Statement of Virginia P. Reno,

Deputy Commissioner for Retirement and Disability Policy,

Social Security Administration

before the Senate Special Committee on Aging

September 14, 2016

Chairman Collins, Ranking Member McCaskill, and Members of the Special Committee:

I am Virginia Reno, Deputy Commissioner for Retirement and Disability Policy at the Social Security Administration (SSA). Thank you for inviting me to discuss how SSA provides information to help workers and their family members decide when to claim Social Security retirement benefits. This decision is a very important one, and we are mindful of our responsibility to provide information to help our claimants make informed decisions that best fit their individual circumstances.

Importance of Social Security

First, I would like to note the importance of Social Security, officially named the Old- Age, Survivors, and Disability Insurance program. Few government agencies touch as many people as we do. We are with people through life’s journey, helping them secure today and tomorrow. Social Security is a social insurance program, under which workers earn coverage for retirement, survivors, and disability benefits by working and paying Social Security taxes on their earnings. Employees today contribute 6.2 percent of their earnings – on earnings up to $118,500 a year – for Social Security protection, and their employers contribute matching amounts. Self-employed workers contribute both the employee and employer shares and receive tax deductions for the amount of the employer share. In 2015, 213 million workers were insured for retirement and survivors benefits, and 151 million workers were protected against a catastrophic loss of income due to disability.

Social Security pays monthly benefits to 60 million individuals, including 40 million retired workers and three million of their spouses and children; nine million disabled workers and two million dependents (mainly children); and six million surviving widows, children, and other dependents of deceased workers.1 In fiscal year (FY) 2015, these benefits totaled around $877 billion. Administrative expenses for Social Security are very low, less than one percent of benefit payments.

Social Security is the foundation of retirement security for almost all U.S. workers, and it is the main source of income for most retirees. Nearly two in three seniors who receive Social Security get more than half of their total income from it, including one in three who rely on their benefits for all or almost all (90 percent or more) of their income.2

Choosing When to Claim Retirement Benefits

Choosing when to start receiving Social Security retirement benefits is an important decision that affects the amount that individuals receive for the rest of their lives. Workers can claim full (unreduced) retirement benefits at their full retirement age (FRA) – currently age 66.3 Social Security offers workers flexibility to claim benefits as early as age 62 or to delay as late as age 70.

Receiving Social Security benefits before FRA permanently reduces an individual’s monthly retirement benefit for every month of benefits received before attaining FRA – and the earlier benefits begin, the greater the reduction.4 In 2016, retirement benefits claimed at age 62 result in a reduction of up to 25 percent, compared to the benefit payable at FRA.5

On the other hand, individuals who delay claiming beyond FRA earn “delayed retirement credits” (DRCs) for every month they do not receive benefits after attaining FRA and prior to attaining age 70. For those born in 1943 and later, each month of delay increases the retirement benefit by two-thirds of one percent, or eight percent per year.

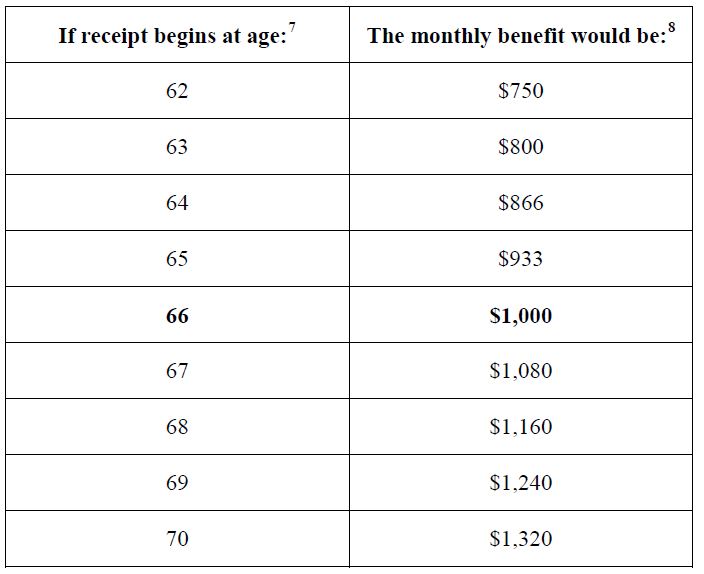

For example, consider an individual eligible for a $1,000 monthly benefit at the FRA of 66. As shown in the following chart, if he or she took benefits at age 62, the monthly amount would be permanently reduced by 25 percent to $750. On the other hand, if he or she delayed benefits until age 70, the monthly amount would be permanently increased by 32 percent (eight percent per year from age 66 to 70) to $1,320. Overall, delaying the start of benefits from age 62 to 70 would increase the monthly benefit by 76 percent (from $750 to $1,320).6

Retirement claiming decisions can also affect the amount of the benefit that the worker’s

surviving spouse will receive, if he or she outlives the worker. In effect, the same adjustment

that applies to the worker’s retirement benefit will apply to survivor benefits paid to the

worker’s widow or widower, for the rest of his or her life.

