Number:104-19

Date: March 28, 1996

THE HOUSE PASSES H.R. 3136

CONTRACT WITH AMERICA ADVANCEMENT ACT OF 1996

On March 28, 1996, the House passed, by a vote of 328-91, H.R. 3136, the Contract With America Advancement Act of 1996. The bill is expected to be taken up in the Senate tomorrow.

In addition to extending the debt limit from $4.9 trill ion to $5.5 trillion, the bill contains the following provisions of interest to Social Security:

Denial of Disability Benefits to Drug Addicts and Alcoholics

- Prohibits disability insurance (DI) and supplemental security income (SSI) eligibility to individuals whose drug addiction and/or alcoholism (DAA) is a contributing factor material to the finding of disability. This provision would apply to individuals who file for benefits on or after the date of enactment and to individuals whose claims are finally adjudicated on or after the date of enactment. This provision applies to curre nt beneficiarie s on January 1, 1997. SSA must: 1) notify current DAA beneficiaries of new provisions within 90 days of enactment; and 2) complete newmedical determinations by January 1, 1997, for affected current beneficiaries who request such a determination within 120 days after the date of enactment.

- Applies repre sentative payee requirements to DI or SSI beneficiaries who have a DAA condition, as determined by the Commissioner, and who are incapable of managing benefits. SSA would refer these individuals to the appropriate State agency for treatment. These provisions would apply to applications filed after the third month following the month of enactment. In addition, retains the $50 fee that representatives can collect for beneficiari es who have a DAA condition.

- Provides an appropriation of $50 million for each of FYs 1997 and 1998 to carry out on a priority basis activities relating to the treatment of drug and alcohol abuse under the Public Health Service Act.

Continuing Disability Reviews

- Provides additional funds to SSA for fiscal years 1996 through 2002 for the purpose of conducting Social Security disability insurance (DI) continuing disability reviews (CDRs) and Supplemental Security Income (SSI) CDRs and disability eligibility redeterminations. This would be accomplished by increasing the amount of funds available for appropriations under the discretionary spending cap.

- Directs the Commissioner of Social Security to ensurethat the funds made available pursuant to this provision are used, to the greatest extent practicable, to maximize the combined savings to the old-age, survivors, and disability insurance (OASDI), SSI, Medicare, and Medicaid programs.

- Requires the Commissioner to report annually, for FYs 1996 through 2002, to Congress on the amount of money spent on CDRs, the number of reviews conducted (by category), the disposition of such reviews (by program), and the estimated savings over the short-, medium-, and long-term for OASDI, SSI, Medicare, and Medicaid programs from CDRs which result in cessations, and the estimated present value of such savings.

- Establishes statutorily in the Social Security Administration the position of Chief Actuary, to be appointed by, and report directly to, the Commissioner, and be subject to removal only for cause.

Dependency Test for Stepchildren

- Provides that a stepchild would have to be receiving at least one-half support from the stepparent when the child's claim is tiled to get benefits. (The option for finding dependency based on living-with would bc eliminated.) This provision would be effective for benefits of individuals who become entitled after the third month following the month of enactment.

If the natural parent and the stepparent of an entitled stepchild divorce, benefits to the stepchild based on the work record of the stepparent would terminate the month after the month in which such divorce becomes final. This provision would be effective for final divorces occurring after the third month following the month of enactment.

Increase in the Earnings Test Annual Exempt Amount

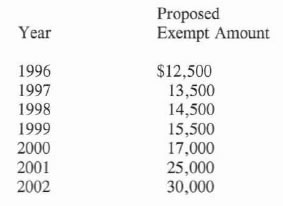

- Gradually ra ises, beginning in 1996, the earnings limit for the retirement

earnings test (REI) for beneficiaries who have attained normal retirement age

to $30,000 by 2002 (compared with $ 14,760 under current law based on the

intermediate assumptions in the Tru stees Report). The applicable 1996 exempt

amount under current law is $ 11,520. Exempt amounts under the bill would

be:

After 2002, the annual exempt amount would be indexed to growth in average wages.

The substantial gainful activity (SGA) amount applicable to individuals who are statutorily blind would no longer be linked to the RET exempt amount for individuals ages 65 to 69. Instead , the SGA amount for blind people would continue to be adjusted annually as under present law, i.e., based on the national average wage index.

Benefit and Tax Statements

- Requires SSA to conduct a pilot study of tile efficacy of providing retired workers with information about their Social Security benefits and taxes . The study would involve a sample of retirement beneficiaries whose entitlement began in or after 1984. SSA would send them estimates of their aggregate covered earnings, their aggregate Social Security taxes (including the employer share), and the total amount of benefits paid on their record.

- Requires the study to be conducted within a 2-year period. beginning as soon as practicable in 1996 and a report on its results be provided to Congress within 60 days of its completion.

Investment of Social Security and Medicare Trust Funds

- Prohibits the Secretary of the Treasury from refraining from investing Social Security and Medicare Trust Fund monies in Federal securities, and from redeeming securities held by the trust funds, to avoid increasing or to reduce outstanding public debt obligations. Effective upon enactnent.

Professional Staff for the Social Security Advisory Board

- Authorizes the Social Security Advisory Board to appoint 3 professional staff employees, one of whom is to be appointed from among individuals approved by Advisory Board members who do not belong to the political party represented by the majority of the Board.