Press Release

Wednesday, October 13, 2021

For Immediate Release

Social Security Announces 5.9 Percent Benefit Increase for 2022

Social Security and Supplemental Security Income (SSI) benefits for approximately 70 million Americans will increase 5.9 percent in 2022, the Social Security Administration announced today.

The 5.9 percent cost-of-living adjustment (COLA) will begin with benefits payable to more than 64 million Social Security beneficiaries in January 2022. Increased payments to approximately 8 million SSI beneficiaries will begin on December 30, 2021. (Note: some people receive both Social Security and SSI benefits). The Social Security Act ties the annual COLA to the increase in the Consumer Price Index as determined by the Department of Labor's Bureau of Labor Statistics.

Some other adjustments that take effect in January of each year are based on the increase in average wages. Based on that increase, the maximum amount of earnings subject to the Social Security tax (taxable maximum) will increase to $147,000 from $142,800.

Social Security and SSI beneficiaries are normally notified by mail starting in early December about their new benefit amount. Most people who receive Social Security payments will be able to view their COLA notice online through their personal my Social Security account. People may create or access their my Social Security account online at www.socialsecurity.gov/myaccount.

Information about Medicare changes for 2022, when announced, will be available at www.medicare.gov. For Social Security beneficiaries receiving Medicare, Social Security will not be able to compute their new benefit amount until after the Medicare premium amounts for 2022 are announced. Final 2022 benefit amounts will be communicated to beneficiaries in December through the mailed COLA notice and my Social Security's Message Center.

The Social Security Act provides for how the COLA is calculated. To read more, please visit www.socialsecurity.gov/cola.

NOTE TO CORRESPONDENTS: Here is a fact sheet showing the effect of the various automatic adjustments.

To get more Social Security news, follow the Press Office on Twitter @SSAPress.