The amount of these reductions and credits is not arbitrary. Rather, the benefit adjustments for early and delayed claiming are designed to be actuarially neutral in the cost to the Social Security trust funds. This means that, no matter when he or she elects to receive retirement benefits, if an individual lives to the average life expectancy, he or she will receive roughly the same lifetime benefits. Of course, real people are not averages. In this respect, people make decisions that best reflect their own situations and needs.

Deciding when to claim retirement benefits can be complex and is a highly personal decision, based on many factors. In addition to the monthly benefit amount, individuals will want to consider their personal and family circumstances, including current and future financial resources and obligations, and current and anticipated health and longevity.

Someone who needs benefits at age 62 to make ends meet, or whose current health is precarious, may choose to claim benefits at age 62. Others may choose to wait until age 70 to get higher Social Security benefits in case they might live to an advanced age when other resources may have decreased. In fact, the likelihood of living to an advanced age is greater than many people might realize. Social Security’s actuaries estimate that more than one in three 65-year-olds today will live to age 90, and more than one in seven will live to age 95.9

Married couples approaching retirement have two lives to plan for. They must consider important information about Social Security protection for widowed spouses. A higher- earning partner who delays benefits will receive higher monthly benefits for his or her life. This delay will also result in higher survivor’s benefits for a spouse if the spouse lives longer. Married couples at age 65 today have greater than a 50-50 chance that at least one member of the couple will live beyond the age of 90.10

Social Security’s Role in Individuals’ Decision-Making

SSA’s role in the retirement claiming decision is to provide objective and clear information that individuals can use to make an informed decision for their own circumstances. The Government Accountability Office (GAO) is currently exploring the ways we inform individuals about their choices. While our outreach, education, and customer service efforts are informative and robust, we appreciate the guidance and recommendations that GAO may offer to improve our interactions with the public.

We have a variety of ways to inform individuals about their claiming decisions before they decide to file for benefits. These resources are critical because they allow individuals to gather information and consider their decisions in advance, so they have time to think about the best claiming age for them. After all, by the time they arrive in a field office or complete an online application to claim benefits, they may have already decided to file for benefits. We provide this information in advance through the Social Security Statement, our website and publications, outreach, and more.

Social Security Statement

The Social Security Statement (Statement) reaches a wide swath of workers and pre- retirees of all ages. It often serves as our first interaction with members of the public. We currently mail Statements to workers ages 25, 30, 35, 40, 45, 50, 55, and 60 or older who are not receiving Social Security benefits and do not have a my Social Security account.11 In FY 2015, we mailed more than 44 million Statements.

The most convenient way for people to see their Statement is by creating and using their personal my Social Security account through our SocialSecurity.gov website. However, we also provide an option for online users to print and mail a request to us, allowing us to send a hard copy Statement without any registration process.

The Statement provides personalized information about an individual’s potential retirement, disability, and survivor benefits, as well as a detailed record of the individual’s earnings history. We encourage people to verify their earnings history and let us know if corrections are needed. This is especially important since we base future benefits on the individual’s earnings history. For retirement benefits, the Statement lists the benefit amounts that he or she could expect to receive at age 62, at FRA, and at age 70. For people age 55 and older, the Statement describes additional factors to consider when choosing when to claim benefits. It includes information on how work affects benefits; how a worker’s claiming decision affects his or her spouse’s survivor benefits; how to avoid a Medicare late-enrollment penalty; and information on life expectancy. Surveys indicate that receiving the Statement increases Social Security program knowledge among recipients,12 and preliminary research findings suggest that Statement receipt also has a statistically significant impact on claiming decisions, reducing the percentage of individuals claiming at ages 62 and 63.13

Because it reaches so many people and provides individualized benefit information, the Social Security Statement is a valuable educational tool. With recent funding levels, however, we have been unable to mail Statements to all workers in some years. As the Statement serves as a vital tool in retirement planning, it is essential that we receive the funding necessary to ensure that we are able to continue its mailing.

Publications and Online Tools

We offer a wealth of information to the public through our publications, website, and other online tools. Over 118 million people visited our website a total of more than 216 million times in the last year. Numerous publications, webpages, and Frequently Asked Questions explain the effect that earnings, the age of claiming benefits, and the receipt of a non-covered pension may have on Social Security benefits. Our resources range from providing basic information about benefits, to delving into the details of benefit calculations, factors to consider in claiming decisions, and more.

