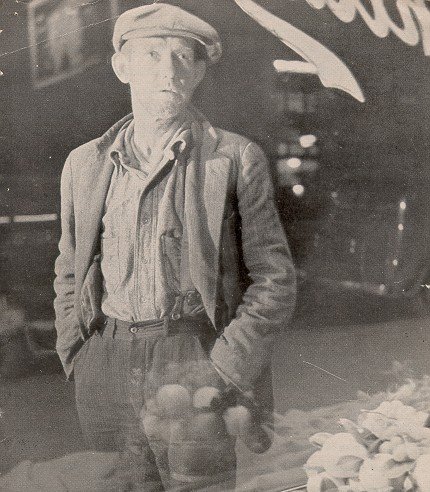

NEED FOR SECURITY

The need of the people of this country for " some safeguard against misfortunes which cannot be wholly eliminated in this man-made world of ours " is tragically apparent at this time, when 18,000,000 people, including children and aged, are dependent upon emergency relief for their subsistence and approximately 10,000,000 workers have no employment other than relief work. Many millions more have lost their entire savings, and there has occurred a very great decrease in earnings. The ravages of probably the worst depression of all time have been accentuated by greater urbanization, with the consequent total dependence of a majority of our people on their earnings in industry.

As progress is made toward recovery, this insecurity will be lessened, but it is not apparent that even in the "normal times " of the prosperous twenties, a large part of our population had little security. From the best estimates which are obtainable, it appears that in the years 1922 to 1929 there was an average unemployment of 8 percent among our industrial workers. In the best year of this period, the number of the unemployed averaged somewhat less than 1,500,000.

Unemployment is but one of many misfortunes which often result in destitution. In the slack year of 1933, 14,500 persons were fatally injured in American industry and 55,000 sustained some permanent injury. Nonindustrial accidents exacted a much greater toll. On the average, 2.25 percent of all industrial workers are at all times incapacitated from work by reason of illness. Each year above one eighth of all workers suffer one or more illnesses which disable them for a week, and the percentage of the families in which some member is seriously ill is much greater. In urban families of low incomes, above one-fifth each year have expenditures for medical and related care of above $100 and many have sickness bills of above one-fourth and even one-half of their entire family income. A relatively small but not insignificant number of workers are each year prematurely invalided, and 8 percent of all workers are physically handicapped.

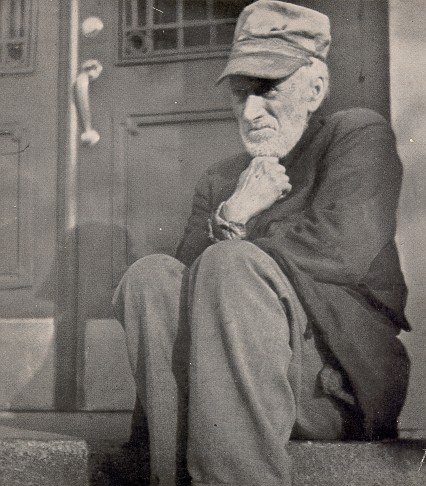

At least one-third of all our people, upon reaching old age, are dependent upon others for support. Less than 10 percent leave an estate upon death of sufficient size to be probated.

There is insecurity in every stage of life.

For the largest group, the people in middle years, who carry the burden of current production from which all must live, the hazards with which they are confronted threaten not only their own economic independence but the welfare of their dependents.

For those now old, insecurity is doubly tragic, because they are beyond the productive period. Old age comes to everyone who does not die prematurely and is a misfortune only if there is insufficient income to provide for the remaining years of life. With a rapidly increasing number and percentage of the aged, and the impairment and loss of savings, this country faces, in the next decades, an even greater old-age security problem than that with which it is already confronted.

For those at the other end of the life cycle--the children--dependence is normal, and security is best provided through their families. That security is often lacking. Not only do the children under 16 constitute above 40 percent of all people now on relief, as compared to 28 percent in the entire population, but at all times there are several millions in need of special measures of protection. Some of these need individual attention to restore, as fully as may be, lives already impaired. More of them--those who have been deprived of a father's support--need only financial aid which will make it possible for their mothers to continue to give them normal family care.

Most of the hazards against which safeguards must be provided are similar in that they involve loss of earnings. When earnings cease, dependency is not far off for a large percentage of our people. In 1929, at the peak of the stock-market boom, the average per capita income of all salaried employees at work was only $1,475. Eighteen million gainfully employed persons, constituting 44 percent of all those gainfully occupied, exclusive of farmers, had annual earnings of less than $1,000; 28,000,000, or nearly 70 percent, earnings of less than $1,500. Many people lived in straitened circumstances at the height of prosperity; a considerable number live in chronic want. Throughout the twenties, the number of people dependent upon private and public charity steadily increased.