Press Release

Monday, October 4, 2021

For Immediate Release

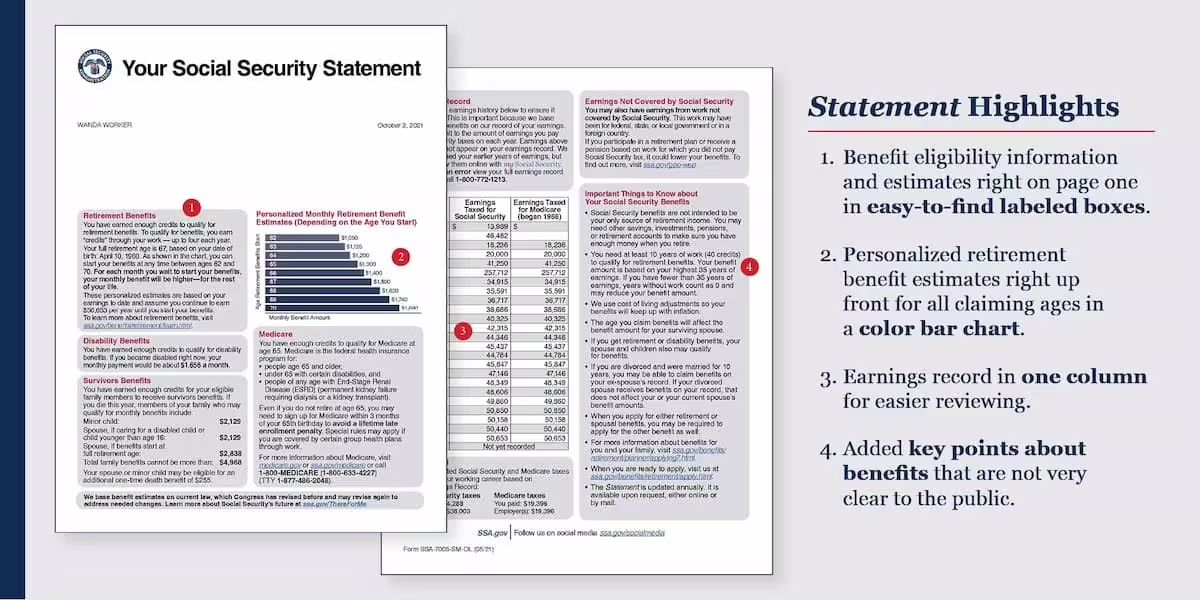

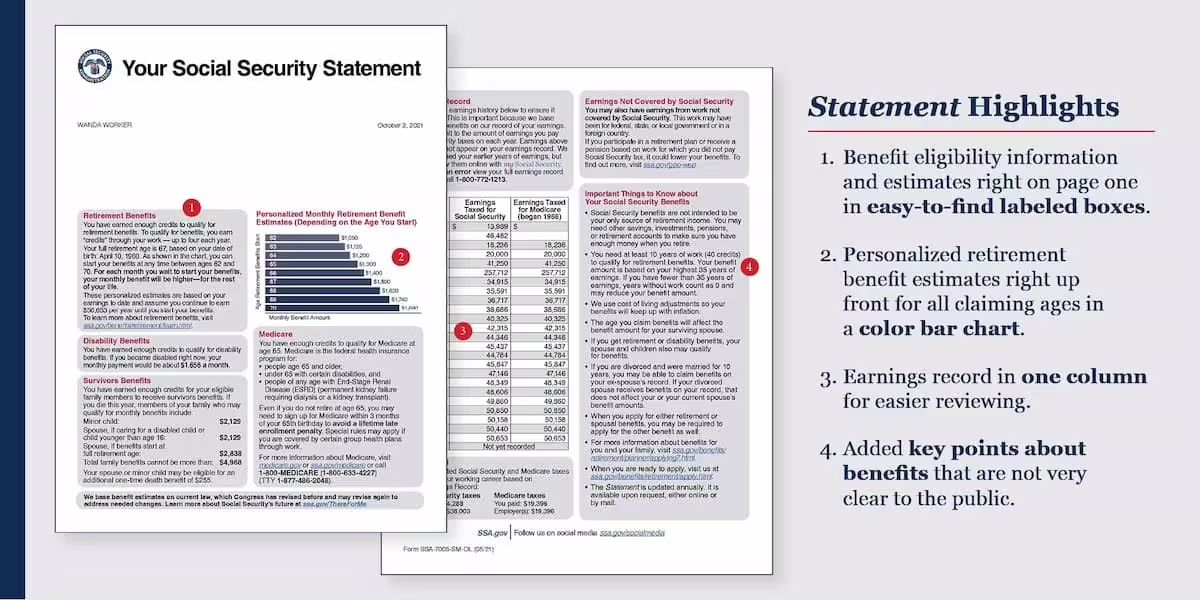

Social Security Announces Redesigned Statement -- Now Available with a my Social Security Account

Kilolo Kijakazi, Acting Commissioner of Social Security, today introduced a new look and feel to the Social Security Statement, available online through the my Social Security portal at www.socialsecurity.gov/myaccount and by mail. The Statement is one of the most effective tools people can use to learn about their earnings and future Social Security benefits. This fresh look will allow millions of people to see their earnings information and estimates of future benefits quickly and securely.

"One of my top priorities is to provide information to people in clear and plain terms about Social Security's programs and services," said Acting Commissioner Kijakazi. "The streamlined Social Security Statement contains clear messaging and makes it easier to find information at a glance, helping to simplify our complex programs for the public."

The agency conducted extensive research, review, and testing to make the updated Statement easy to understand. The new Statement is shorter, uses visuals and plain language, and includes fact sheets tailored to a person's age and earnings history. It also includes important information people have come to expect from the Statement, such as how much a worker and family members could expect to receive in Social Security benefits and a personalized earnings history, in a clear, concise manner. Examples of the new Statement and fact sheets are available at www.socialsecurity.gov/myaccount/statement.html.

More than 61 million people have already created my Social Security accounts. U.S. citizens age 18 or older can easily view their redesigned Social Security Statement online by creating a my Social Security account. People age 60 or older who do not receive benefits and do not have a my Social Security account will receive their Statement by mail three months before their birthday. Workers should check their Statement at least once a year for accuracy.

People can check information and conduct most Social Security business through their personal my Social Security account. If they already receive Social Security benefits, they can start or change direct deposit online, request a replacement SSA-1099, and if they need proof of their benefits, they can print or download a current Benefit Verification Letter from their account.

In addition to obtaining their personalized Social Security Statement, people not yet receiving benefits can use their account to request a replacement Social Security card online if they meet certain requirements. The portal also includes a retirement calculator and links to information about other online services, such as applications for retirement, disability, and Medicare benefits.

Many Social Security services are also conveniently available by dialing toll-free, 1-800-772-1213. People who are deaf or hard of hearing may call Social Security's TTY number, 1-800-325-0778.

To get more Social Security news, follow the Press Office on Twitter @SSAPress.

Press Release

Tuesday, August 31, 2021

For Immediate Release

Social Security Board of Trustees: Combined Trust Funds Projected Depletion One Year Sooner Than Last Year

The Social Security Board of Trustees today released its annual report on the long-term financial status of the Social Security Trust Funds. The combined asset reserves of the Old-Age and Survivors Insurance and Disability Insurance (OASI and DI) Trust Funds are projected to become depleted in 2034, one year earlier than projected last year, with 78 percent of benefits payable at that time.

The OASI Trust Fund is projected to become depleted in 2033, one year sooner than last year's estimate, with 76 percent of benefits payable at that time. The DI Trust Fund is estimated to become depleted in 2057, eight years earlier than last year's estimate, with 91 percent of benefits still payable.

In the 2021 Annual Report to Congress, the Trustees announced:

- The asset reserves of the combined OASI and DI Trust Funds increased by $11 billion in 2020 to a total of $2.908 trillion.

- The total annual cost of the program is projected to exceed total annual income, for the first time since 1982, in 2021 and remain higher throughout the 75-year projection period. As a result, asset reserves are expected to decline during 2021. Social Security's cost has exceeded its non-interest income since 2010.

- The year when the combined trust fund reserves are projected to become depleted, if Congress does not act before then, is 2034 - one year earlier than last year's projection. At that time, there would be sufficient income coming in to pay 78 percent of scheduled benefits.

"The Trustees' projections in this year's report include the best estimates of the effects of the COVID-19 pandemic on the Social Security program," said Kilolo Kijakazi, Acting Commissioner of Social Security. "The pandemic and its economic impact have had an effect on Social Security's Trust Funds, and the future course of the pandemic is still uncertain. Yet, Social Security will continue to play a critical role in the lives of 65 million beneficiaries and 176 million workers and their families during 2021."