We offer a variety of online calculators. One of these, the Retirement Estimator, allows an individual to input a few pieces of personal information and receive an estimate of benefits that would be payable if he or she were to claim benefits at age 62, at FRA, at age 70, or at any age in between based upon his or her actual earnings information. The Retirement Estimator lets individuals enter different future earnings information, retirement dates, and scenarios to help decide the best time to retire. We also offer a Life Expectancy Calculator to aid people with their retirement planning. This calculator allows an individual to see his or her estimated total life expectancy based on his or her gender and date of birth.

Individuals with a my Social Security account gain immediate access to their Statement online, including both their earnings record and their expected Social Security benefits were the individual to claim benefits at ages 62, FRA, and 70. Currently, over 26 million individuals have signed up for a my Social Security account.

We also offer substantial information while an individual completes the online application for retirement benefits. Throughout the online retirement application, we provide links that explain why we ask for particular pieces of information or that offer information based on a claimant’s individual circumstances. For example, within the online application, when claimants indicate the date they want to start receiving benefits, we provide information to let them know that if they begin receiving their benefit before FRA, their benefits will be permanently reduced. We also provide links to more information about FRA and full benefit amounts. Additionally, we provide a link to a retirement estimator, mentioned earlier, that allows claimants to see what their benefit amount would be at various ages. This level of information is important because most retirement claims are filed online – in 2015, 52 percent of retirement applications were filed online.

Direct Service to Customers

Our employees are dedicated to providing customers with all the information they need to make a well-informed decision about claiming Social Security benefits. They assist the public in a variety of ways, through face-to-face interaction in the field offices, by telephone, in response to online applications, and by mail.

Employees inform claimants of all benefits for which they and their family members may be eligible; provide monthly benefit amounts at early, full, and delayed retirement ages; and discuss other information the claimant may need to know about Social Security rules, requirements, and benefits. In short, our employees provide customers with information about Social Security and how our rules apply to each customer’s individualized situation. At the same time, we instruct our employees not to persuade or influence claimants about benefit decisions. Rather, our information about Social Security benefits and rules is part of a much larger picture that a claimant and his or her family must put together to make decisions that fit their own circumstances. Our employees are not in a position to know about or discuss a worker’s financial resources, tax situation, health, family history, or other information that may be important when making individual retirement decisions.

Ending Use of Breakeven Analysis

In the past, we used to calculate a “breakeven age” for claimants who were deciding when to claim benefits.14 We discontinued this practice in 2008 based on concerns within the agency, from stakeholders, and from researchers that its use encouraged early benefit claiming. Breakeven analysis generally weights the discussion toward getting the most money as soon as possible (often by claiming early), and may undervalue Social Security’s annuity protection against the so-called “longevity risk”– the very real risk that an individual or his or her surviving spouse may face deprivation at an advanced age. Based on these concerns, we discontinued using the breakeven concept in 2008. Subsequent research supports this decision. For example, a 2011 study tested different ways of framing or presenting information on Social Security claiming options, and found that use of breakeven framing led to substantially earlier expected claiming dates than other ways of presenting the same information.15 Additionally, more recent research finds that psychological factors, such as loss aversion and preference for immediate over future rewards, could also encourage earlier claiming of benefits.16

Field Office Employee Training

Our field office employees serve as the face of our agency, providing integral in-person

decision-making information to our claimants. To ensure that they are well informed and able to

provide exemplary customer service to the public, we train our field office claim specialists

through a variety of methods and over the course of their careers. Claims specialists’ training

begins with approximately four months of formal entry-level and advanced training. This training

covers topics that employees need to perform their jobs, and explains how employees should discuss

items with claimants during interviews and

in response to questions.

After formal training, claims specialists enter into a mentorship under a journeyman employee until they have shown their proficiency in their job duties. To ensure that our employees retain their knowledge and are aware of any updates to policy and procedure, we offer continued training even after an employee has been certified to complete work independently, and such training continues throughout his or her career.

Collaboration

Public outreach is an essential part of our strategy to educate the public on the retirement benefit options available. We provide the public with critical information about our programs, benefits, and services. To this end, we participate in ongoing communications and collaborations with key national organizations, advocacy groups, Federal agencies, and state and local government organizations.

We collaborate with a number of outside organizations on research and other projects to expand our understanding of retirement claiming decisions and related factors, and to improve how we explain this information to the public. For example, we are working with the White House Social and Behavioral Sciences Team to use insights from the behavioral sciences to improve how we explain options that individuals have about the retirement earnings test and claiming options. We are also partnering with AARP to explore messaging about claiming ages (such as at full retirement and early retirement). In addition, we support a nationally-representative panel survey that allows us to determine what participants know about Social Security, how they want to receive information from us, and how well they understand particular messages or terminology about retirement claiming.