With the depression, the scant margin of safety of many others has disappeared. The average earnings of all wage earners at work dropped from $1,475 in 1929 to $1,199 in 1932. Since then, there has been considerable recovery, but even for many who are fully employed there is no margin for contingencies.

The one almost all-embracing measure of security is an assured income. A program of economic security, as we vision it, must have as its primary aim the assurance of an adequate income to each human being in childhood, youth, middle age, or old age--in sickness or in health. It must provide safeguards against all of the hazards leading to destitution and dependency.

A piecemeal approach is dictated by practical considerations, but the broad objectives should never be forgotten. Whatever measures are deemed immediately expedient should be so designed that they can be embodied in the complete program which we must have ere long.

To delay until it is opportune to set up a complete program will probably mean holding up action until it is too late to act. A substantial beginning should be made now in the development of the safeguards which are so manifestly needed for individual security. As stated in the message of June 8, these represent not "a change in values " but" rather a return to values lost in the course of our economic development and expansion." " The road to these values is the way to progress." We will not " rest content until we have done our utmost to move forward on that road."

EMPLOYMENT ASSURANCE

Since most people must live by work, the first objective in a program of economic security must be maximum employment. As the major contribution of the Federal Government in providing a safeguard against unemployment we suggest employment assurance--the stimulation of private employment and the provision of public employment for those able-bodied workers whom industry cannot employ at a given time. Public-work programs are most necessary in periods of severe depression, but may be needed in normal times, as well, to help meet the problems of stranded communities and overmanned or declining industries. To avoid the evils of hastily planned emergency work public employment should be planned in advance and coordinated with the construction and developmental policies of the Government and with the State and local public-works projects.

We regard work as preferable to other forms of relief where possible. While we favor unemployment compensation in cash, we believe that it should be provided for limited periods on a contractual basis and without governmental subsidies. Public funds should be devoted to providing work rather than to introduce a relief element into what should be strictly an insurance system.

UNEMPLOYMENT COMPENSATION

Unemployment compensation, as we conceive it, is a front line of defense, especially valuable for those who are ordinarily steadily employed, but very beneficial also in maintainingpurchasing power. While it will not directly benefit those now unemployed until they are reabsorbed in industry, it should be instituted at the earliest possible date to increase the security of all who are employed.

We believe that the States should administer unemployment compensation assisted and guided by the Federal Government. We recommend as essential the imposition of a uniform pay-roll tax against which credits shall be allowed to industries in States that shall have passed unemployment compensation laws. Through such a uniform pay-roll tax it will be possible to remove the unfair competitive advantage that employers operating in States which have failed to adopt a compensation system enjoy over employers operating in States which give such protection to their wage earners.

We believe also that it is essential that the Federal Government assume responsibility for safeguarding, investing, and liquidating all reserve funds, in order that these reserves may be utilized to promote economic stability and to avoid dangers inherent in their uncontrolled investment and liquidation. We believe, further, that the Federal act should require high administrative standards, but should leave wide latitude to the States in other respects, as we deem experience very necessary with particular provisions of unemployment compensation laws in order to conclude what types are most practicable in this country.

OLD-AGE SECURITY

To meet the problem of security for the aged we suggest as complementary measures non-contributory old-age pensions, compulsory contributory annuities, and voluntary contributory annuities, all to be applicable on retirement at age 65 or over.

Only non-contributory old-age pensions will meet the situation of those who are now old and have no means of support. Laws for the payment of old-age pensions on a needs basis are in force in more than half of all States and should be enacted everywhere. Because most of the dependent aged are now on relief lists and derive their support principally from the Federal Government and many of the States cannot assume the financial burden of pensions unaided, we recommend that the Federal Government pay one-half the cost of old-age pensions but not more than $15 per month for any individual. The satisfactory way of providing for the old age of those now young is a contributory system of old-age annuities. This will enable younger workers, with matching contributions from their employers, to build up a more adequate old-age protection than it is possible to achieve with non-contributory pensions based upon a means test. To launch such a system we deem it necessary that workers who are now middle-aged or older and who, therefore, cannot in the few remaining years of their industrial life accumulate a substantial reserve be, nevertheless, paid reasonably adequate annuities upon retirement.

There still remains unprotected by either of the two above plans, professional and self-employed groups, many of whom face dependency in old age. Partially to meet their problem we suggest the establishment of a voluntary Government annuity system, designed particularly for people of small incomes.

SECURITY FOR CHILDREN

A large group of the children at present maintained by relief will not be aide by employment or unemployment compensation. There are the fatherless and other "young" families without a breadwinner. To meet the problems of the children in these families, no less than 45 States have enacted children's aid laws, generally called "Mothers' pension laws.'' However, due to the present financial difficulty in which many States find themselves far more of such children are on the relief lists than are in receipt of children's aid benefits. We are strongly of the opinion that these families should be differentiated from the permanent dependents and unemployables, and

we believe that the children's aid plan is the method which will best care for their needs. We recommend Federal grants-in-aid on the basis of one-half the State and local expenditures forthis purpose (one-third the entire cost.)