Other highlights of the Trustees Report include:

- Total income, including interest, to the combined OASI and DI Trust Funds amounted to $1.118 trillion in 2020. ($1.001 trillion from net payroll tax contributions, $41 billion from taxation of benefits, and $76 billion in interest)

- Total expenditures from the combined OASI and DI Trust Funds amounted to $1.107 trillion in 2020.

- Social Security paid benefits of $1.096 trillion in calendar year 2020. There were about 65 million beneficiaries at the end of the calendar year.

- The projected actuarial deficit over the 75-year long-range period is 3.54 percent of taxable payroll - higher than the 3.21 percent projected in last year's report.

- During 2020, an estimated 175 million people had earnings covered by Social Security and paid payroll taxes.

- The cost of $6.3 billion to administer the Social Security program in 2020 was a very low 0.6 percent of total expenditures.

- The combined Trust Fund asset reserves earned interest at an effective annual rate of 2.6 percent in 2020.

The Board of Trustees usually comprises six members. Four serve by virtue of their positions with the federal government: Janet Yellen, Secretary of the Treasury and Managing Trustee; Kilolo Kijakazi, Acting Commissioner of Social Security; Xavier Becerra, Secretary of Health and Human Services; and Martin J. Walsh, Secretary of Labor. The two public trustee positions are currently vacant.

View the 2021 Trustees Report at www.socialsecurity.gov/OACT/TR/2021/.

To get more Social Security news, follow the Press Office on Twitter @SSAPress.

Press Release

Monday, August 16, 2021

For Immediate Release

Social Security Expands Compassionate Allowances Program for People with Severe Disabilities

Program Expedites Decisions for Disability Benefits

Kilolo Kijakazi, Acting Commissioner of Social Security, today announced 12 new Compassionate Allowances conditions: Charlevoix Saguenay Spastic Ataxia (ARSACS), Choroid Plexus Carcinoma, CIC-rearranged Sarcoma, Congenital Zika Syndrome, Desmoplastic Mesothelioma, Duchenne Muscular Dystrophy - Adult, Pericardial Mesothelioma, Refractory Hodgkin Lymphoma, Renpenning Syndrome, SCN8A Related Epilepsy with Encephalopathy, SYNGAP1-related NSID, and Taybi-Linder Syndrome. Compassionate Allowances is an initiative that quickly identifies severe medical conditions and diseases that meet Social Security's standards for disability benefits.

"Everyone who is eligible for benefits under the programs we administer should receive them," said Acting Commissioner Kijakazi. "Our Compassionate Allowances program helps us address barriers by helping accelerate the disability application process for people who are likely to get approved for benefits due to the severity of their medical condition."

The Compassionate Allowances program quickly identifies claims where the applicant's condition or disease clearly meets Social Security's statutory standard for disability. Due to the severe nature of many of these conditions, these claims are often allowed based on medical confirmation of the diagnosis alone; for example, certain cancers, amyotrophic lateral sclerosis (ALS), and a number of rare disorders that affect children. To date, more than 700,000 people with severe disabilities have been approved through this accelerated, policy-compliant disability process, which has grown to a total of 254 conditions.

When a person applies for disability benefits, Social Security must obtain medical records in order to make an accurate determination. The agency incorporates leading technology to identify potential Compassionate Allowances cases and make quick decisions. Social Security's Health IT brings the speed and efficiency of electronic medical records to the disability determination process. With electronic records transmission, Social Security is able to quickly obtain a claimant's medical information, review it, and make a fast determination.

For more information about the program, including a list of all Compassionate Allowances conditions, please visit www.socialsecurity.gov/compassionateallowances.

To learn more about Social Security's Health IT program, please visit www.socialsecurity.gov/hit.

People may apply online for disability benefits by visiting www.socialsecurity.gov.

To create a my Social Security account, please visit www.socialsecurity.gov/myaccount.

To get more Social Security news, follow the Press Office on Twitter @SSAPress.

Press Release

Friday, May 7, 2021

For Immediate Release

Olivia and Liam are Social Security's Top Baby Names for 2020

Mason and Ethan Fall Out of Top 10

Olivia and Liam are once again America's most popular baby names in 2020. It appears parents chose to stick with the familiar during an unprecedented time, with the top three names for both girls - Olivia, Emma, and Ava - and boys - Liam, Noah, and Oliver - remaining the same for the second year in a row. In fact, out of both Top 10 lists combined, only two names changed, with the traditional names Henry and Alexander edging out Mason and Ethan. The name Henry has been steadily rising in popularity, last appearing in the Top 10 over a century ago, in 1910.

Here are the top 10 boys and girls names for 2020:

| Boys |

Girls |

| 1. Liam |

1. Olivia |

| 2. Noah |

2. Emma |

| 3. Oliver |

3. Ava |

| 4. Elijah |

4. Charlotte |

| 5. William |

5. Sophia |

| 6. James |

6. Amelia |

| 7. Benjamin |

7. Isabella |

| 8. Lucas |

8. Mia |

| 9. Henry |

9. Evelyn |

| 10. Alexander |

10. Harper |

For all of the top baby names of 2020, and to see where your name ranks, go to Social Security's website, www.socialsecurity.gov/babynames.

Social Security encourages everyone to enjoy the baby names list and, while online, create a my Social Security account at www.socialsecurity.gov/myaccount. my Social Security is a personalized online account that people can use beginning in their working years and continuing while receiving Social Security benefits.