We also work with other Federal agencies to provide people with the information tools they need to plan for retirement and to encourage financial readiness. For example, we partnered with the Department of Labor to develop and publicize the Retirement Toolkit. This toolkit includes information on Social Security benefits and claiming, Medicare, retirement savings, and other related topics. We also recently co-hosted a public Financial Security Research Symposium with the Department of the Treasury, as part of the Financial Literacy and Education Commission.

These collaborations, and others like them, further our understanding of how best to explain complicated claiming information in a way that promotes informed decision- making for all of our claimants. We are using empirical evidence to improve tools and techniques to help our customers make informed decisions about claiming Social Security retirement benefits.

Funding

Finally, I would like to emphasize our need for adequate, sustained funding to carry out Social Security’s core missions, including our commitment to provide the world-class service that this Committee, the GAO, and our public expect. When workers contribute 6.2 percent of their earnings throughout their working lives into the Social Security program, they are paying not only for insurance protection and a monthly insurance benefit. They are also paying for the comprehensive service they expect from us before and when they claim benefits.

However, our operating budget (excluding dedicated program integrity funds) to administer Social Security has been severely constrained in recent years. SSA’s core operating budget has shrunk by 10 percent since 2010 after adjusting for inflation, even as the number of Social Security beneficiaries has risen by 12 percent over the same time. We expect to serve a record number of claimants and beneficiaries in FY 2017. And large numbers of claimants and beneficiaries continue to come to us expecting the services that they paid for throughout their working lives. We do not expect this to subside in the foreseeable future, as the first boomers reached age 62 only in 2008 (and the last ones will not reach that age until the mid-2020s).

But we can only do so much when we receive far less money than we need, even as our workloads are increasing with the baby boomers reaching retirement age. Our FY 2016 enacted budget was $350 million less than the President’s request. Given the significant demand for our services and the budget constraints of recent years, the result has been that more people are waiting to be served at field offices, more people are waiting longer for their claims to be allowed, and more people (over one million) are waiting for their hearings before administrative law judges.

We are greatly concerned about FY 2017 under a continuing resolution or even lower funding levels. Each year we must absorb $300-350 million inflationary growth in our fixed costs (e.g., payroll, benefits, rent, postage, and guard services), which means less money to do our work and serve the public. We already are faced with a hiring freeze, which means – due to attrition – we are shrinking even as the number of Social Security beneficiaries grows. The House appropriations bill, if enacted, would cut the agency’s base administrative funding below the FY 2016 enacted level and result in serious degradation of service. For example, at such low funding levels, we could face up to two weeks of employee furloughs, when our field offices could be closed to the public. The Senate appropriation bill, while higher than the House bill, would still fall short of providing us the funding to serve record numbers of claimants and beneficiaries.

The President’s Budget request of $13.067 billion would provide funding to improve service to the public, and it would allow us to continue mailing Social Security Statements to millions of workers. We have demonstrated that we do an excellent job managing our administrative budget despite needing a large infrastructure that requires many people and buildings to be accessible to the public. Our administrative costs are extremely low considering the volume of work we do. In 2015, administrative expenses represented only 0.7 percent of total Old-Age and Survivors Insurance (OASI) and Disability Insurance (DI) benefits. Looking at OASI alone, the numbers are even lower, at 0.4 percent of OASI outgo. Again, that is less than one-half of one percent – far less than any private sector system for providing life insurance and retirement annuities.

As GAO and many others point out, decisions about claiming retirement benefits have lifelong consequences for retirees and their spouses. It is crucial that we get a funding level that allows us to rebound from this year’s constraints to restore and improve service to the public. We reiterate the critical importance of adequately funding our agency so that we can deliver the level of service the American people deserve and have paid for with Social Security contributions from their paychecks throughout their working lives.

Conclusion

When Congress enacted the Social Security Act in 1935, it did so to provide seniors with benefits based on their earned income to sustain them through their retirement. This continues to be one of the program’s core purposes. But our efforts should not result in pushing our claimants into a one-size-fits-all choice. Our program rules allow individuals to claim their retirement benefits at any time between the ages of 62 and 70, offering individuals the flexibility to start benefits at the date that best suits their needs. Through interaction with agency employees, the Social Security Statement, my Social Security, and other online tools, our publications, and our outreach efforts, we provide valuable ways for individuals to learn about how claiming decisions may affect their benefits. While there is no “best age” for all individuals to receive their retirement benefits, we design our efforts to ensure that individuals can make informed decisions based on their own circumstances.

Thank you again for inviting me here today. I would be glad to answer any questions.

________________________________________________________________________