We recommend also that the Federal Government give assistance to States in providing local services for the protection and care of homeless, neglected, and delinquent children and for child and maternal health services especially in rural areas. Special aid should be given toward meeting a part of the expenditures for transportation, hospitalization, and convalescent care of crippled and handicapped children, in order that those very necessary services may be extended for a large group of children whose only handicaps are physical.

HEALTH SERVICES AND ACCIDENT COMPENSATION

As a first measure for meeting the very serious problem of sickness in families with low income we recommend a Nation-wide preventive public-health program. It should be largely financed by State and local governments and administered by State and local health departments, the Federal Government to contribute financial and technical aid. The program contemplates (1) grants in aid to be allocated through State departments of health to local areas unable to finance public-health programs from State and local resources, (2) direct aid to States in the development of State health services and the training of personnel for State and local health work, and (3) additional personnel in the United States Public Health Service to investigate health problems of interstate or national concern.

The second major step we believe to be the application of the principles of insurance to this problem. We have enlisted the cooperation of advisory groups representing the medical and dental professions and hospital management in the development of a plan for health insurance which will be beneficial alike to the public and the professions concerned. We expect to make a report on this subject in the near future.

We make the following recommendations concerning the hazard of industrial accidents.

(1) The Department of Labor should further extend its services in promoting uniformity and raising the standards of the accident-compensation laws of the States.

(2) The four States which do not have such laws are urged to enact such legislation.

The Economic Security Act

By Edwin E. Witte, Executive Director of the President's Committee on Economic Security

THE ECONOMIC Security Bill now before Congress embodies in legislative form the recommendations of the President in his special message of January17, 1935. This bill, introduced by Senator Wagner and Representatives Doughton and Lewis, is based upon the report of the Committee on Economic Security. It embodies all of the major recommendations of the committee except those relating to employment assurance, which are dealt with in a companion measure, the Administration's Public Works Bill.

The objectives of this bill have been summarized in the preceding pages of this booklet. Briefly it provides:

1. Old Age Security.

(A) Federal grants-in-aid to the States matching amounts paid by them for pensions to people over 65 years of age who are dependent upon the public for support.

(B) A self -sustaining Federal system of compulsory contributory annuities under which younger workers are enabled to make their own provisions for old age, with matching contributions from their employers.

(C) Voluntary annuities available at cost from the United States Treasury, designed primarily for people of small means who cannot be brought under the compulsory system and who are outside of the field covered by commercial insurance companies.

2. Unemployment Compensation.

A cooperative Federal-State system is proposed, in which the Federal Government will make it possible for the States to enact employment compensation laws through levying a uniform tax on employers, measured by their payrolls against which a credit will be allowed for payments made under State unemployment compensation laws. The Federal Government will also undertake the task of safeguarding. investing, and liquidating all reserve funds, to insure their use to stabilize industrial conditions, as far as possible. It will also keep central records and assist the States in the solution of difficult administrative and other problems arising in unemployment compensation. The actual administration willbe vested in the States. Subject to a few restrictions designed to insure efficient administration and use of all funds collected for the payment of benefits, to unemployed workmen, the States will be free to determine for themselves thetype of law they prefer, the length of the waiting periods, the duration of benefits, and all other features of the legislation.

3. Security for Children.

The Federal Government will pay one-third of the total cost of aid to dependent children (mothers' pensions), to be administered by the States. It will also make grants-in-aid to the States for maternity and infancy welfare, local child welfare services, and the physical restoration of crippled children.

4. Public Health Services.

The bill proposed Federal grants-in-aid for building up and strengthening State and local public health services. with a view toward eliminating preventable sickness. This program will not usher in a millenium. In the words of thePresident. a complete program of economic security "because of many lost years, will take many future years to fulfill." But this bill represents a substantial beginning in the development of safeguards to provide "securitv for men, women, and children."

This is not a radical proposal, as indicated by the bitter attacks made upon it by so many radical groups. It is not untried, but has behind it a long, successful European experience. Yet it does not merely copy European models; but is in accord with tried American policies and traditions. It represents not Federal interference, but a cooperative attack on the problems of insecurity, in which the Federal Government assumes leadership but does not dictate what the States shall do or interfere with their proper sphere of action.

This bill contemplates large appropriations ($98,500,000 in the first year and $218,500,000 in subsequent years), but these are small in comparisonwith the enormous costs of insecurity. It should result in material reduction of the costs to society of destitution and dependency in future years and be immediately helpful in allaying fears that are responsible for extreme and unsound proposals. It is designed to promote social and industrial stability and will operate to enlarge and make steady a widely diffused purchasing power upon which depends the high American standard of living and the internal market for our mass production, industry and agriculture.

Printed by

CITIZENS' SERVICE EXCHANGE

A Self-Help Cooperative

Richmond, VA.

Photos by Theodor Jung

|