Social Security beneficiaries have instant access to their benefit verification letter, payment history, and complete earnings record by establishing a my Social Security account. Beneficiaries also can change their address, start or change direct deposit information, and request a replacement SSA-1099 online. People receiving benefits can request a replacement Medicare card online.

People age 18 and older who are not receiving benefits can also sign up for a my Social Security account to get their personalized online Social Security Statement. The online Statement provides workers with secure and convenient access to their Social Security earnings and benefit information, and estimates of future benefits they can use to plan for their retirement. Residents of most states may request a replacement Social Security card online if they meet certain requirements.

Additional Baby Names Information:

Social Security began compiling the baby name list in 1997, with names dating back to 1880. At the time of a child's birth, parents supply the name to the agency when applying for a child's Social Security card, thus making Social Security America's source for the most popular baby names.

Each year, the list reveals the effect of pop-culture on naming trends. Here are the top five fastest rising boys and girls names in 2020:

| Boys |

Girls |

| 1. Zyair |

1. Avayah |

| 2. Jaxtyn |

2. Denisse |

| 3. Jakobe |

3. Jianna |

| 4. Kylo |

4. Capri |

| 5. Aziel |

5. Rosalia |

Please visit www.socialsecurity.gov/babynames to view the entire list.

To get more Social Security news, follow the Press Office on Twitter @SSAPress.

Press Release

Tuesday, May 4, 2021

For Immediate Release

File 2020 Tax Return with the IRS to Receive Missing Economic Impact Payments

The Internal Revenue Service (IRS) issued the third round of Economic Impact Payments (EIP) in April. Most Social Security beneficiaries and Supplemental Security Income (SSI) recipients should have received their EIPs by now. If a person is missing their first or second EIP, they need to file a 2020 tax return with the IRS and claim the 2020 Recovery Rebate Credit (RRC) as soon as possible.

Any person who did not receive his or her EIP, or the full amount of their EIP, please read this carefully. To get any missing first or second EIPs, file a 2020 tax return with the IRS and claim the 2020 Recovery Rebate Credit (RRC) immediately. People should file the 2020 tax return even if they have no income to report for 2020. When the tax return is processed, the IRS will pay the RRC as a tax refund. The IRS will send any additional third EIP amount owed in 2021 separately.

If people already filed their 2020 tax return, they do not need to do anything else.

Visit Social Security's Economic Impact Payments and Tax Credits page at www.socialsecurity.gov/coronavirus/eip/ to learn more.

For questions about tax-related topics and economic impact payments, please contact the IRS.

Read the IRS' April 28 press release at https://www.irs.gov/newsroom/nearly-2-million-more-economic-impact-payments-disbursed-under-the-american-rescue-plan-continuing-payments-reach-approximately-163-million for more information.

For Social Security information, please visit the agency's COVID-19 web page at www.socialsecurity.gov/coronavirus/.

To get more Social Security news, follow the Press Office on Twitter @SSAPress.

Press Release

Monday, April 26, 2021

For Immediate Release

Commissioner Saul Communicates to Congress about the State of Social Security Services

Andrew Saul, Commissioner of Social Security, wrote to key members of Congress to raise awareness of the resources Social Security needs to recover from the ongoing pandemic and improve service.

"Since becoming Commissioner, I have focused our actions and our resources on efforts to improve the service we provide to the millions of people who turn to us for help. I have been clear in my budget requests about what it takes to improve service and maintain the integrity of our programs: both additional frontline staff to help people now, and information technology (IT) investments to improve our future," said Commissioner Saul. "2021 is a critical year to shape the agency for post-pandemic success, but our resource constraints will delay our recovery. I appreciate President Biden's support of our needs with his FY 2022 budget request of nearly $14.2 billion for us, which is $1.3 billion more than what we received this year to operate our agency. No one anticipated the duration of the pandemic and the ongoing challenges it presents."

The full text of the letter follows:

April 21, 2021

The Honorable John B. Larson

Chair, Subcommittee on Social Security, Committee on Ways and Means

U.S. House of Representatives

Washington, DC 20515

Dear Subcommittee Chair Larson:

I am writing because I want to be clear about the negative impact to Social Security services due to the ongoing pandemic and our funding level in fiscal year (FY) 2021. Our FY 2021 annual appropriation was nearly $900 million less than my original request. It is effectively level with the funding we have received for each of the last four years, despite significant increases in costs that we do not control - such as the Government-wide pay increases.

The pandemic has resulted in unprecedented changes. The safety of the public and our employees has been the paramount driver of how we deliver services during the pandemic. To protect the public and our employees, we have necessarily limited in-person service to critical situations that can only be resolved in-person. While we continue to serve the public over the phone and online, we are still experiencing issues receiving and verifying documents and medical evidence we need to make decisions. Even with fewer applications in FY 2021, pandemic-related challenges and operational constraints present numerous barriers to employees completing workloads timely. In FY 2020, the average time it took us to complete an action in our field offices increased by 20 percent, significantly reducing our productivity. We are working diligently to address these challenges, but the abrupt changes to the way we do our work has caused bottlenecks in certain workloads and service deterioration beyond our control. On February 23, 2021, we shared with your staff the potential implications of our FY 2021 funding level to further harm services.

However, our operational challenges have been aggravated by our inability to fully use our program integrity funding. To use this funding, we must complete cost-saving continuing disability reviews (CDR) and Supplemental Security Income redeterminations. We have had to reduce our planned full medical CDRs by 30 percent due to the pandemic, the lowest level since FY 2013. We deferred these workloads in the early part of the pandemic to protect beneficiaries' income and healthcare and to reduce the burden on the medical community, which had stopped most elective services.

While we restarted these workloads at the end of FY 2020, we are handling them through the mail and over the phone. During the pandemic, these complex workloads often require multiple contacts with a beneficiary, which slows our ability to complete this work. In addition, over 30 percent of our initial disability claims and CDRs require a consultative exam (CE) with a medical provider so that we can obtain enough medical information to make a decision. Right now, just over 70 percent of our CE providers are scheduling in-person exams. We have focused our limited CE capacity on initial disability claims to ensure that we can provide benefits to people who qualify. Even with that focus, the average processing times for initial disability claims increased about 45 days in the last year. Ultimately, we currently estimate the constraints on our program integrity funding deepens our shortfall by approximately $200 million.

Since becoming Commissioner, I have focused our actions and our resources on efforts to improve the service we provide to the millions of people who turn to us for help. I have been clear in my budget requests about what it takes to improve service and maintain the integrity of our programs: both additional frontline staff to help people now, and information technology (IT) investments to improve our future. IT is fundamental to offering the public more electronic and online options they expect from organizations today, improving the technology to make it easier for our staff to help the public, and ensuring we have a safe, modern platform to support over $1 trillion in benefits payments each year.

I have frozen hiring in non-frontline positions so that we can push all available resources to the offices that directly serve the public. I have increased the staffing in our field offices, national 800 number, processing centers, and State disability determination services (DDS) by nearly 3,000 people since 2019. I have increased IT investments to accelerate our modernization and increase online service options.

We are working with the advocate community to help ensure that the most vulnerable populations can access our services. Our efforts include a robust communications campaign, in combination with a wide range of online resources, to provide information on service options for the beneficiary and individuals or organizations that help them.

I also decided to pay employee awards so they know that we appreciate their hard work and dedication, especially during this difficult time. I have pushed the agency to find creative ways to maintain these efforts despite the significant cut to our budget request this year.

We have explored all possibilities to eliminate our budget shortfall but we are unable to overcome it. I have no other option but to delay our planned hiring to operate within our appropriated resources. Further, we will not be able to compensate for fewer employees with additional overtime. We are operating with the lowest level of overtime in the last decade. These decisions have a lasting negative impact on the service we can provide to the American public. It will increase waits for service from our field offices and on our 800 number as we begin to emerge from the pandemic. The number of pending actions in our processing centers will grow from about 3.7 million actions pending at the end of FY 2020 to more than 4.2 million actions pending by the end of FY 2021. It will delay our plan to eliminate the backlog of cases in the DDS, which currently has about 20 percent more pending cases than prior to the pandemic, as we anticipate an increase in disability receipts into FY 2022.

The pandemic has changed the way we do work at SSA in unprecedented ways. At the start of the pandemic, we transitioned to remote work, focused on critical service workloads through online and telephone options, and suspended some adverse actions to protect the public during an especially critical time. The pandemic required necessary operating adjustments to safely serve the public, reducing our ability to complete our workloads and contributing to increased backlogs and wait times in some priority service areas. These novel factors prevented us from achieving some of our goals in FY 2020 and put our goals for FY 2021 and future years at risk. FY 2021 is a critical year to shape the agency for post-pandemic success, but our resource constraints will delay our recovery.

I appreciate President Biden's support of our needs with his FY 2022 budget request of nearly $14.2 billion for us, which is $1.3 billion more than what we received this year to operate our agency. No one anticipated the duration of the pandemic and the ongoing challenges it presents. I hope you will consider these challenges and support his request to help us improve service.

Sincerely,

Andrew Saul

Commissioner

To get more Social Security news, follow the Press Office on Twitter @SSAPress.

Press Release

Thursday, April 15, 2021

For Immediate Release

Social Security's Business Services Online Portal Key to Accurate Earnings Records for Workers

Accurate earnings records are vital to the Social Security Administration and to every worker in the United States. If Social Security cannot match the name and Social Security number (SSN) reported on a W-2, Wage and Tax Statement, to its records, the agency cannot credit the earnings to that worker's record. When earnings are missing, the worker may not qualify for Social Security benefits or the benefit amount may be wrong.

Historically, approximately 10 percent of the W-2s the agency receives each year from employers initially have mismatched name/SSN combinations. There are a number of reasons why reported names and SSNs on W-2s may not match with Social Security's records, such as typographical errors, unreported name changes, and inaccurate or incomplete employer records. By using more than twenty automated matching routines the agency can identify commonly occurring errors that, when corrected, allow the accurate crediting of reported earnings to the correct worker's earnings record.

Social Security works hard to educate employers—large and small, at the national and local level—about the importance of accurate wage records and the free tools available to them. The agency works closely with the payroll provider community through organizations such as the American Payroll Association and the National Association of Computerized Tax Processors. Agency employees speak at the Internal Revenue Service's Nationwide Tax Forums and participate in quarterly meetings with Reporting Agents (large third-party filers). Social Security's Employer Services Liaison Officers and Public Affairs Specialists educate small business employers throughout the nation through local engagements.

In all of the activities, the agency includes information about its online suite of services, Business Services Online (BSO), at www.ssa.gov/bso/bsowelcome.htm. The tools included in BSO provide employers the opportunity to correct errors before, during, and after the development and submission of their wage reports. These tools include:

AccuWage: Software that tests the accuracy of wage reports before submission by identifying common formatting errors.

Social Security Number Verification Service: A free service to verify that all employees' names/SSNs match the Social Security Administration's records before submission.

View Name and Social Security Number Errors: A service for electronic wage reporters to view the processing status and errors (including name and SSN mismatches) after their submission.

"It is extremely important that the Social Security Administration has accurate earnings records for workers throughout the country, and this begins with accurate wage reports from the nation's employers," said Andrew Saul, Commissioner of Social Security. "I encourage all employers, large and small, to use the free tools on our Business Services Online portal. The earnings record of every worker determines their future eligibility and the amount of Social Security benefits they will receive, so accuracy is vital."

Commissioner Saul also made the decision to discontinue mailing employers educational correspondence (EDCOR) notices to focus agency efforts on making it a better, easier, and more convenient experience for employers to report and correct wages electronically. EDCOR notices inform employers that name/SSN combinations on a submitted W-2 cannot be matched to Social Security's records and provides instructions on how to correct the mismatches using tools on BSO. The agency also will continue to seek out new opportunities to educate employers and provide modernized software for electronic wage reporting that informs wage reporters of certain errors in real time as they upload their wage reports.

In addition to Social Security's work with employers, the agency encourages workers to view their personal earnings records, and submit corrections, online by creating a my Social Security account at www.ssa.gov/myaccount.

Through their my Social Security account, people can check personal information and conduct business with Social Security. If they already receive Social Security benefits, they can start or change direct deposit online, request a replacement SSA-1099, and if they need proof of their benefits, they can print or download a current Benefit Verification Letter from their account.

People not yet receiving benefits can use their online account to get a personalized Social Security Statement, which provides earnings information as well as estimates of future benefits. Residents of most states may request a replacement Social Security card online if they meet certain requirements.

The portal also includes links to information about other online services, such as applications for retirement, disability and Medicare benefits.

To get more Social Security news, follow the Press Office on Twitter @SSAPress.

Press Release

Thursday, March 25, 2021

For Immediate Release

Statement from Andrew Saul, Commissioner of Social Security, about Economic Impact Payments

"I want to provide an important update about the Social Security Administration's (SSA) processing of Economic Impact Payments (EIPs) under the American Rescue Plan (ARP) Act.

At each turn over the last 12 months, immediate delivery of EIPs has been, and remains, a top priority for this agency. SSA's public service mission is squarely focused on many of those who are most economically-vulnerable in our society and we owe it to our beneficiaries to ensure they receive their EIPs right away. In fact, it was the substantial efforts of SSA that successfully overcame the fact that the IRS did not have a mechanism to automatically identify Supplemental Security Income (SSI) recipients, some of the most financially insecure people in America. It was SSA that pushed the prior Administration and Congress to allow us to send to IRS a file of those individuals, who do not receive forms SSA-1099, so that IRS could automatically issue EIPs to them.

Since the time that discussions began regarding issuance of EIPs in the ARP Act, weeks before passage, we have worked tirelessly with our counterparts at IRS to provide to them the information they need to issue payments to our beneficiaries. Despite the fact that Congress did not directly provide SSA funding to support our work on EIPs, we have provided countless hours of assistance to IRS consistent with the laws that establish how we may use the Trust Funds that every American counts on us to protect.

SSA discussed with Treasury and IRS, both before passage and after enactment of the ARP Act, that the Social Security Act does not allow the agency to use our administrative appropriation to conduct work on any non-mission provision or program. Accordingly, we were not authorized to substantively engage Treasury or IRS prior to the ARP's passage. Instead, upon passage, we were required to pursue a reimbursable agreement with IRS because we received no direct appropriation through the ARP Act. From the outset of discussions, we kept congressional staff apprised of the hurdles this approach would create for SSA, and we have continued to update them on our progress with IRS as we completed the required interagency agreements.

Once we were free to move forward, we aggressively worked with Treasury and IRS to issue payments. As a result of our efforts, we successfully signed the reimbursable agreement and a Memorandum of Understanding (MOU) less than one week after passage, on March 17. That process often takes weeks or months to complete, but we got the job done in a matter of days. A few days later, on Monday, March 22, SSA sent initial test files to IRS. IRS confirmed testing success on Wednesday, March 24. Production files were delivered to IRS before 9 AM on Thursday, March 25 - more than a week sooner than we were able to provide a similar file to IRS during the first round of EIPs.

While we were working through the agreements with IRS that would fund our efforts to support issuance of EIPs, we were also protecting the integrity of the EIP program by updating the files that IRS will use to issue payments to our beneficiaries. Those updates to our files ensure that payments go to correct bank accounts and addresses, and, that those who are deceased are removed from the files. In short, Social Security employees have literally worked day and night with IRS staff to ensure that the electronic files of Social Security and SSI recipients are complete, accurate, and ready to be used to issue payments. There is no one more committed to serving the public than the employees of this agency, and there should be no doubt whatsoever that they are striving each day to serve the vulnerable populations to whom they have committed their careers. I find any insinuation to the contrary to be unacceptable.

I assure you that we will continue to do all we can to support implementation of the ARP Act."

To get more Social Security news, follow the Press Office on Twitter @SSAPress.

Press Release

Wednesday, March 24, 2021

For Immediate Release

Outreach to Vulnerable Populations During the COVID-19 Pandemic

Advocates and Community Organizations Can Help Connect People with the Social Security Administration

The Social Security Administration has a long history of outreach and coordination with advocates and community-based organizations across the nation. During the COVID-19 pandemic, continuing to work with advocates and community-based organizations is essential to reaching the country's most vulnerable populations, including individuals with low income, limited English proficiency, mental illness, or those facing homelessness. The agency is fully committed to assisting people in gaining access to the information and services they need with a specific emphasis on applying for Supplemental Security Income (SSI) and Social Security Disability Insurance (SSDI) benefits.

"I made this issue a strategic agency priority and focused resources to reach vulnerable communities and help them access our services and receive their benefits. I ask leaders in every community to share information about our programs with people and help them connect with us to apply for benefits," said Andrew Saul, Commissioner of Social Security. "Social Security is working on many initiatives to reach vulnerable populations and I am pleased to share information about our national outreach campaign, developed in collaboration with leaders in the community, to raise awareness of the SSI and SSDI programs."

To ensure effective outreach to these vulnerable populations who need access to agency programs, and to the advocates and organizations who can help to connect people with Social Security, the agency launched a national campaign to raise awareness of the SSI and SSDI programs and encourage people to apply. Campaign efforts include:

- A new webpage, People Helping Others, at www.socialsecurity.gov/thirdparty, for anyone who could assist another person with accessing Social Security's programs and services;

- A new outreach website, at www.socialsecurity.gov/thirdparty/groups/vulnerable-populations.html where all partner groups can access informational materials to share through their networks, including resources tailored to specific vulnerable populations;

- An updated Faith-Based and Community Groups website at www.socialsecurity.gov/thirdparty/groups/faithandcommunity.html with a new outreach toolkit and SSI and SSDI fact sheets. The agency coordinated this effort with the White House, and the White House Office of Faith-Based and Neighborhood Partnerships is helping to promote these resources; and

- An upcoming national advertising campaign to support all outreach efforts on TV, radio, and social media, with special emphasis on children with disabilities (see the recently redesigned website focused on SSI for children at www.socialsecurity.gov/benefits/disability/apply-child.html). TV and radio PSAs highlighting SSI for children currently are being tested in the Dallas, TX area to determine their impact.

- The agency is now completing training videos for community-based caseworkers to help their clients with the SSI application process.

People can apply for SSI benefits, and for other benefit programs, through a telephone appointment with the agency, even while local offices are not able to accept walk-in visitors. More people need to be made aware of the SSI program and reminded that they can call toll-free 1-800-772-1213, or their local Social Security office, to make a phone appointment to apply for SSI. People who are deaf or hard of hearing may call Social Security's TTY number, 1-800-325-0778.

To get more Social Security news, follow the Press Office on Twitter @SSAPress.

Press Release

Wednesday, March 17, 2021

For Immediate Release

Statement about Service from Andrew Saul, Commissioner of Social Security

"I want to update you about how things are going at the Social Security Administration.

About a year ago, I took the unprecedented step to close our offices to the public. I did this to keep our employees and you—the public we serve—safe. As we enter year two of the COVID-19 pandemic, vaccines and other precautionary measures give us cause for hope. For now, we will continue our current safety measures as described in our COVID-19 Workplace Safety Plan. This plan is iterative, and we will update it as we receive additional government-wide guidance and information from public health experts in the Centers for Disease Control and Prevention.

Like many businesses and organizations, the pandemic has forced us to adapt. I want to thank our employees for their willingness to embrace innovative ways of working while we continue to deliver our mission. As we examine our work in a new light, we are asking which lessons learned could improve service beyond the COVID-19 pandemic.

We understand that the public wants to engage with us on some matters in person, and our local offices are integral to our communities. We also know that not everyone can conveniently come to us in person and that when you do visit, you want the process to be efficient. For example, we may need evidence from you, but we do not need to interview you in person. We are currently testing drop box and express appointment options for the public to bring in documentation.

Often, you only need to know your Social Security number and do not need a physical Social Security card. However, if you do need to replace your card, we are testing video appointments if you need a new Social Security card but do not need to change any of the information in our records. Although ideas like these began as solutions during COVID-19, we are considering how they could improve service in the future.

Some of these concepts also allow us to consider how we might continue to use telework, something that most organizations and companies have depended on during the COVID-19 pandemic, to drive longer-term operational efficiencies like reducing space. We could use those savings to provide you more online service options and hire more people to serve you more quickly as well as to retain outstanding employees. We will continue to engage our managers, employees, and unions on ways we could use telework to improve customer service and other issues.

We often note that Social Security touches the lives of nearly every American. Be assured that as we continue to evolve, we are committed to serving everyone including our most vulnerable populations who often require in person assistance. We are working with the White House Office of Faith-Based and Neighborhood Partnerships, claimant advocates, and other organizations to ensure our services are accessible to people with low income, limited English proficiency, mental illness, or facing homelessness. We recently added online tools and information pages to our website including:

As we contemplate the future, we are delivering now. To help improve deteriorating service, we have added over 6,000 frontline employees to help you. We decreased the average wait to talk to our 800 Number agents by one-third and reduced the agent busy rate by over 50 percent in the last two years, and our 800 Number agents handled 1.6 million more calls than they did a year ago.

During the pandemic, we shifted service to the telephone where local office employees answered 13 million more calls last year than they did in fiscal (FY) 2019. They answered your calls in under 3 minutes on average compared to an average wait of nearly 24 minutes in FY 2019.

For individuals who were denied benefits and requested an appeal, we quickly shifted to holding hearings by telephone at the start of the pandemic and then added online video hearings. During the pandemic, we have continued to reduce the number of people waiting for a hearing to 376,000 at the end of February 2021, the lowest level in nearly 20 years. We reduced the average wait for a hearing by over 9 months in the last two years. If you are still waiting for a hearing, please consider scheduling by telephone or video. You can find out more information about telephone hearings here and video hearings here.

The pandemic has significantly disrupted parts of our disability process, particularly at the state Disability Determination Services (DDS) that make disability determinations for us. We have provided the DDSs with additional hiring and overtime to help address a significant increase in pending initial disability cases. The DDSs have been able to reduce the number of people waiting for a decision on initial disability claims by about 100,000 cases since the height of the pending cases in August 2020. In order to make initial disability decisions as quickly as possible, and to reduce the burden on the medical community still stressed from the pandemic, we have focused our limited resources on completing initial requests for disability benefits and have reduced the number of continuing disability reviews we are conducting.

We have made some notable improvements to our online services:

- Our redesigned Retirement Benefits Portal helps you prepare and apply for retirement benefits, with clearer, simplified information.

- We improved our registration process for our online my Social Security account - more than one million people will register for an account this month.

- Our Message Center allows people with a my Social Security account to access notices online instead of by mail.

- We implemented an online payment option for people to repay debts to Social Security.

- We expanded our online Social Security card replacement service to almost all states. If you need to replace your card, you can request a replacement through your my Social Security account if you:

- Are a U.S. citizen age 18 years or older with a U.S. mailing address;

- Are not requesting a name change or any other change to your card; and

- Have a driver's license or a state-issued identification card from one of 45 participating states or the District of Columbia. If your state does not yet participate in this service, check back soon. More states are added regularly.

The entire team at Social Security is working hard to serve you. We thank you for your patience during the COVID-19 pandemic and we look forward to welcoming you back in our offices when it is safe to do so. We also look forward to continuing to improve all of our service channels to provide you with convenient options to do business with us."

To get more Social Security news, follow the Press Office on Twitter @SSAPress.

Press Release

Thursday, March 4, 2021

For Immediate Release

Social Security and OIG Hold Second Annual 'Slam the Scam' Day

The Social Security Administration and the Office of the Inspector General (OIG) have once again joined forces to raise public awareness about Social Security imposter scams during the second annual 'Slam the Scam' Day on March 4. Social Security scams - in which fraudsters mislead victims into making cash or gift card payments to fix purported Social Security number problems or to avoid arrest - are the #1 type of government imposter fraud reported to the Federal Trade Commission and Social Security. The agency has made concerted efforts to address this issue, including partnering with other Federal and State agencies to identify and pursue scammers, increasing employee and public outreach and education, raising awareness through marketing in post offices nationwide, and maintaining a Social Security/OIG workgroup to maximize resources and ensure a cohesive response.

"I am deeply troubled that crooks are deceiving Americans and using fear tactics to trick people into providing personal information or money," said Social Security Commissioner Andrew Saul. "I urge everyone to remain vigilant, hang up on these fraudsters, and go to oig.ssa.gov. to report any attempted scam."

Criminals are sophisticated and there are many variations of this fraud scheme. For example, scammers may call or email saying they are from Social Security and that the person's Social Security number is suspended or was used in a crime. The caller identification may be spoofed to appear as a legitimate government number. They may text or email fake documents in attempts to coerce people to comply with their demands. In recent twists, thieves even use real Social Security and OIG official's names and send pictures of fabricated government ID badges.

Social Security will never tell you that your Social Security number is suspended, contact you to demand an immediate payment, threaten you with arrest, ask for your credit or debit card numbers over the phone, ask for gift cards or cash, or promise a Social Security benefit approval or increase in exchange for information or money.

"We are working with the Department of Justice and law enforcement agencies across the United States to combat Social Security imposter scams—but our best weapon in this fight will always be awareness," said Inspector General Gail S. Ennis. "I want to thank the many agencies and organizations that have joined us in our effort this year to alert Americans to hang up on suspicious calls, and talk to their family and friends about phone scams."

Today's events include:

- 1 p.m. ET: @SocialSecurity and @TheSSAOIG participate in a Spanish-language #OjoConLasEstafas on Twitter hosted by @USAgovespanol.

- 3 p.m. ET: @SocialSecurity and @TheSSAOIG participate in a #SlamTheScamChat on Twitter hosted by @USAgov.

- 7 p.m. ET: Facebook Live with the SSA Office of the Inspector General and the Division of Consumer & Business Education at the Federal Trade Commission.

Social Security employees do occasionally contact the public by telephone for business purposes. Ordinarily, the agency calls people who have recently applied for a Social Security benefit, someone who is already receiving payments and requires an update to their record, or a person who has requested a phone call from the agency. If there is a problem with a person's Social Security number or record, Social Security will typically mail a letter.

For more information, please visit www.socialsecurity.gov/fraud/.

To get more Social Security news, follow the Press Office on Twitter @SSAPress.